SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – Budget Secretary Benjamin Diokno takes the helm of the Bangko Sentral ng Pilipinas (BSP) following the death of Nestor Espenilla Jr on February 23.

Espenilla, appointed by President Rodrigo Duterte in 2017, was heavily praised by economists, bankers, and industry leaders, citing the continuity of stable monetary policies and the smooth transition Espenilla represents from former BSP governor Amando Tetangco Jr.

The public is now eager to see how Diokno will fit in his new position. (READ: FAST FACTS: What does the Bangko Sentral ng Pilipinas do?)

But why is this role so important?

1. It is beyond politics.

Ideally, this means the governor of the central bank stays independent from politics. He or she should focus on the arduous task of helping to manage the country’s wealth and economy.

Unlike other presidential appointments, the position of the BSP governor is a fixed appointment that spans 6 years. He cannot be removed at whim by the powers-that-be.

The only voice of the political leaders in the BSP is through a seat reserved for a Cabinet member — usually the Finance Secretary — in the Monetary Board. His or her vote, though, is only one among the 7 members of the policy making body.

2. He chairs the powerful Monetary Board.

The BSP governor is the chairman of the Monetary Board, which exercises the powers and functions of the BSP. It is the Philippine equivalent to the powerful Federal Reserve Bank in the US, whose chief’s carefully worded public statements can either calm the markets or trigger jitters of trillions of dollars-worth magnitude.

While the funds involved in the Philippines are less in scale, the BSP governor’s announcements after the Monetary Board’s every-six-weeks meeting keep those who want to know hints of where the local economy is headed on their toes.

The body has 5 full-time members from the private sector and one member from the Cabinet.

3. He has a direct impact on the value of our money and how affordable goods or services are.

The BSP adopted an inflation target in 2002, abandoning the previous goal of monetary targeting. This means the BSP’s main goal is to “promote price stability conducive to a balanced and sustainable growth of the economy,” which is the aim of the inflation target.

The inflation target is announced for the next two years, and if the BSP misses it, the governor has to issue an open letter to the president to explain to the public why it missed the target. The allowable circumstances for not meeting the inflation target include natural calamities, government policy changes that directly affect prices, such as changes in the tax structure, incentives, subsidies.

To meet the inflation targets, the Monetary Board announces policy moves, usually in the form of interest rates or, in some cases, how much it wants the banks to put aside as reserve funds. Think water faucet: the BSP can either loosen the tap to allow more funds to flow, or tighten it to restrict a freer flow (or mop up excess liquidity).

Doing this impacts inflation or the price of goods in an economy because of an old economic truism: the more the supply (of money), the lower the price (of money). Banks are the most ubiquitous entities that directly handle the citizen’s money. Interest rates reflect the cost of money.

If the BSP and the Monetary Board are able to time their policy moves well and choose which monetary tool is best to use, their decisions have a direct impact on the value of the Filipinos’ money in the short and long term. In other words, how much Filipinos can afford to buy or at what level they aim to sell their goods or services are a product of the decisions made at the BSP.

The past years’ low interest rate regime meant that lower inflation allowed Filipinos to afford more. And this has resulted in a chicken-and-egg situation.

An increasing number of retail outlets have been apparent to cater to consumers who have more money in their pockets. Cars and homes became more affordable. Businessmen are gaining confidence in the economy, prompting them to build factories or processing plants, expand their reach nationwide, or diversify their portfolio of businesses.

All these economic activities ideally create more jobs.

4. He is in charge of ensuring the health of the financial system.

Using carrot and stick, the BSP regulates the banks and other non-bank financial institutions (like pawnshops, foreign exchange dealers, money changers, remittance agents). It is the BSP’s role to ensure these entities that the Filipinos entrust their hard-earned money to are in tip-top financial shape and prudent. After all, the BSP is considered the “lender of last resort” only to banks that need to get over a hump. Otherwise, the BSP orders them closed or slap the wrongdoers with a fine.

After the Asian financial crisis in the 1990’s, the BSP increased the capital requirement of the banks and other non-banks to prepare them for bigger shocks and risks ahead. What a wise move in turned out to be, especially during and after the global financial crisis in 2008-09. The Philippines breezed thru that latest crisis, thanks to a banking system that proved to be one of the most stable in the region.

With the rise of protectionism policies around the globe, the BSP (and the governor) will likely be tested once again. The country’s financial institutions have to steady and all buffered up.

5. The BSP is key in ensuring the economic growth benefits all.

Aside from maintaining the rapid growth of the Philippine economy, the BSP also faces the challenging task of helping address the high poverty rate. Data from the Philippine Statistics Authority show that 21.6% of Filipinos live below the poverty line.

To ensure that benefits of economic growth reach the grassroots, the BSP’s policy decisions that affect prices and influence job creation must be timely and appropriate.

