SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Editor’s note: This press release is sponsored by Maybank Philippines, Inc. and was handled by BrandRap, the sales and marketing arm of Rappler. No member of the news and editorial team participated in the publishing of this piece.

Remember the banking experience pre-pandemic? Customers can either earn high interest but with locked funds (via time deposit), or have available funds with very low interest. Even worse, customers would need to visit physical branches or ATMs to fulfill their banking needs.

Fast-forward to after the pandemic, the new normal has now provided greater opportunities for online banking – from cashless payments, digital fund transfers, online shopping, to tracking of finances – all made readily available with just a few taps. And with today’s busy lifestyle, consumers are looking for a bank that helps them fulfill “Ezy” financial transactions, without leaving the safety and comfort of their homes. The adoption of digital banking, as well as partnering with the right bank for this gives customers flexibility in seamlessly managing and fulfilling their financial needs.

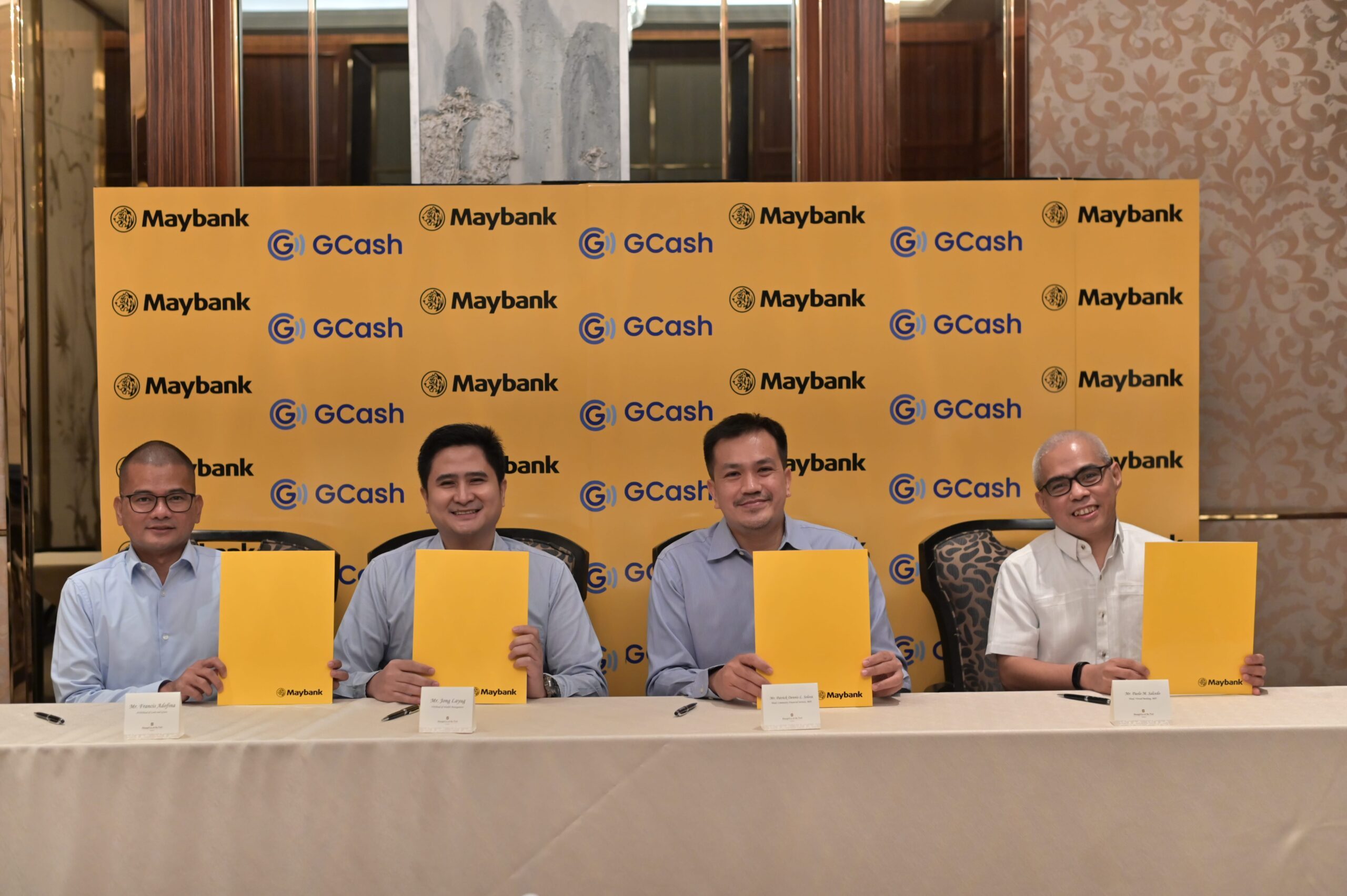

Maybank x GCash

The company is proud and happy to announce that Maybank, the fourth largest bank in Southeast Asia, has recently partnered with GCash, the Philippine’s leading mobile wallet, to offer a digital savings account to jump start Filipinos’ digital banking journey.

Through GCash, Maybank offers a fully operational digital account that provides financial rewards, but at the same time allows customers access to their money anytime, anywhere! Customers can quickly and conveniently open an account, earn interest on their savings, and easily perform mobile wallet transactions between their EzySave+ account and their GCash wallet.

“The transformation of the banking system from branch to digital banking has paved the way for easy and convenient banking transactions, especially with the changes in lifestyle brought about by the new normal. With our partnership with GCash, we are hoping to encourage Filipinos to start saving with security and convenience. In line with our role as a financial institution, we want to ensure a seamless online banking experience for our customers. With the launch of EzySave+, not only can our customers jumpstart their savings, they can also enjoy interest earnings, and perform cashless payments and fund transfers suited for their needs.” said Maybank Philippines’ president and CEO Abigail Del Rosario.

