SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

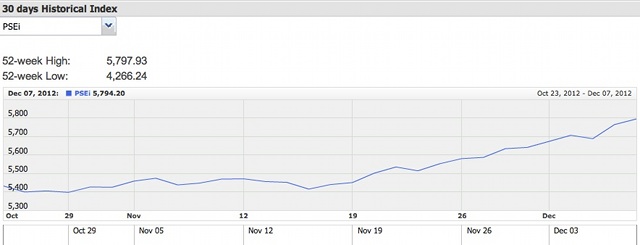

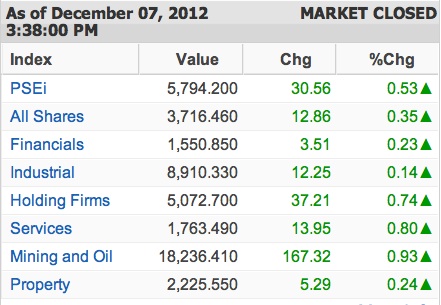

MANILA, Philippines – The main index of the Philippine Stock Exchange (PSE) closed at 5,794 on Wednesday, December 7, rewriting the all-time high for the 36th time this 2012.

The new historic high marks a hefty 32.5% increase year-to-date.

The PSE index (PSEi) has been hitting record highs in 9 out of the past 10 days, gaining 242 points over the past two weekds.

The index also hit another intraday record at 5,797.93 on December 7. It closed 30 points higher than the previous day.

At the foreign exchange market, the Philippine peso closed at P40.945 to the dollar, shedding two centavos against its P40.965:$1 close the day before.

Asian markets up, euro falls

Asian markets mostly climbed Friday, December 7, following a positive lead from Wall Street, while the euro extended the losses made in New York after the ECB cut its growth forecast for the eurozone.

Seoul gained 0.4%, or 7.83 points, to 1,957.45 and Sydney added 0.94%, or 42.5 points, to close at 4,551.8 but Tokyo ended 0.19%, or 17.77 points, down at 9,527.39.

In the afternoon Hong Kong gained 0.32% and Shanghai was 1.61 percent higher.

Shares in New York provided a bright start to the day as data showed that jobless claims in the United States fell last week after three weeks of higher figures caused by superstorm Sandy.

Initial claims for unemployment insurance in the week to December 1 dropped from 395,000 the previous week and well over 400,000 in the two weeks before.

The news bodes well ahead of the release later Friday of key non-farm payrolls data.

On Wall Street the Dow closed 0.30% higher, the S&P 500 added 0.33% and the Nasdaq gained 0.52%.

In Tokyo, the euro rose as dealers moved back into buying mode after it suffered a big fall in New York late Thursday on news the European Central Bank had tipped the eurozone economy shrink 0.3% in 2013. It had previously forecast 0.5% growth.

The bank also hinted that it might be moving toward cutting its benchmark rate, despite holding firm on Thursday.

The single currency was quoted at $1.2960 in afternoon Asian trade, from $1.2969 in New York late Thursday, and 106.80 yen from 106.86 yen.

The unit was also well down from the $1.3055 and 107.69 yen in Asia earlier on Thursday.

The dollar was at 82.41 yen in Asia, from 82.37 yen in New York.

In Hong Kong insurance firm PICC jumped almost 8% at one point on its trading debut after raising $3.1 billion in an initial public offering, making it the city’s biggest listing this year.

Shanghai also continued its rebound after hitting a near 4-year low on Monday, with traders hoping the mainland government will introduce a fresh round of measures to support the world’s number two economy.

On oil markets New York’s main contract, light sweet crude for delivery in January was up 29 cents at $86.55 a barrel in the afternoon and Brent North Sea crude for January added 23 cents to $107.26.

Gold was at $1,701.72 at 0655 GMT compared with $1,693.03 late on Thursday. – Rappler and Agence France-Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.