SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – A key indicator of investor confidence, foreign direct investments (FDIs) that flow into the Phlippines from January to June grew 10.6%, according to data released by the United Nations on Tuesday, October 23.

In its Global Investment Trends Monitor, the UN Conference on Trade and Development (UNCTAD) estimated that FDIs into the country amounted to $0.9 billion in the first semester of the year, higher than the $0.8 billion recorded in the same period last year.

The Philippines recorded the 3rd fastest increase in FDI flows in Southeast Asia, but UNCTAD was quick to note that the Philippines was one of the countries with the smallest total amount of FDI flows.

“Investment leads economic growth but the current trends of investment flows to developing countries, particularly to Asia, are worrisome and the challenge for channelling FDI into key development sectors such as infrastructure, agriculture and the green economy remains daunting” UNCTAD Secretary-General Dr. Supachai Panitchpakdi.

Cambodia posted the highest growth at 165.7% to $0.9 billion, the same with the Philippines, followed by Thailand with a growth of 62.1% to $5.6 billion.

Except for these 3 countries, the rest of Southeast Asia recorded contractions in FDI flows. Countries that posted negative growth in FDIs were:

- Indonesia which posted a contraction of 20.6% to $8.2% during the period;

- Malaysia, a negative growth of 36.6% to $4.4 billion; and

- Singapore, a contraction of 1.9% to $27.4 billion.

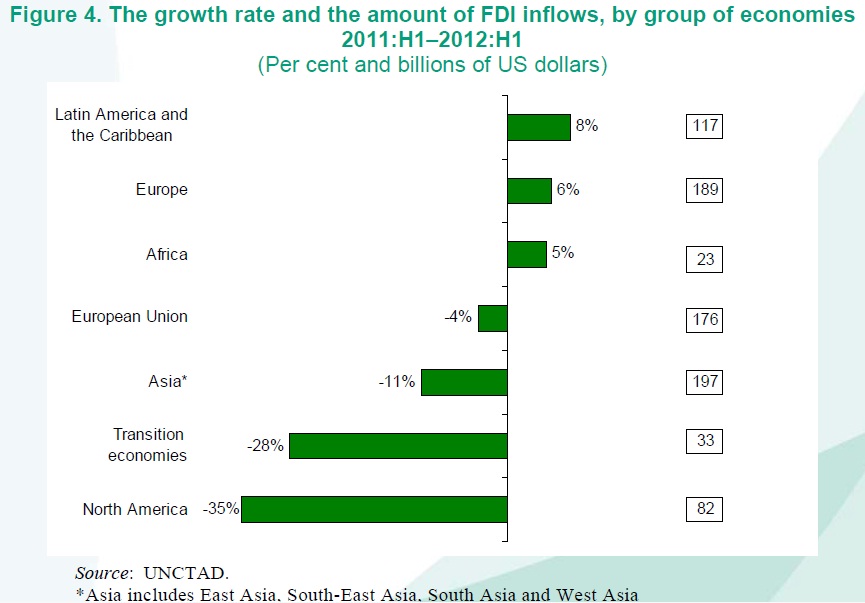

This caused a decline of 5.4% in FDI flow into the Southeast Asian region to around $51.8 billion in the first semester of 2012. This decline also contributed to the overall decline of 8.4% in global FDI to $667.6 billion in the January to June period.

“FDI flows to South-East Asia decreased by 5 per cent to US$52 billion. Member States of ASEAN demonstrated diverging trends: inflows to Cambodia, the Philippines and Thailand rose in the first half of 2012, while those to Indonesia, Malaysia and Singapore declined,” the report stated.

UNCTAD said the decline in global FDI was due to more uncertainty in the global economy, marked by fears of that the sovereign debt crisis in Europe will worsen and the slow down in economic growth in major emerging market economies.

The UN agency said that in the second quarter of 2012 the value of UNCTAD’s FDI Global Quarterly Index, which tracks FDI flows, dropped from 128 to 123.

“The slow and bumpy recovery of the global economy, weak global demand and elevated risks related to regulatory policy changes continue to reinforce the wait-and-see attitude of many transnational companies (TNCs) toward investment abroad. UNCTAD’s longer term projections still show a moderate rise. However, the risk of further macroeconomic shocks in 2013 can impact FDI inflows negatively,” UNCTAD said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.