SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Food and beverage global giant Del Monte Pacific, Ltd (DMPL) has a compelling offer to those who want to invest their money in dollar-denominated instruments: buy their preferred shares and fetch fixed-rate dividends of 6.625% every year for 5 years.

That’s more competitive than how much other dollar-denominated investment products are currently offering. The going rate of a 4-year dollar bond issued by the Philippine government is about 2.4%.

A first of its kind to be listed in the Philippine Stock Exchange, DMPL’s offer is expected to drive more dollar-denominated securities in the country as more companies engage in offshore business deals.

DMPL is positioning to realize benefits of its previous acquisitions, and allow investors in its preferred shares to participate in it.

Global shopping spree

The facility will allow DMPL to meet their dollar requirements. While DMPL is owned by a Filipino company, bulk of its operations is abroad. It is using the fund raising proceeds to refinance a $350 million loan with BDO Unibank, which helped fund DMPL’s acquisition of its parent, the United States-based Del Monte Foods, Incorported (DMFI), in 2014.

That $1.7 billion deal made DMPL among the first of Filipino companies that have been on a big-ticket global shopping spree.

Not long after, an unprecedented big-ticket acquisitions abroad by homegrown firms followed. (READ: Philipine firms on global shopping spree)

Universal Robina Corporation took over New Zealand snack food giant Griffin’s. Local instant noodle maker Monde Nissin acquired meat substitute manufacturer Quorn of the United Kingdom for about $831 million. Emperador, the liquor firm of tycoon Andrew Tan, bought Spanish firm Whyte & Mackay for about $726 million, the Spanish brandy producer Bodega Las Copas for $82 million, among others.

“When they said they (DMPL) were going to bid for it, admittedly it was ambitious, I agree with you. But we were rooting for them,” said Eduardo V. Francisco of BDO Capital and Investment Corporation, the sole issue manager of the offer.

DMPL—or its majority owner, Filipino firm NutriAsia—is no stranger to tredding uncharted waters.

NutriAsia acquired Singapore-listed DMPL in 2006. DMPL owns the iconic canned fruits and ready-to-drink juice brand Del Monte in the Philippines. DMPL exports its pineapple and other fruit products from the Philippines to other markets in Asia and the Middle East.

NutriAsia currently owns 59.44% of DMPL.

Initially a local condiments group, NutriAsia was founded by Joselito Campos Jr, a businessman from the Campos family behind pharmaceutical giant Unilab. NutriAsia now owns household brands, like Jufran and Mafran ketchup, UFC Tamis-Anghang Banana Ketchup, Mang Tomas lechon sauce, and Datu Puti and Sauce Silver Swan soy sauce and vinegar.

The US business (DMFI) added popular brands like S&W and Contadina into the group’s portfolio.

Finding partners, targets

“When we bought DMFI, it was a natural because they’re really part of the Del Monte family. It was a reunion of sorts so it was very easy,” recalled DMPL Chief Operating Officer Luis Alejandro.

“I’d say if you want to buy something, there’s got to be a relationship with your current category. If you buy something else that’s different from your business, you can do that also but you have to recognize that might be a different strategy. In our case, we made sure it was really related to our food,” added Alejandro who also helped NutriAsia acquire DMPL.

Alejandro said evaluating people was also necessary. During a 15-year stint with Proctor and Gamble, Alejandro familiarized himself with the landscape of US business, which he said is similar till this day. As he shared plans to look for DMFI’s new CEO he added, “You really have to take a look at people. You have to be very careful.”

It’s a sentiment that Francisco of BDO Capital shared as he explained the local investment house’s decision to assist DMPL in its ambitious US acquisition. “Even if things were not as clear then, we believed because of the management and the principles [of DMPL]. That’s important for us because sometimes, the numbers—you can make up. But if you don’t trust the principles and the management, nothing will happen,” said Francisco.

Cleansing process

Just like any other business acquisition, the first years have not been smooth sailing. After DMPL acquired its parent in the US, DMFI’s declining sales affected DMPL’s overall financial performance.

