SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – With car loan rates at an all-time low, about 359,572 brand-new passenger cars sprawl across the Philippines in 2016, clogging most major thoroughfares of the country. To help curb the worsening traffic situation, the government has proposed to raise car taxes significantly, causing concern among local auto companies.

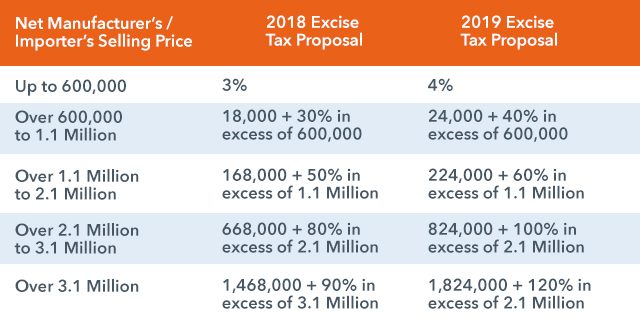

The House of Representatives Ways and Means Committee on May 3 approved a new auto excise tax proposal, which is segmented into 5 price groups. This is part of a tax package proposal that substituted House Bill (HB) 4774, which failed to get approval when Congress adjourned last March 18, 2017.

The new auto excise tax proposal will be staggered in two years: 2018 and 2019. Here’s the substitute bill approved at the committee level:

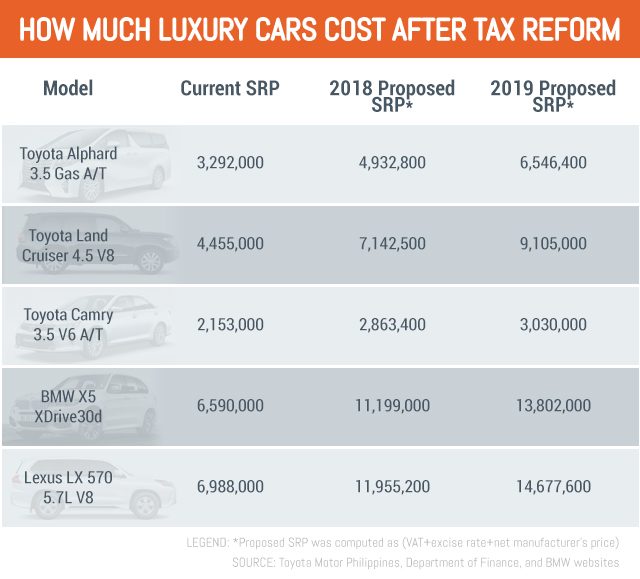

The proposal could potentially sap demand for luxury cars, local car companies said.

“The concern lies on the upper end, the luxury market. The proposed program is quite drastic. We have to consider the future of these importers. Not just us, but everybody else,” Toyota Motors Philippines Corporation vice-chairman Alfred Ty said on the sidelines of an annual stockholders’ meeting in Makati City on May 11.

The expected boost to consumer spending from lower personal income taxes could be enough to offset the increase in vehicle prices for the average household. But prospects are not brighter for the high-end market. (READ: Will tax reform really hurt the poor?)

“In totality, it does not even take up 1% of total car sales. Those P3 million and above cars make up less than 1% of the total sales,” Ty said.

Finance Secretary Carlos Dominguez III had said the proposed auto excise tax hike would mainly impact the higher social classes that can buy luxury cars.

“I don’t know how much of that contributes in the traffic. It likely less than 1% of the total cars on the road,” Ty said.

Toyorta managed to produce 55,028 vehicles in 2016, with its top-selling Vios and Innova vehicles assembled in its facility in Laguna. Its long-term goal is to sell at least 200,000 vehicles by 2022.

Meanwhile, Ayala has high hopes for the growth of automotive manufacturing in the group and operates a network of dealerships across the Honda, Isuzu and Volkswagen brands as well as signing a deal last year to manufacture and sell KTM motorcycles.

Ty said the the Chamber of Automotive Manufacturers of the Philippines Incorporated (CAMPI) is in talks with Dominguez to lobby the industry’s concerns on the proposed tax hike.

“Yes, we’ve tallked to Dominguez. He is looking at it on the overall package, which on the reverse side the lowering of income tax will gove more purchasing power to the people. We are also considering that point of view. CAMPI is speaking for us and we are just one group to share our inputs to the legislators,” Ty told reporters.

For Ayala chairman Jaime Augusto Zobel de Ayala, the Bureau of Internal Revenue has a tough job because in the end one has to keep the credit standing of the country – and this involves making adjustments to the tax policy.

“It always nice when you have a strong domestic economy for a product that is growing. And an economy that is accelerating the way ours is will need an automotive sector that increases. The problem is not that there are too many cars, the problem is that there is too little infrastructure. That’s the way it should be viewed,” he said.

Zobel de Ayala pointed out “that a strong automotive market would also give great strength to manufacturing because if you can tie that to strong domestic demand then obviously that’s a big plus.” (READ: Cabinet officials back Duterte’s tax reform plan)

“That being said, I’m not going to pass judgment on the decisions of the government to raise revenues, that’s their call. They have to raise it in whatever way they can and we all have different opinions on the way that needs to get done,” he said.

“But just the fact that the government is putting an emphasis on balancing their budget is good for all of us. It will keep our interest rates stable, it will keep our foreign exchange stable and it will keep foreign direct investments coming in,” Zobel de Ayala noted.

“That’s the finance secretary’s job. Its not an easy one and I will always respect any decision he has to make in this matter,” he added.

For Dominguez, “financing is available. We’re awash in cash. Interest rate is low. Taxation is relatively lower compared to other countries. I think there is a lot of room for increasing revenues for government by adding taxes on cars.” – with Chris Schnabel/Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.