SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

The Philippine Tax Whiz reminds all businesses and professionals of a number of Bureau of Internal Revenue (BIR) deadlines this January and other requirements for the renewal of business permits.

I have a startup company which was registered last year. Is it true that even if I have not fully operated my business, I must comply with all the BIR requirements? If yes, what are the documentary requirements and deadlines I need to know to avoid paying penalties and compromises?

Unfortunately, yes. Once you have registered with the BIR, you have to ensure monthly and quarterly compliance, including annual renewal and filing of the income tax return (ITR). Here are the deadlines for January 2017:

*January 14 – Monthly Withholding Tax on Compensation (1601C)

*January 14 – Monthly Expanded Withholding Tax (1601E)

- Required Attachment: Monthly Alphalist of Payees (MAP) with Validation

January 25 – Quarterly Value-Added Tax (2550Q)

- Required Attachment: Quarterly Summary List of Sales & Purchases with Validation

January 25 – Refund of Excess Tax Withheld on Compensation by Employer to its Employees

January 30 – Annual Inventory List

January 31 – Annual Registration Fee (using BIR Form 0605)

January 31 – Distribution of Certificates of Income Payment/Tax Withheld (2316) to Employees

January 31 – Annual Information of Income Tax Withheld on Compensation (1604CF)

- Required Attachment: Annual Alphalist of Employees with Validation

*Note that deadlines falling on weekends, holidays, and non-working days will be moved to the next working day. In this case, monthly withholding tax returns (1601C & 1601E) are due on January 16.

Aside from the BIR, are there other government agencies I need to deal with at the start of the year? How do I renew my business permit? Is it true that drug test results are required before they release my permit? When is the deadline for the renewal of business permits?

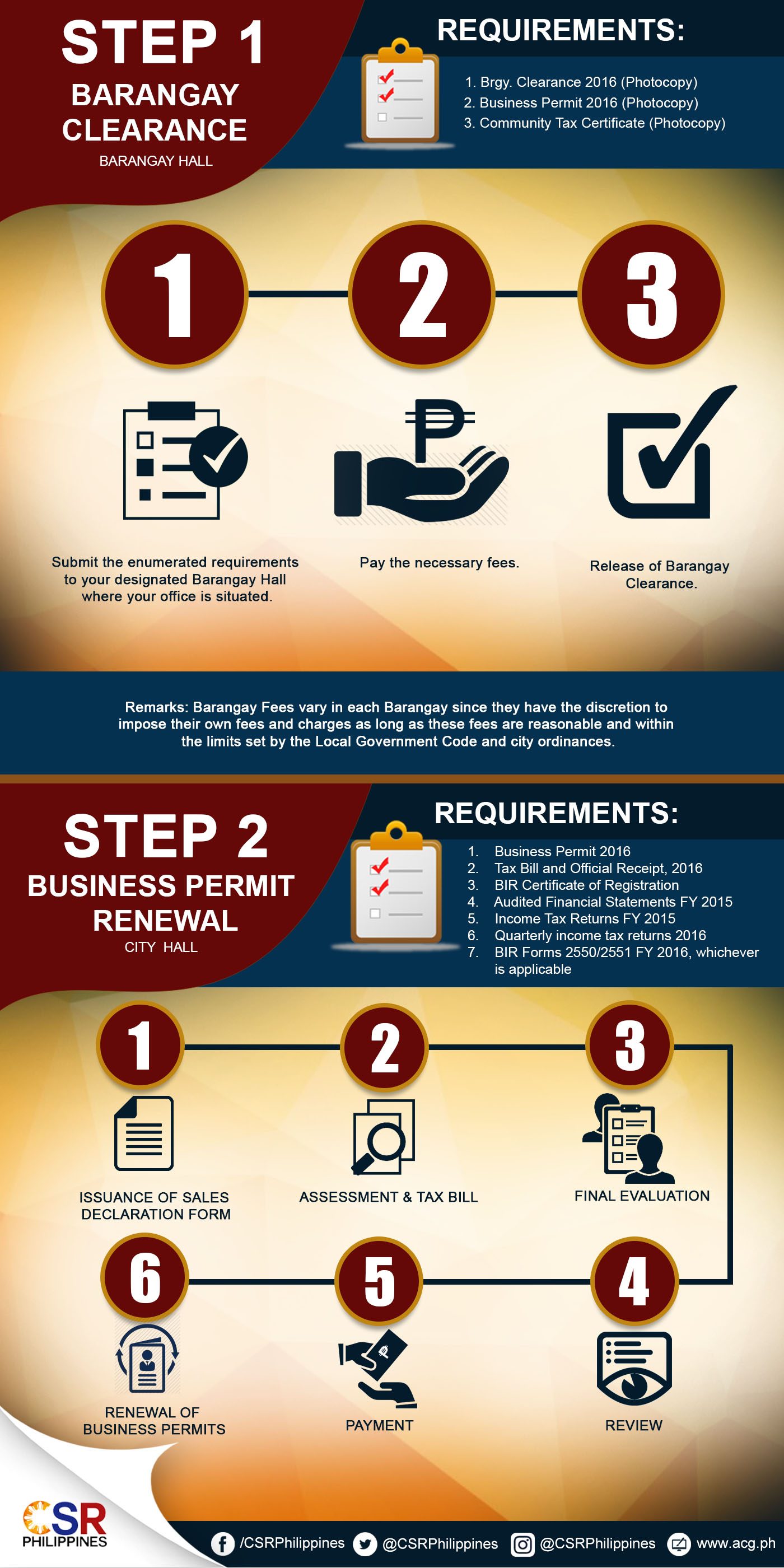

Yes. Aside from the BIR, you need to deal with the barangay for barangay clearance, city hall or municipal office for your business permit (or mayor’s permit), and if your business is a corporation, you also have to deal with the Securities and Exchange Commission (SEC).

Unfortunately, there are some barangays like Barangay Laging Handa in Quezon City which require drug test results before the release of the barangay clearance. Although I find it unconstitutional, baseless, and irrational as it has no relevance to doing business in the area, our office complied anyway to avoid unnecessary penalties since the barangay clearance is also needed to get a business permit.

January 20 is the deadline for the renewal of business permits. For more information, read this.

Am I still required to file my annual income tax return if I did not make any income last year? When is the deadline? Can I file early if I have nothing to declare?

Yes. Again, once you have registered with the BIR, you are required to comply with the monthly, quarterly, and annual filing.

April 15 is the deadline for the filing of the annual ITR. But you can file as early as now, especially if you have nothing to declare and pay.

For tax compliance review and assistance, you may email us at consult@acg.ph or call (02) 6227720. – Rappler.com

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com.

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2016 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founder of the Abrea Consulting Group and Center for Strategic Reforms of the Philippines (CSR Philippines). He currently serves as Adviser to the Commissioner of Internal Revenue of the Philippine government on tax administration reform in promoting inclusive growth. Follow Mon on Twitter (@askthetaxwhiz) or visit his Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.