SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

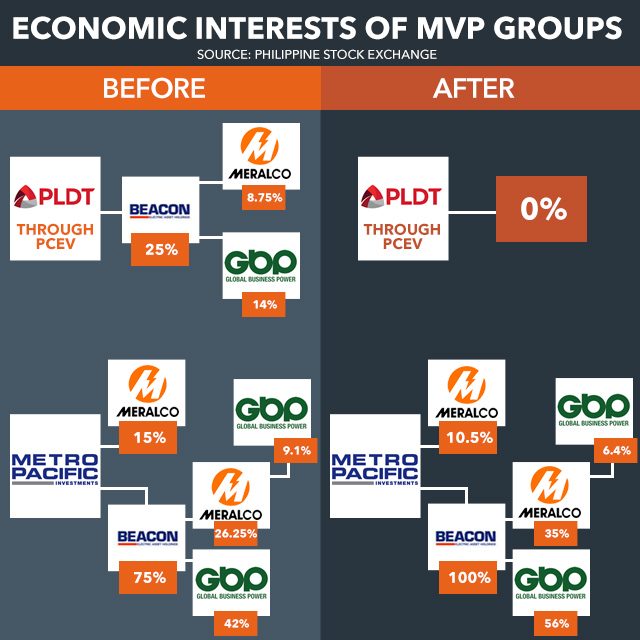

MANILA, Philippines – In an effort to reduce debt, PLDT Incorporated is selling its remaining 25% equity interest in Beacon Electric Asset Holdings Incorporated (Beacon) to its sister company Metro Pacific Investments Corporation (MPIC). This transaction is worth P21.8 billion.

Beacon holds a 35% interest in Manila Electric Company (Meralco) and a 56% interest in Global Business Power Corporation (GBP).

The money will help PLDT pay off its debt, mainly arising from the acquisition of a 59% equity interest in San Miguel Corporation’s telecommunications business.

For MPIC’s part, the additional stake will help the conglomerate increase equity interest in GBP, which is GT Capital Holdings Incorporated’s power generation arm.

“The divestment of our Beacon investment will help the PLDT group focus on the key priorities in its core businesses. While the investment is now viewed as no longer strategic, it has nonetheless been a very financially satisfying one,” PLDT chairman Manuel V. Pangilinan said in a statement on Wednesday, June 14.

“Proceeds from the sale will be used principally to reduce debt and to fund the ongoing network upgrade and expansion,” he added.

Beacon is a special purpose company jointly owned by PLDT Communications and Energy Ventures Incorporated and MPIC.

MPIC will pay P12 billion in cash on closing, which is anticipated to occur within this month. The balance of P9.8 billion will be paid in the next 4 years, PLDT said.

Upon completion of payment, PLDT will no longer have any direct interest in Beacon or any indirect interest in Meralco and GBP.

No more minority partner

To fund the investment, MPIC said it completed an overnight placing of 4.5% of its directly held Meralco shares for P12.67 billion.

Upon acquiring 100% interest in Beacon, MPIC will increase its ownership interest in Meralco to 45.5% from 41.2% and in GBP to 56% directly and 6.4% indirectly.

“The acquisition of [PLDT’s] remaining 25% in Beacon, at what I consider to be a very attractive entry price, means that for the first time we have no minority partner in our power portfolio holding company,” MPIC chief executive officer Jose Maria Lim said.

“We are now free to accelerate our rate of participation in the Philippine power sector, building on our nationwide presence as we embrace distribution, thermal generation, renewables, and energy from waste. The transactions announced today are also immediately accretive to earnings,” Lim added.

MPIC is the Philippines’ largest infrastructure investment management and holding company. Meralco is the biggest electricity distributor in the Philippines.

Pangilinan chairs PLDT, MPIC, and Meralco. PLDT and MPIC are 2 of the 3 Philippine subsidiaries of First Pacific Company Limited.

Last June 3, MPIC and GBP announced that the latter had entered into an agreement with Alsons Consolidated Resources Incorporated to acquire 50% of its coal generation portfolio holding company in Mindanao, subject to fulfillment of certain conditions. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.