SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Due to favorable weather conditions and higher prices, the country’s corn production could see an 11.9% increase to 7.8 million metric tons (MMT) by end-2012.

Philippine Maize Federation, Inc. (Philmaize) president Roger Navarro told reporters on Wednesday, October 10, most of the double-digit increase will come from Isabela, one of the country’s major corn-producing provinces.

Navarro’s estimate is higher than the 7.46 MMT output expected by the Bureau of Agricultural Statistics (BAS) this year. Corn production reached 6.97 MMT in 2011.

“Harvest will be good this year. That’s why we are urging the government to allow us to export while prices in the international market remain high,” said Navarro at the sidelines of the 38th Philippine Business Conference held in Manila on October 10.

Corn inventory

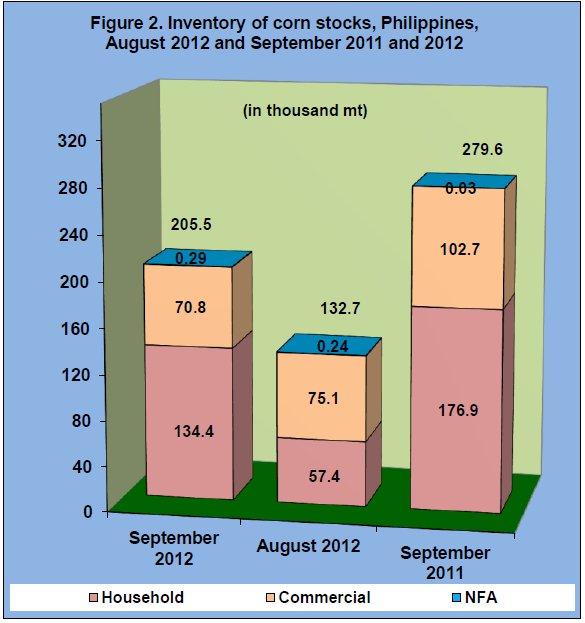

As of September 1, 2012, the BAS said the country’s total corn stock inventory was at 205,500 MT.

In its Rice and Corn Inventory report, the BAS said this is 54.8% higher than last month’s 132,700 MT but 26.5% lower than year’s 279,600 MT.

“Compared to last month’s records, household stocks showed a significant increase of 134.2%. Stocks in NFA depositories increased from 236 MT to 289 MT. In contrast, stocks in commercial warehouses decreased by 5.7%,” BAS said.

Further, the BAS said that compared to the inventory records of September 2011, this month’s holdings dropped by 24% in the households and 31.1% in commercial warehouses.

However, stocks in NFA depositories grew to 289 MT from 29 MT.

Of the current stock level, 65.4% were with the households and 34.5% were with the commercial warehouses. Only 0.1% was in NFA depositories.

Higher local corn prices

Domestic corn prices are expected to rise because of higher farmgate prices, the reluctance of traders to sell at lower prices and high importation costs, according to industry players.

Roderico Bioco, Chief Operating officer Mindanao Grain processing Co. Inc. said imported corn now costs P18 per kilogram, not including tax while local farmgate prices are now higher at P15 to P16 per kilo from the previous P12 to P13 per kilo early this year.

Bioco said these speculations may have risen because corn traders are reluctant to let go of their stocks because they would not be able to recover their buying expenses.

“The prices that the prices that the traders pay framers now are higher than what they can sell in the market. So, if they sell now, they are going to lose money,” he said.

Corn exports

Navarro said the National Food Authority (NFA) council has yet to tell them whether it has approved the plan of corn farmers to export surplus corn. Earlier, Navarro said the country will have a surplus of around 500,000 MT.

Navarro noted that during the latest NFA council meeting, it was bared by the Inter-Agency Committe (IAC) on rice and corn that the country’s inventory of grains is at 1.2 MMT. These grains include cassava, corn, and feedwheat.

He said these include imported feedwheat which is used as a substitute for yellow corn in manufacturing animal feeds.

“The government is liberalizing imports but it is restricting exports. These imports have an effect on domestic prices. I hope the government will take a second look at its policies and harmonize them,” said Navarro.

Due to the drought which hit the United States, corn prices shot up to unprecedented levels. This development encouraged local corn farmers to make a pitch for exporting their produce so they can take advantage of good prices. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.