For GCash, EzySave+ allows their customers to earn interest on their online deposit accounts. This product complements the breadth of their financial options. Teaming up with Maybank to offer a user-friendly platform to open a savings account, GCash ensures a seamless, convenient and hassle-free customer experience for Maybank customers and GCash users alike. “This partnership with Maybank is a major step in achieving our vision of ‘Finance for All.’ It also opens up more opportunities for our users to achieve their personal finance goals,” said Martha Sazon, president and CEO of GCash. “Making EzySave+ available in our GSave Marketplace is also a testament that we will work tirelessly to ensure that our customers remain financially empowered when they use the GCash app.”

Savings made Ezy

So how can customers apply for EzySave+? It’s Ezy with the GCash app! EzySave+ requires no initial deposit, no maintaining balance, and earns interest for as low as Php0.01! Your savings also earn interest and are insured by the Philippine Deposit Insurance Corp (PDIC) by up to P500,000. Your EzySave+ also comes with a free EMV-enabled Maybank Visa Debit Card, should you need to withdraw cash, buy from your favorite shops, or pay for your online transactions. And as a bonus for new customers, Maybank will give an additional 5% cash credit on your Average Daily Balance (ADB) during the first 90 days of opening an EzySave+ account! Furthermore, to protect you and your future, EzySave+ comes with a free personal accident insurance of up to P1 million, with a minimum ADB of only P50,000.

Humanising financial services #ForYou

EzySave+ is part of Maybank Philippines’ offerings as it celebrates its 25th anniversary this year in the Philippines. With the campaign theme of #ForYou, Maybank Philippines reiterates their brand promise of putting their customers at the heart of everything they do. Connecting the bank’s products and services to the customers’ needs, for their financial and personal well-being, through relevant products and expanded services, Maybank strives to be your trusted partner for a sustainable future, by providing financial and innovative products that offer greater convenience – all made especially #ForYou.

Maybank maintains a “phygital” proposition that combines physical accessibility through its network of more than 60 branches and 90 ATMs nationwide, and digital capabilities through its Maybank2U PH mobile and internet banking platform. Together with GCash, and the new EzySave+ savings product, Maybank aims to expand its reach and provide secure and convenient financial services to Filipinos. – Rappler.com

For more information, please contact:

Maybank Customer Care: Metro Manila: (02) 8588-3888| Toll Free: 1-800-10-8588-3888 | Email: mpi.customerservice@maybank.com

Add a comment

How does this make you feel?

![[Finterest] What exactly does a bank do, and how can they help you?](https://www.rappler.com/tachyon/2022/09/shutterstock-philippine-peso.jpg?resize=257%2C257&crop=329px%2C0px%2C900px%2C900px)

There are no comments yet. Add your comment to start the conversation.