SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (2nd UPDATE) – The Ayala group’s Bank of the Philippine Islands (BPI) has confirmed reports that it is in talks with the Lucio Tan group for a deal to create potentially the country’s largest financial institution.

The two groups on Wednesday, November 21, disclosed negotiations on BPI’s possible acquisition of a majority stake in Philippine National Bank (PNB).

Trading in the two banks was suspended for the day.

“We confirm discussions with the Lucio Tan group and we will make the appropriate disclosures in accordance with the PSE rules,” BPI said in a disclosure to the Philippine Stock Exchange (PSE).

In a separate announcement, PNB said a disclosure on the details of the transaction may be made within the day.

“We will make the appropriate disclosures within the day once we obtain the necessary board approvals,” it said.

A Reuters report quoting banking sources said the deal between two of the country’s biggest conglomerates involves a share swap that will give Lucio Tan 20% of BPI.

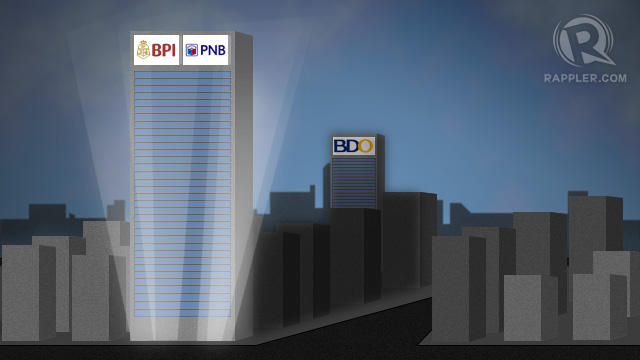

The deal may result in a combined entity that will unseat Banco de Oro Unibank, owned by the country’s richest man Henry Sy, as the country’s largest bank by assets.

BPI is the Philippines’ third-largest lender, with assets of P842.6 billion by the end of 2011, while PNB’s assets amounted to P316.3 billion.

A merger between the two will result in combined assets of P1.56 trillion, slightly higher than BDO’s P1.1 trillion as of end-2011.

A Philippine Daily Inquirer report which quoted sources on the BPI-PNB deal also said that the Lucio Tan group had explored a possible merger with George Ty-led Metropolitan Bank & Trust Co. (Metrobank).

However, Metrobank denied this in a disclosure also on Wednesday.

“Metrobank denies that it explored the possibility of a merger with PNB,” the Ty-led bank said.

PNB-Allied Bank merger

The BPI-PNB talks come as the Lucio Tan group works to get the long-delayed merger between PNB and another unit, Allied Banking Corp., approved.

The two banking arms of tycoon Lucio Tan will merge via a share-for-share swap deal that was approved by the Bangko Sentral ng Pilipinas in August.

The BSP’s nod is part of a series of regulatory approvals locally and overseas that the banks need to obtain before their merger could push through.

PNB said in a dislcosure Wednesday that “the Hong Kong Monetary Authority has given its approval for PNB to become majority shareholder controller of Allied Bank.”

It said it is now waiting only the approvals of regulators in the United Kingdom, where PNB has operations, and the Philippine Securities and Exchange Commission. – Rappler.com, with a report from Agence France-Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.