SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Consunji-led Semirara Mining and Power Corporation (Semirara) said it doesn’t think Environment Secretary Gina Lopez’s ban on prospective open-pit mines will affect its operations in any way.

Semirara chief executive officer Isidro Consunji, speaking to media after the firm’s annual stockholders’ meeting on Tuesday, May 2, noted that the ban does not cover existing mines.

Semirara operates the country’s largest open-pit mine in Panian on Semirara Island, and has other open-pit mines in Narra, Palawan and Molave in Caluya, Antique.

“It shouldn’t affect us. The Panian, Narra, and Molave mines are all existing [operations]. The Environmental Compliance Certificates (ECCs) are all okay so they shouldn’t be affected,” Consunji said.

The Semirara CEO also pointed out that expansion plans on Semirara Island, due to the discovery of more mineral deposits, would involve “additional area and depth in existing mine [sites] and not opening up new sites.”

Earlier during the stockholders’ meeting, Semirara president and chief operating officer Victor Consunji also assured investors that no laws are being violated.

“There are standards established by law … and I think as long as we conform to these … then the audit team represented by the academe and professionals [should clear the firm]. There should be no risk as far as Semirara is concerned,” he said.

“Seven audits have come [under the Duterte administration] and I am proud to say we have passed with flying colors,” he added. (READ: Philex Mining suspends Silangan mine project)

New market, higher target for coal exports

Besides mining, the firm is also heavily involved in selling coal for use in power plants, both here and abroad.

Victor Consunji noted that the firm is expected to send out its first coal shipment to Japan this year.

“The shipment will be 70,000 metric tons (MT) of coal to Tohoku Electric in northwestern Honshu Island for a 2×600 megawatt (MW) coal power plant. The shipment is a trial run and should be delivered by the end of May. If successful, we will do 4 more shipments,” he said.

The major international markets for Semirara are Thailand and China. Last year, the firm exported 12 million MT of coal. It plans to raise its total coal exports to 16 million MT, the maximum allowed by its ECC, in 2 or 3 years.

To do so, Semirara is planning to spend around P2 billion this year to expand the pier in its shipment base, adding more conveyor systems and coal storage areas. Its current infrastructure is maxed out at the capacity of 12-14 million MT annually.

The firm said it will need to spend around P3 billion on top of that for mining equipment such as trucks and excavators to be able to hit the 16-million-MT target by 2018.

Semirara also raised its authorized capital base from P3 billion to P10 billion during the stockholders’ meeting.

The increase was in order to avoid being fined by the Bureau of Internal Revenue for inappropriate accumulation capital.

“We have too much retained earnings. There is a requirement wherein if retained earnings goes over the paid-in capital you will be penalized a 10% tax by the BIR,” Consunji explained.

As a result, the firm also announced it will be handing out cash dividends totaling P5 billion, a 25% increase from last year, with the disbursement to be decided by directors.

Semirara’s consolidated net income in 2016 jumped by 48% to P12 billion compared to the P8.47 billion seen in 2015.

The firm’s management expects even stronger demand and higher prices for coal this year. Its composite projection for coal shipments in 2017, both local and international, is at P2,200 per MT compared to the P1,970 average in 2016.

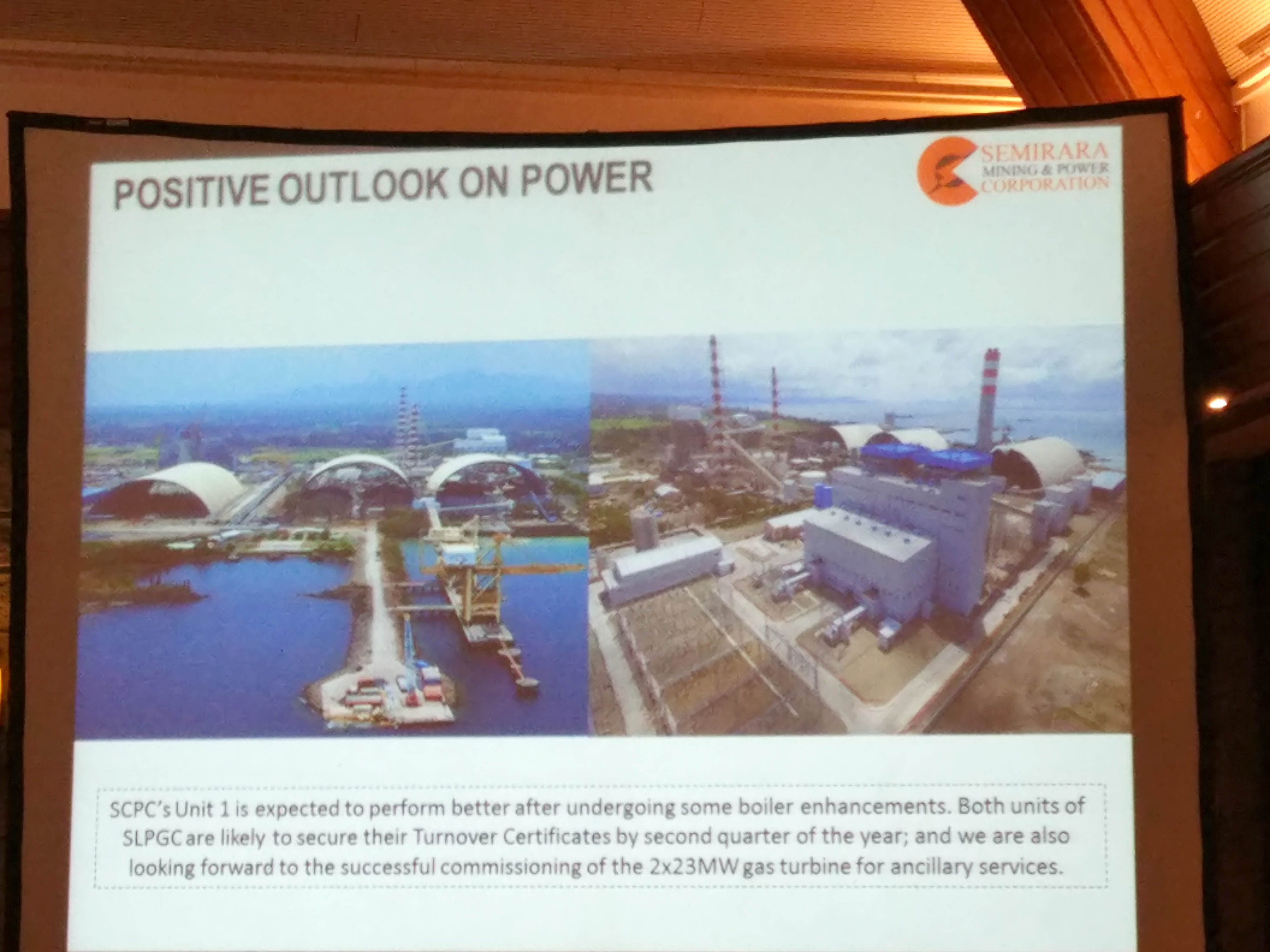

“The [coal] prices are higher, there is more production, and the 4 units of Calaca should produce more electricity this year since retrofitting of unit 1 is finished and units 3 and 4 have commenced commercial operations,” Consunji said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.