SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Did the Bureau of Internal Revenue (BIR) collect the target revenue for 2016? Was there any improvement in tax collections from July 2016 to June 2017 or in the first year of Commissioner Caesar Dulay? Are there any tax administration reforms being implemented?

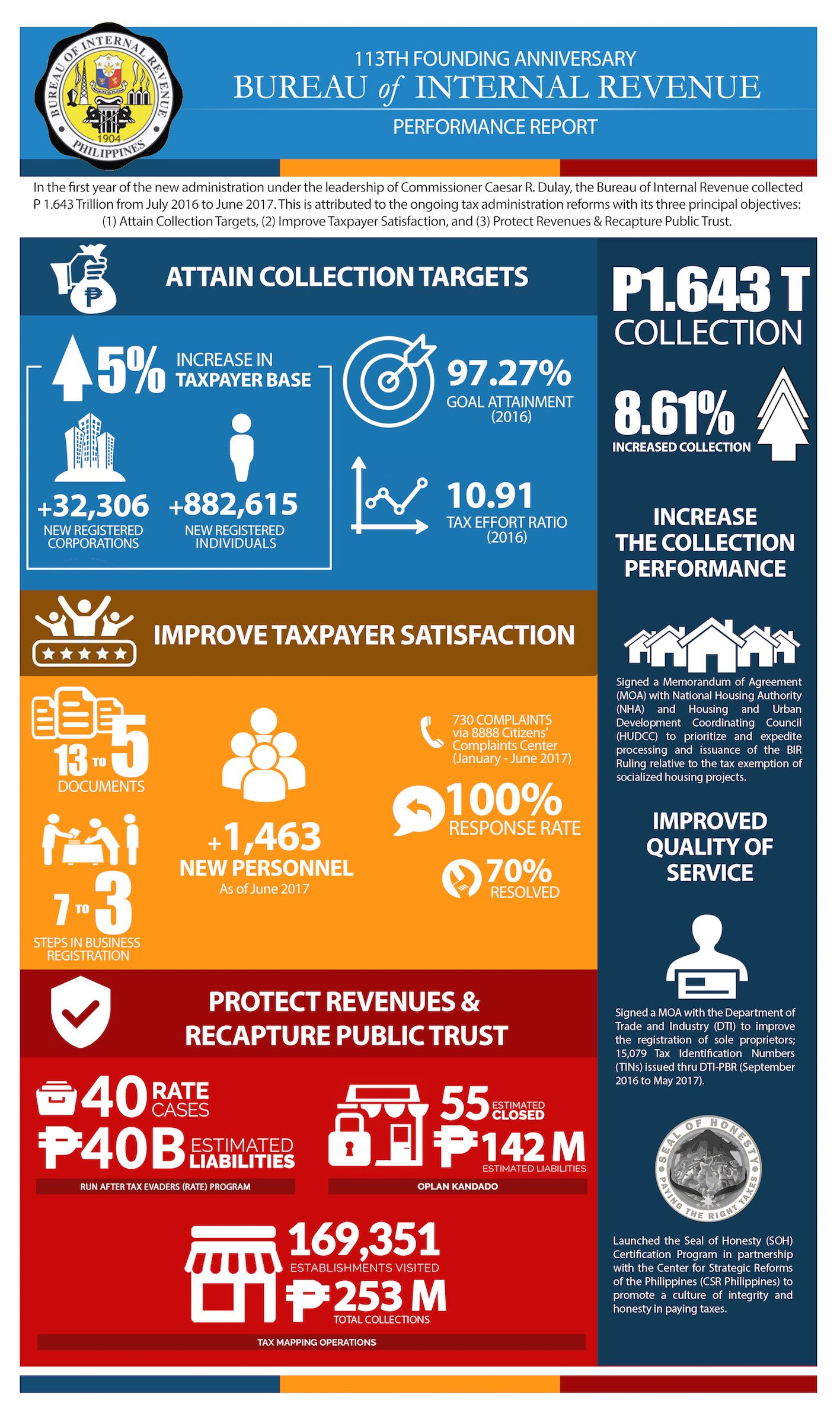

The target revenue for 2016 was not reached but collection performance improved, hitting 97.27% of the goal. Like in previous years and past administrations, the collection target remains a challenge.

However, in the first year of Commissioner Dulay, the BIR collected P1.643 trillion or an 8.61% growth rate.

This is attributed to its ongoing tax administration reforms. The principal objectives are the following: (1) attain the collection target, (2) improve taxpayer satisfaction, and (3) protect revenues and recapture public trust.

During his first 3 months, Commissioner Dulay suspended the BIR audit as it was perceived to be the source of corruption. But we read in the papers that somebody filed a plunder case against him and other BIR officials and that Congress is investigating him for alleged irregularities in tax administration. How do you explain this? Is it true that he is also being asked to resign?

After one year in office, 379 revenue officers were called to explain due to taxpayer complaints. Erring examiners were put under investigation after being asked to resign if they will not stop corrupt practices.

It is true that Commissioner Dulay was implicated in the settlement case of Del Monte Philippines, Incorporated (DMPI) which was protested after being initially assessed at P8.6 billion (not P80 billion as some columnists or writers would claim). But the approval of P65.4 million (again, not P50 million as earlier mentioned by some columnists or writers who give misleading information) is within the delegated authority of the head of the Large Taxpayer Service. In short, unless Commissioner Dulay has personal knowledge of the case or an appeal was brought to his office, he doesn’t need to approve it as it is not an abatement case where he will have to approve the compromise agreement as provided in our tax code.

For tax practitioners, we know how ridiculous, absurd, and sometimes unimaginable the assessments of the BIR can become. In fact, assessments involving hundreds of millions of pesos or even a billion pesos are possible even for small companies, that’s why the BIR audit is sometimes perceived as a source of corruption or harassment.

Regarding the issue of Commissioner Dulay being asked to resign, it is true as what we have read in the papers. But it is up to President Rodrigo Duterte or to Commissioner Dulay to decide that, and not any deputy commissioner or revenue official. (READ: Integrity over power)

Is there still corruption in the BIR? If Commissioner Dulay is indeed a good and honest man, what is he doing to stop this?

Yes. It doesn’t disappear overnight. Corruption is embedded in our tax system, benefitting both tax collectors and taxpayers.

As Commissioner Dulay puts it: “Corruption is a two-way street. Walang korap, kung walang mangongorap!” He said during the launch of the Seal of Honesty (SOH) Certification Program on May 31 that we need to promote a culture of integrity and honesty to fight the culture of corruption. We need to help the BIR collect the right taxes and stop corruption in the BIR by paying taxes correctly and on time.

On the BIR’s 113th founding anniversary with the theme “Tunay na Pagbabago Para sa Bayan” (Real Change for the Nation), Commissioner Dulay issued RMC 60-2017 announcing the launch of the SOH Certification Program to promote integrity and honesty in paying taxes. For inquiries, email info@sealofhonesty.ph. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2016 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founder of the Abrea Consulting Group and Center for Strategic Reforms of the Philippines (CSR Philippines). He currently serves as Adviser to the Commissioner of Internal Revenue of the Philippine government on tax administration reform in promoting inclusive growth. Follow Mon on Twitter (@askthetaxwhiz) or visit his Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.