SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Hiking the excise tax levied on sin products, especially cigarettes, could boost the Philippine economy and reduce deaths, according to the recent report of the Asian Development Bank (ADB).

In the report Tobacco Taxes released on Tuesday, November 13, the Manila-based multilateral development bank said cigarette-related deaths could decrease if governments will allow cigarette prices to increase.

A 50% increase in cigarette prices will boost the national government’s revenues by $600 million, a 177% increase from the current level, it said.

The Manila-based lender added that a 25% to 100% increase in cigarette prices would also boost Gross Domestic Product (GDP) by 0.11% to as much as 0.53%.

Sin tax

The ADB report essentially supports the Aquino government’s current move to increase excise taxes for “sin” products, including cigarettes and tobacco.

The Senate is still negotiating the sin tax bill after the House of Representatives passed a version meant to collect additional P30 billion from simplifying the current complex tax structure that favors cheap and locally-made sin products.

The Aquino government said it hopes to pass the measure that will yield at least P40 billion before yearend 2012.

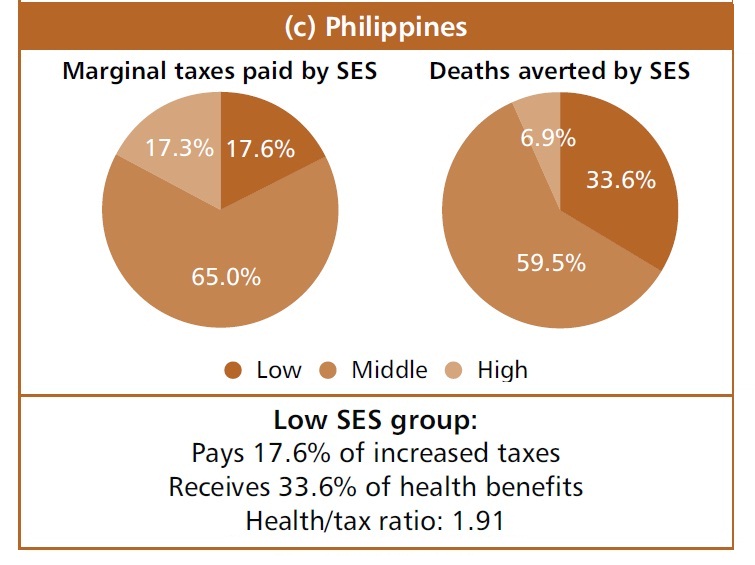

Anti-tobacco groups have been pushing higher sin taxes to benefit health programs, mostly meant for the poor, as well as tobacco farmers.

Increasing prices

To arrive at a 50% increase in cigarette prices, the ADB said the government must raise taxes 222% while a 100% increase in cigarette price will require a 343% increase in taxes.

The ADB added that, currently, 41% of the street price of cigarettes is expected to dramatically increase to 61% and 71% under a 50% and 100% price increase, respectively.

“The tax increases required to achieve a 50% or 100% increase in retail price are large, but not outside the range of tax increases that other countries, such as France, have implemented, or which are being considered by the Government of the Philippines,” the lender said.

“A tax increase of about 172% to 222%, depending on country, would raise the retail prices by 50%, and a tax increase of about 245% to 344% would double the retail prices,” the ADB explained.

Reduce deaths

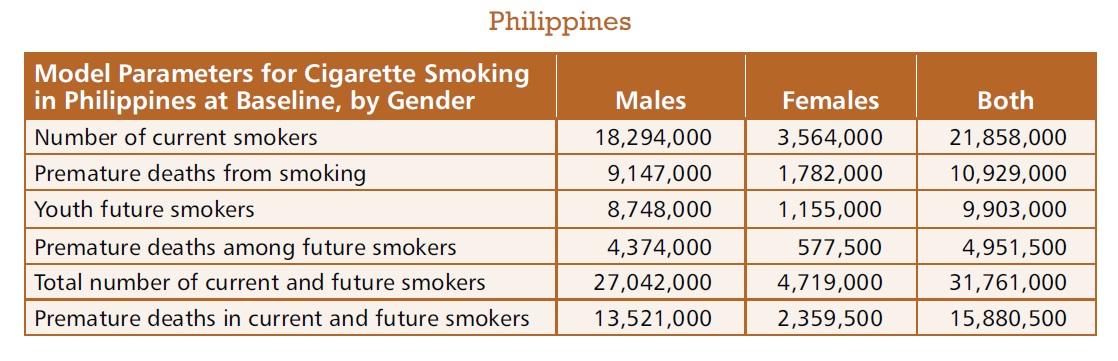

Around 15.9 million Filipinos are projected to die from smoking, projected the ADB. Some 10.9 million of them are current smokers while some 5 million are among the future smokers.

The ADB said there are 21.9 million smokers today and some 9.9 million are expected to be added to their number in the next few years.

Majority of smokers in the Philippines, around 18.3 million, are male while the remaining 3.6 million are women.

“Smoking will kill about 267 million of these 530 million current and future cigarette smokers. The majority of these deaths (201 million) will be among current smokers,” the ADB report said.

“The main strategy for all countries is to raise substantially the number of current smokers who quit via price and non-price interventions,” the ADB report stated.

A 50% increase in cigarette prices will result in 4.2 million Filipinos expected to quit and not start smoking, as well as bringing down the number of deaths by 1.8 million.

A 100% price increase, on the other hand, will significantly decrease the number of deaths by 3.5 million, the ADB said.

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.