SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Palace-backed “sin” tax bill may not survive deliberations at the Senate without being watered down further as some lawmakers feel its plan to raise P33 billion additional taxes may not be “realistic.”

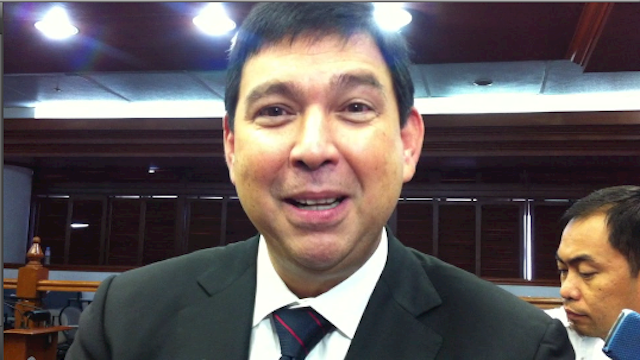

Senator Ralph Recto, Senate ways and means committee chair who is set to draft a report on the proposed measure, said it is ironic that the government is expecting additional revenues from the bill, which aims to reduce consumption of sin products – tobacco and alcohol.

“‘Di kaya magkasalungat, sinasabi nila bawawasan ang paginom at sigarilyo. Pa’no natin makokolekta ‘yan kung babawasan?” he told reporters on the sidelines of the third committee hearing on the bill Thursday, August 30.

(Isn’t it ironic that they’re saying it should decrease alcohol and cigarette consumption. How can we collect additional taxes if consumption will be reduced?)

In a landslide vote in June, 210 lawmakers voted to pass amended House Bill 5727, authored by Cavite Rep Joseph Emilio Abaya, helping the Aquino administration succeed where its predecessors failed. It has been over 15 years since a sin tax bill made it out of committee meetings in Congress.

But the bill was watered down. Originally, it sought to raise P60 billion in the first year; it will now raise P33 billion. The bill aims to reduce consumption of tobacco and alcohol, especially among the poor, while raising additional revenues, which will be channeled to the government’s health care program.

In the Senate, Sen Miriam Defensor-Santiago filed Senate Bill 3249, which is close to the original bill filed in the House.

Asked which of the two bills is reasonable, Recto said: “‘Di nga maliwanag ‘yang P60 billion eh. Pati ‘yang P30 billion ‘di rin maliwanag. Hindi n’yo ba nakita, from P60 billion naging P30 billion. Ang laki nang nawala kaagad kasi nagumpisa tayo sa Ripley’s Believe It or Not,” he said, referring to the show that featured world wonders and almost impossible feats. (It is unclear where they will get the P60 billion, even the P30 billion. In the first place, it was reduced significantly from P60 to P30 billion because it was a case of Ripley’s Believe It or Not.)

“Ang akin (what I want is something) realistic. We will see when BIR submits the report,” he added.

During the Senate hearing, Recto asked Bureau of Internal Revenue (BIR) Commissioner Kim Henares to submit a detailed report of where the P30-P60 billion additional revenues will come from. “Who will pay for that? What brands are we talking about?” he asked Henares.

Henares agreed to submit the report, but said she is prohibited by law to name the brands. “I can put codes, but I can’t put if it’s Marlboro or another brand.”

Recto said the report is the last piece he needs so he can complete the draft committee report on the proposed sin tax reform.

“Two-thirds of the report I can write already. That’s the only set of data I’m waiting for.”

Recto earlier said he was confident they would be able to come up with their version of the bill for final approval in the plenary in November. He said it may be passed into law before the year ends.

Demand ‘inelastic’

Recto expressed misgivings about the amount of revenues projected by finance officials, citing what he said is the basic principle of the sin tax bill: higher taxes will result in higher prices of tobacco and alcohol, which in turn, will result in lower consumption.

Lower consumption equals lower tax revenues for government, he said.

He said the sin industry generated a total of P200 billion in gross revenues in 2010. He said of this, P75 billion went to taxes, P100 billion to operating expenses; the remaining P25 billion was the net income of firms.

“You want to collect P60 billion more? If you will raise prices and consumption will go down, how can you attain that projection?”

“What we’re afraid is we may put in jeopardy not only the incremental revenues but the P75 billion we are currently collecting because of this very radical increase.”

But Recto’s fears are “unfounded,” sin tax reform advocates said.

Filomeno Sta Ana, an economist and coordinator for Action for Economic Reform (AER), said Recto’s argument does not take into account that demand for sin products is “inelastic” because of their addictive nature.

Sta Ana said demand inelasticity means that tobacco consumption is not proportionally responsive to changes in prices.

A paper by AER’s Jo-Anne Latuja illustrates this further. It said, for example, that a P30 tax per pack will increase the price of a popular brand by 50%, but consumption will only go down by 30%.

“Using a range of elasticity coefficients, which will measure the drop in demand and the increase in revenues, you’ll still come out with positive figures for revenues and at the same time see a reduction in smoking prevalence,” Sta Ana said.

“There’s still a segment of consumers who will still buy the products. The revenues from the higher tax rates will more than offset the revenue losses due to the drop in demand,” he added, noting that it is the price sensitive segments – the poor and the youth – that will be affected by higher prices.

“It’s a win-win. We achieve health objectives and attain incremental revenues.”

Health costs

If passed into law, revenues from the sin tax bill will be used to fund the government’s universal health care program and help tobacco farmers shift to other crops.

Henares said it is important that consumption of tobacco and alcohol is reduced especially among the disadvantaged in order to lessen expenses stemming from treating diseases linked to these products.

Health advocates said smoking is one of the top causes of non-communicable diseases – heart ailments, stroke, cancer, diabetes, and lung illnesses.

Henares pointed out that currently, tax revenues collected from sin products are much lower than health care costs associated to them.

Plus, the tax revenues do not cover the “true costs” the government and the country shoulder due to these health hazards.

Henares said aside from medical expenses, the government also loses tax revenues “if people are sick and they cannot earn money.” – Rappler.com

For related stories, read:

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.