The BSP has introduced innovations in the way it approaches its role as a regulator in the recent past. These included providing access to legitimate financial institutions in underbanked and unbanked communities that traditional banks may not be able to reach. These out-of-the-box approaches have been recently and are carefully being rolled out. The new governor has to create momentum for these innovations to bear fruit so more Filipinos, including those below the poverty line, can be reached.

Another ongoing innovation at the BSP to make economic growth inclusive is the gradual shift to a digital financial ecosystem. The BSP has noted that the Philippines maintains a largely cash- and check-based payment system, and that these transactions are confined within each of the banks, ATM networks, and other silos.

To keep up with the digital times and added need for financial security, it is key that the governor and the BSP see the full roll-out of its pioneering National Retail Payment System (NRPS) project by 2020.

What the BSP governor can do

Article 3 of Republic Act 7653, also known as the New Central Bank Act, outlines the duties and powers of the BSP governor. These include:

- Leadership – The governor has the duty to render opinions, decisions, or rulings on matters that relate to carrying out the functions of the central bank, which are final unless revised by the Monetary Board.

- Agenda setting – The governor prepares the agenda for meetings of the Monetary Board and submits to the board plans and actions necessary to carry out the purposes of the BSP.

- Execution and administration – Policies and measures approved by the Monetary Board are executed and administered by the BSP governor.

- Overseeing the BSP’s operations – The BSP governor may also delegate tasks and responsibilities to other full-time members of the Monetary Board.

- Salary affixation of BSP personnel – In line with plans approved by the Monetary Board, the governor is responsible for determining the salary of personnel below the rank of a department head and may impose disciplinary measures on BSP personnel. However, removal of employees will need the approval of the Monetary Board.

- Official appointment – Not more than 3 deputy governors can be appointed by the governor. The deputy governor acts as the chief executive of the BSP in the absence of the governor.

The BSP governor is also the principal representative of the Monetary Board. In line with this role, his or her responsibilities include:

- Official representation – The governor holds the power to officially represent the Monetary Board and the BSP in dealing with outside parties, whether foreign or domestic. The governor also has the power to represent the BSP personally or through counsel in any legal proceedings and studies.

- Official signatory – The governor is the official signatory to all contracts, notes, securities, reports, balance sheets, profit and loss statements, correspondence, and other documents of the BSP. When appropriate, an exact copy of the BSP governor’s signature may be used.

The BSP governor may also delegate these powers to other officers when necessary.

What the BSP governor cannot do

While in office, the BSP governor and other full-time board members cannot accept positions or other employment, whether public or private, outside their direct positions at the BSP.

However, exceptions are possible for positions in charity, civic, cultural, or religious organizations.

BSP governors

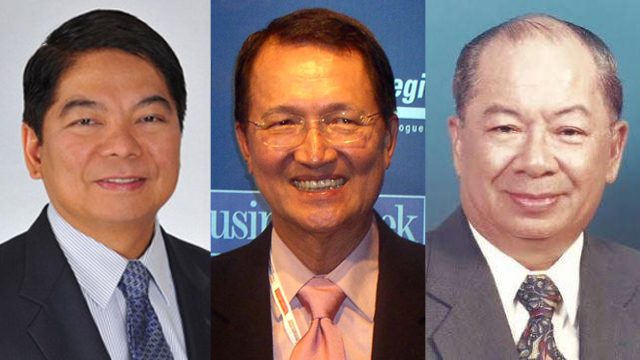

Since its conceptualization in 1993, the BSP has had 3 governors whose accomplishments have helped to develop the Philippine economy as we know it today.

Nestor Espenilla Jr, who served from 2017, was a long-serving official at the BSP before his appointment. He was the deputy governor for banking supervision and regulation. His appointment was only the 2nd time in the BSP’s history that an “insider” clinched the top job.

Amando Tetangco Jr, whose 2nd term ends in July 2017, is the only BSP governor to serve for two terms. He began his term as BSP governor in July 2005 and steered the Philippines through the 2008 global financial crisis. Tetangco is credited with the rapid growth of the Philippine economy, transforming it from the “Sick Man of Asia” to “Asia’s Rising Tiger.”

From July 1999 to July 2005, Rafael Buenaventura served as the BSP governor under the administrations of Joseph Estrada and Gloria Macapagal-Arroyo. He championed the development of microfinance as a means to alleviate poverty, and also campaigned for the passage of the Special Purpose Vehicle Act and the Anti-Money Laundering Act.

Gabriel Singson served as BSP governor from July 1993 to July 1999 and took on the task of transitioning from the Central Bank of the Philippines to the Bangko Sentral ng Pilipinas. He laid the foundation for a strong central bank, which is now considered among the best in the world. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.