SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – The chief-on-leave of the embattled Rizal Commercial Banking Corporation (RCBC) held positions of trust in financial institutions such as the Bankers Association of the Philippines (BAP) and the Asian Bankers Association.

Under Lorenzo Tan‘s leadership, RCBC reaped 57 awards from institutions such as the London-based World Finance magazine, Visa International, and the IDC Financial Innovations and Asia Responsible Entrepreneurship Awards (Southeast Asia).

He was even dubbed the “miracle man” for rehabilitating the ailing Philippine National Bank (PNB) two years ahead of schedule when he led it from 2002 to 2005.

These shining accomplishments, however, have been dimmed by his alleged involvement in the laundering of $81 million stolen from Bangladesh central bank.

Since the heist was reported, Tan had vehemently denied any links to it, and offered to go on leave twice to clear his name. (READ: RCBC chief offers to go on leave)

“I have been in banking for 18 years, rebuilding banks, instituting reforms in Philippine and Asian banking, creating products for the unbanked, and providing capital to small entrepreneurs,” Tan said in a statement, in defense of his reputation.

In response to allegations that he was aware of the stolen money coursed through the RCBC branch in Jupiter Street in Makati City, Tan said, “My track record is unblemished and even counts positions of trust such as head of the Bankers Association of the Philippines and the Asian Bankers Association.” (READ: 6 things we know about RCBC money-laundering scam)

Not the first time

But according to documents obtained by Rappler, this is not the first time Tan’s name was dragged into a bank-related controversy.

During his leadership of the United Coconuut Planters Bank (UCPB), the bank was involved in a civil case for padding by over P440 million the loan obligation of a property developer client.

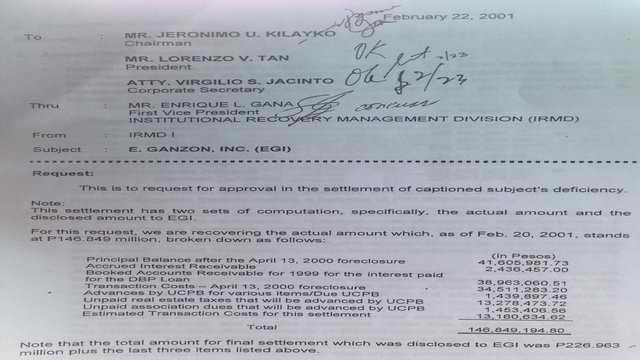

The memorandum included two tables showing different figures of the principal and interest loan obligation, transaction costs, lawyer fees, and consultancy fees.

In UCPB’s charge sheet, the bank admitted that the February 22, 2001 memo is a “highly confidential internal” note signed by its former officers: Lorenzo Tan, Virgilio Jacinto, Enrique Gana, Jaime Jacinto, and Emily Lazaro.

The case

When the bankers found out that EGI had a copy of the memo, UCPB filed charges of theft against EGI officers on June 16, 2001. The case was dismissed in August of that year.

In October 2001, EGI President Eulalio Guanzon filed a case of estafa and other deceits against the 6 UCPB officials.

On May 21, 2004, EGI filed a civil case at the regional trial court of Pasay City against UCPB. The Pasay court ordered UCPB to pay EGI over P1 billion on December 18, 2007.

“The refusal of UCPB to be transparent with the documents in its possession can only lead to the conclusion that it is hiding these documents because they are damaging to its interest,” Judge Jesus Mupas said in his 32-page decision.

The judge said “the many reprehensible acts committed by UCPB against the plaintiff groslly violate the bank’s fiduciary duty and they fall short of the required high standards of integrity that are required of banking institutions.”

The Pasay court found that EGI only owed to UCPB P746.11 million, but the bank collected a total of P1.19 billion.

Links

Maia Santos-Deguito, the sacked manager of the RCBC branch linked to the money-laundering scheme, had dragged Tan’s name to the scandal by linking him to individuals allegedly involved in the money-laundering scheme.

On March 23, the RCBC board accepted Tan’s second offer to go on leave pending the internal investigation into the money-laundering incident. (READ: Network: Who’s who in the RCBC money-laundering scam)

“Tan insisted on taking a leave to allow him to focus on clearing his name in the money laundering issue a board committee is investigating. The committee is assisted by SGV auditors and external counsels,” the RCBC board said in a statement.

“So far, no evidence has been presented against Tan linking him to the issue and the board has taken cognizance of the statement of Deguito before the Senate that Tan had nothing to do with the opening of the accounts that received the $81-million remittance,” the board said. (READ: $951M stolen money would have gone to RCBC)

Unidentified hackers stole $101 million from Bangladesh Bank in February in an attempted heist of about $1 billion. Sri Lanka has returned $20 million, while casino junket agent Kim Wong has turned over $4.63 million, but most of the money sent to the Philippines remains missing.

Support from big firms

But amid the allegations of involvement of Tan and RCBC on the heist, big clients of RCBC have expressed support for the Yuchengco-led bank.

In a statement, businessmen Andrew Tan, Manuel Villar, Edgar Sia, and Liberato Laus have expressed their support to RCBC in light of the bank heist.

Tan who owns Megaworld Corporation wrote a letter to RCBC chair Helen Dee expressing full support to the Yuchengco-led bank.

“During the past years, RCBC has been a solid partner of Megaworld in its corporate banking requirements. Our long-time partnership has been anchored on mutual trust and confidence. Your various awards and recognition as a company are testament to your dedication in providing the best banking services that we deserve,” Tan said in the letter.

The taipan said Megaworld would continue to do more business with the bank that was dragged into the bank heist.

“We look forward to more productive years as one of our partner banks,” he added.

For his part, Vista Land’s Villar said his companies have been doing business with RCBC for more than 30 years.

“For over 30 years, our group has relied on RCBC’s reliable service for its growing banking needs. And as we look forward to an even stronger partnership, the group shall continue to vest upon RCBC its full trust and confidence,” Villar said.

Sia’s Injap Investments and the Laus Group of Companies have also expressed full support for RCBC.

“Being a long time client of RCBC, they have my continued trust and confidence,” Sia said.

“We have been a client of RCBC for the longest time and we benefit from their very reliable banking services and high level of professionalism. We will continue to grow with them,” Laus added. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.