SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine stock market continues its strong showing with the first quarter of 2015 in full swing. The Philippine stock index (PSEi) broke the previous high of 7,413 set in September 2014 with 7,800 today.

On January 22, COL Financial, one of the country’s leading online stockbrokerage firms, had its annual market briefing “Stay Invested” at the Meralco Theater. Over 1,400 participants attended to learn how to best navigate the 2015 stock market.

April Tan, COL’s Head of Research, believes that the Philippines is well on its way to meet its 10,000 index target in the next couple years.

The PSEi, she said, is “well on its way to meet our goal of 10,000 by 2020 at the latest.”

COL sees positive prospects as the country enters its demographic sweet spot, which means that the country’s population is nearing the point where majority of Filipinos will be at the productive working age. Large numbers of working age citizens translate to high economic growth, averaging at about 6 to 10 percent in the years to come.

Reasons to remain bullish

COL points to increased liquidity both locally and globally as another factor to stock market growth. This means that there is a sufficient amount of money in investors’ hands ready to put into the market.

Interest rates also continue to be low, which makes stocks a more attractive investment than other financial instruments like savings accounts and bonds. According to COL, bank savings accounts yield a 2.5 percent in interest, while time deposits yield a lower 1.4 percent. Stocks offer up to a 5.6 percent yield.

Another indicator for the market’s strong performance is the consistent growth of the Philippine economy – at or above 6 percent in recent years. Even amidst political noise and controversial investigations, international credit rating agencies like Standard & Poor’s and Moody’s have upgraded the country’s investment grade.

The recent sharp decline in oil prices will also be a shot in the arm for the economy. A study published in Fortune billed the country as the biggest beneficiary of cheap oil imports.

Government infrastructure spending – at the highest level during the Aquino administration – is expected to increase approaching the 2016 elections.

There are, said Tan, “expectations that reforms to address shortcomings in the country will endure beyond the current administration.”

Risks to watch out for

Juanis Barredo, COL’s Chief Technical Analyst, warned investors to expect both local and global markets to show volatility with prices moving within a wider range of values.

“Markets will remain volatile as we enter unchartered territories,” Barredo said, “making it crucial for investors to make well-informed decisions.”

Barredo added, however, that “the Philippines will stay on an upward path” in spite of “short term ripples from global volatility.”

He reminded everyone to keep an eye out for pullbacks that will offer a better chance to buy targeted stocks at support levels, in order to maximize profits from the projected increase of the PSEi.

Top stock picks

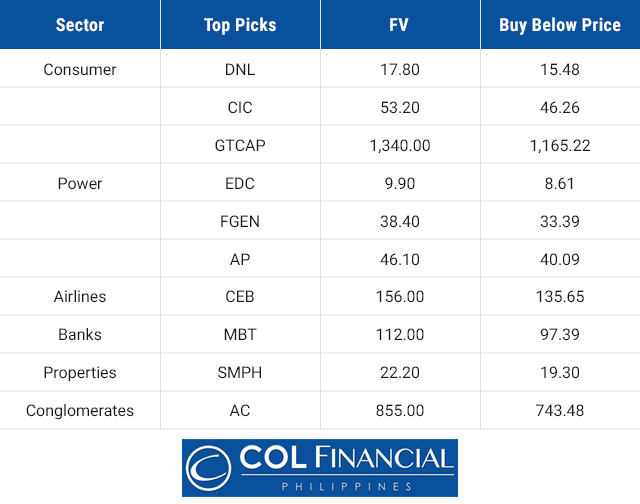

Based on their analysis, COL offered their top industry stock picks by industry for 2015:

COL’s market outlook briefings are offered free to the public, in an attempt to give both seasoned and beginner investors the information needed for making sound financial decisions. For an entire evening, attendees are provided timely information for growing portfolios, and are encouraged to raise queries and clarifications directly to the experts.

COL Financial also hosts seminars and events promoting financial literacy in the country. – Rappler.com

For more information on COL Financial products and available seminars on stock investing, please visit www.colfinancial.com

For event announcements and market updates, follow COL on Facebook and Twitter. To view previous seminars and other tutorials, subscribe to their Youtube account.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.