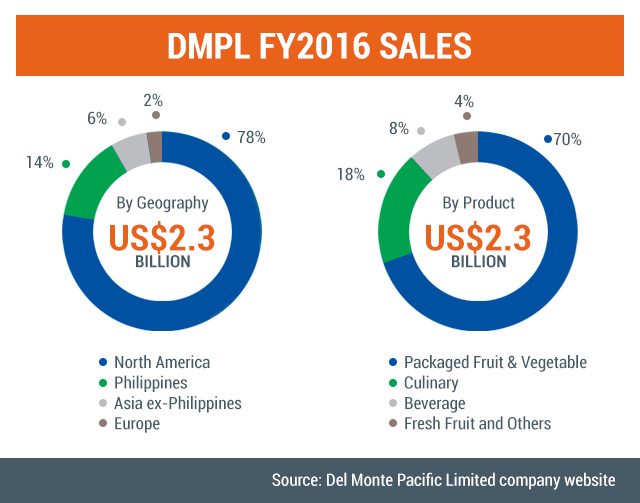

The US business, which contributes 78% of overall sales, posted a 6% decline in 2016. It caused DMPL’s bottomline to be in the red for several quarters.

Alejandro said this was due to a “cleansing process” that they subjected the US operations to go through. As new owners who don’t have emotional or historical affinity to some of the business operations of the acquired US unit, they were more logical and clinical in finding ways to cut costs and rationalize operations.

DMPL thoroughly examined the US unit’s product portfolios and unloaded products that did not carry as much value to the brand heritage.

Parag Sachdeva, DMPL’s Chief Finance Officer, explained the decline was seen in fruit sales, along with the group’s other regional brands in the US. He attributed this to supply-chain issues as the company closed down some of its plants in the US, including its operations in North Carolina in 2016.

Additionally, the decline in US business sales was seen in its private label products, which are produced as in-house brands for companies like Walmart and Costco.

“It’s the private label US sales in non-retail where we are seeing some decline and that is not necessarily a bad thing because going forward we will be focusing on profitable sales [coming from branded products],”Sachdeva told Rappler at the sidelines of the roadshow.

Changes in consumer preferences from canned goods to tetra-packaged products contributed as well to the decline in sales volume as consumers become increasingly health and environmentally conscious. Unfavorable price trends resulted in the lowering of prices of food products.

Moving forward

To address the decline in sales, DMPL chartered an ambitious 5-year growth plan for both its US and other markets.

The plan included efforts that emphasized strengthening the company’s core branded products business while expanding its current offerings. New products like the company’s Fruit Refreshers have been launched to received success. Other specialty products exclusive to specific regions, such as Del Monte’s Creamy and Cheesy Spaghetti in the Philippines, and eggless mayonnaise in India were also released.

DMPL shared plans to expand its consumer market. The company aims to reach out to a larger demographic in the US that would go beyond its “all-American” reputation.

Outside the US, DMPL’s operations and products are in markets, including India and other Asian countries, and the Middle East. The Philippines is its second largest market, contributing 14% of total sales. DMPL supplies companies such SM, Puregold, Robinsons, Jollibee, 7 Eleven, McDonalds, Greenwich, and Shakeys.

Unlike its US business, the company’s base business posted continued growth in sales.

Eyes on China

Alejandro said the company would be looking to capture the China market. “For DMPL, we have a long way to go in penetrating China, which is the biggest of them all. We’re not even where we want to start in China, so we’re starting. That’s the biggest piece of it.”

He added the company would not be looking to expand its market in Europe anytime soon as competition between private labels remains high.

The company will also respond to consumer trends through e-commerce opportunities. It recently cemented a partnership with Amazon, one of the world’s largest online retail groups and the 8th largest retailer.

Marketing would be a major focus to further relay the health claims of its products to consumers, Sachdeva said.

Along with this, DMPL hopes to respond to consumer trends by improving its agriculture and manufacturing technology along with its processing and packaging technologies.

Long time coming

Treading into new territory once more, DMPL along with BDO Capital had long been preparing for the offer of its dollar-denominated preferred shares.

Francisco explained this was because rules and measures for the new instrument needed to be put in place. “We had to work with the equities bourse, the PSE, the SEC—it was very difficult because it’s [dollar denominated shares] is a new instrument. But we’re hopeful that this will start a new set of instruments for us so that after Del Monte, there will be other issuers of dollars who will have that chance,” said Francisco.

It took almost 2 years to put all the systems for the new instrument in place. “There is no reason why we should wait any longer,” DMPL’s CFO Sachdeva added.

Selling period for the preferred shares is from March 22-28, and listing will be on April 7.

Del Monte Pacific Limited was founded in 1999. It is one of the largest packaged fruit and vegetable sellers in the world. DMPL carries 4 heritage brands including Del Monte, S&W, Contadina, and College Inn.

DMPL is not affilated with other Del Monte companies in the world such as Fresh Del Monte Produce, Incorporated, Del Monte Canada, and Del Monte Asia Pte. Limited. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.