SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – DoubleDragon Properties Corporation, owned by Mang Inasal founder Edgar “Injap” Sia II and Jollibee chief Tony Tan Caktiong, announced on Monday, August 7, that it plans to raise P7.5 billion through a follow-on offering, in a deal worth more than 6 times its initial public offering (IPO).

A follow-on offering refers to the sale of shares of stock that comes after a listed firm has issued an IPO. In April 2014, DoubleDragon raised P1.16 billion from 579.73 million IPO shares priced at P2 apiece.

DoubleDragon told the local bourse that it plans to conduct a follow-on offering to “enhance trading liquidity and further strengthen its balance sheet with higher equity levels.”

The property firm is undertaking such a move as it aims to become one of the blue chip stocks in the bellwether Philippine Stock Exchange index (PSEi) in the near term.

In September 2016, DoubleDragon was among the 5 listed firms included in the PSEi reserve list, mainly because of growth in market capitalization.

Steady trading activity is a criterion for inclusion in the PSEi. DoubleDragon said it believes that a follow-on offering will increase trading volumes in the stock and allow the entry of a good base of institutional investors to further strengthen its position in the international investment community.

In a disclosure, DoubleDragon said the offering for 150 million common shares will result in increased total equity. As of March 31, 2017, DoubleDragon’s total equity stood at P19.96 billion, while total assets closed at P49.7 billion.

Revised 2020 targets

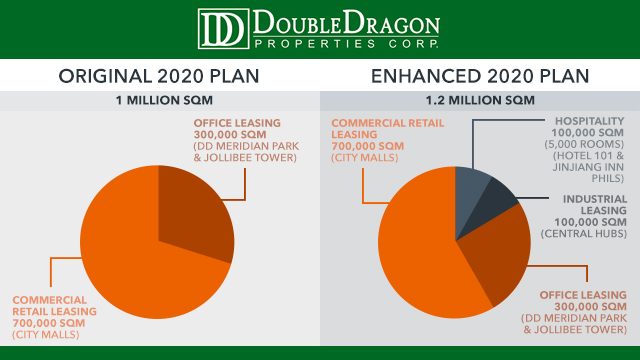

To further improve its portfolio, the listed property developer also revised upward its 2020 targets. Instead of one million square meters (sqm) of leasable space, DoubleDragon now expects to hit 1.2 million sqm of leasable space by 2020. (READ: DoubleDragon completes acquisition deal with Hotel of Asia)

It also aims to grow its net income to P5.5 billion by 2020, from its initial target of P4.8 billion.

To achieve its target, DoubleDragon is set to form a wholly-owned subsidiary called Central Hub Industrial Centers Incorporated. This will serve as its industrial leasing arm, providing a standardized multi-use warehouse chain for commissaries, cold storage, and logistic centers.

Under the plan, Central Hub will develop 100,000 sqm of industrial leasing space, and another 100,000 sqm from hospitality and hotels through the Hotel 101 and Jinjiang Inn brands.

“We are glad that DoubleDragon now has 4 strong legs in various property spectrums, namely commercial retail leasing, office leasing, industrial leasing, and hospitality, which will provide the company with a diversified source of recurring revenues,” DoubleDragon chairman Sia told the local bourse.

The company said it intends to dominate the branded industrial leasing industry in the near term through the development of central hubs in Northern Luzon, Southern Luzon, the Visayas, and Mindanao.

DoubleDragon’s net income more than doubled to P1.47 billion in 2016, after its recurring revenue almost tripled.

Shares of DoubleDragon closed at P48 each on Monday, down 0.62% from Friday, August 4. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.