SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

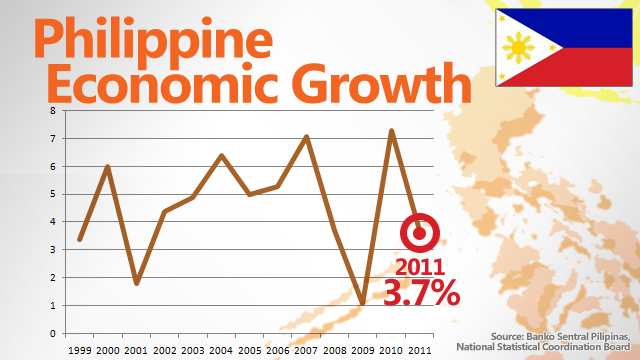

MANILA, Philippines – In 2011, the first full year of the Aquino administration, the Philippine economy slowed down to 3.7% from a robust 7.6% the year before due to factors beyond the government’s control–global economic woes and bad weather–as well as the well-criticized delays in government spending on crucial infrastructure.

This confirms previous forecasts that the government missed its GDP growth rate target of 4.5% to 5.5% for 2011. Gross domestic product (GDP) is one of the primary indicators to gauge the health of an economy.

At the official announcement of the economic performance on Monday, January 30, Romulo Virola of the National Statistical Coordination Board (NSCB) said the economy grew at 3.7% in the 4th quarter, far slower than the 6.1% growth in the same quarter in 2010 despite the rush to spend previously budgeted funds. Infrastructure spending was up by 136% in 4th quarter, according to Virola.

The results are not entirely unexpected. Growth had been plummeting since the 1st quarter of 2011 from 4.9%, to 3.4% in the 2nd and a disappointing 3.6% (revised from 3.2%)in the 3rd.

Beyond control

The woeful economies of trade partners and investment sources, especially the US and the eurozone, as well as the natural calamities that hit Japan and Thailand, dragged Philippine exports hard in 2011. Exports is one of the country’s top dollar earners. (The other key dollar earner is remittances from overseas Filipino workers.)

Exports dropped 5.6% in the first 11 months of 2011, as electronics, which account for almost half the total exports, was affected by weak global demand and supply chain disruptions due to the earthquakes and tsunami in Japan, and the massive flooding in Thailand, a major source of automotive parts and units.

“Philippine exports is very concentrated in one sector and that was the sector most hit by global slowdwn,” economic planning secretary Cayetano Paderanga said during the Monday briefing.

Disasters at home also shaved as much as 0.4% off from the country’s growth, according to Virola. Typhoons ravaged different parts of the country in 2011. Agriculture decelarated 2.5% in the 4th quarter due to bad weather.

Infrastructure

The Aquino administration has been criticized for a major factor in the less than stellar economic performance in 2011–underspending, especially in infrastructure.

Ensuring that the infrastructure projects are studied and implemented based on good governance and anti-corruption efforts of the Aquino government resulted in massive delays that only one road project out of the almost 10 in the list of Public-Private Partnership (PPP) program was bid out in 2011.

The Aquino government has trumpeted its PPP flaship program for infrastructure to produce jobs and stimulate major sectors of the economy.

Virola noted that the 6.3% growth in private construction was not enough to counteract the 29.3% decline in public construction in 2011. Overall, construction experienced a 4.1% contraction in growth in 2011.

“We hope that construction (spending) will come in early. The changes in process took awhile to be absorbed. We hope that we are finally ready,” explained Paderanga.

“If the government will build 60,000 additional classrooms it is estimated to add at least 0.11% to GDP in 2012,” Virola said, referring to the growing lists of PPP projects that the government plans to roll out this year.

Paderanga said government is maintaining 5% to 6% GDP target for 2012.

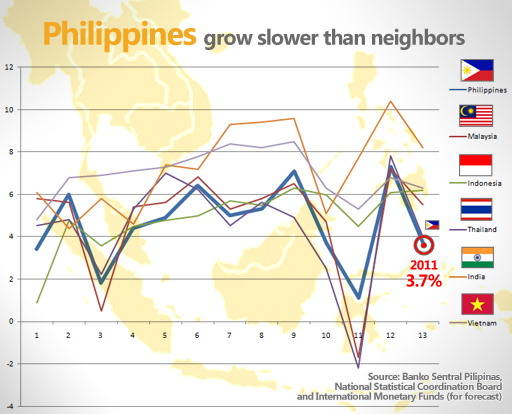

Slower than neighbors

Nonetheless, a growing economy, despite a slower pace, is still welcomed by most analysts and fund managers who scour for alternative investment destinations amid recessions and economies grounding to a halt in what were considered as risk-free countries.

HSBC Research even recently issued a study forecasting that, if the Philippines grows by 7% until 2050, it will be the 16th largest in the world. Analysts looking for opportunities in Asia have been keen on adding the Philippines in their portfolio.

Below is a visual of how the Philippine economy performed compared to its neighbors in Asia.

Why GDP matters

The GDP measures the size of the economy since it represents the total value of all goods and services produced over a period of time. It has a large impact on nearly everyone within that economy.

When the economy is healthy, typical results include more jobs and higher wages as businesses demand labor to meet the growing economy. It also affects the capital markets, including the stock exchange, since a bad economy usually means lower profits for companies, which in turn means lower stock prices.

We asked several influencers in their industry how they view the GDP.

David Leechiu, country manager of property consultant Jones Lang LaSalle Leechiu

For many years, foreign capital has ignored the Philippines. With higher GDP sustained for many years, the country will regain foreign investors’ confidence and this will translate to higher FDIs, which will lead to a faster rate of progress for the Philippines. All these progress and development will translate to more demand for Philippine real estate not just from local buyers but certainly from foreign ones as well.

Tony Herbosa, Managing Director for consulting, The Center for Global Best Practices

For me, what the 2011 GDP numbers show is that the government has been slightly behind the curve. Private sector has been more bullish. If you look at the portfolio flows post-eurozone crisis, our PSEi at all time high, the weakened US dollar index given the FED’s quantitative easing, this is our moment! A major structural shift away from dollar assets towards commodities, emerging assets and currencies is favoring us. And in these asset classes, we are up there given our demographics. This is a long-term trend. We should borrow, invest, spend! PNoy’s team better know how to think and act like a DRAGON in these times, not like a tortoise.

Junie del Mundo, CEO of EON Stakeholder Relations Firm

The public relations (PR) industry is a good barometer of the state of the economy. If the economy is healthy, consumer and corporate practice are booming. If the economy is bad, we get lots of requests for crisis communication and reputation management. In 2011, our consumer practice accounted for a significant percentage of our topline.

Avelino Zapanta, CEO of budget carrier Seair

The GDP and airlines’ performance both almost always grow or slump in tandem. One influences the other. It is difficult to conceive of commercial air transport growing while economy is on a downturn. Air transport, however, is a catalyst for economic growth.

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.