SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Shares in Chelsea Logistics Holdings Corporation, the 2nd publicly-traded firm of businessman Dennis Uy, had a bland stock market debut on Tuesday, August 8, as investors continued to take profits after seeing gains early on.

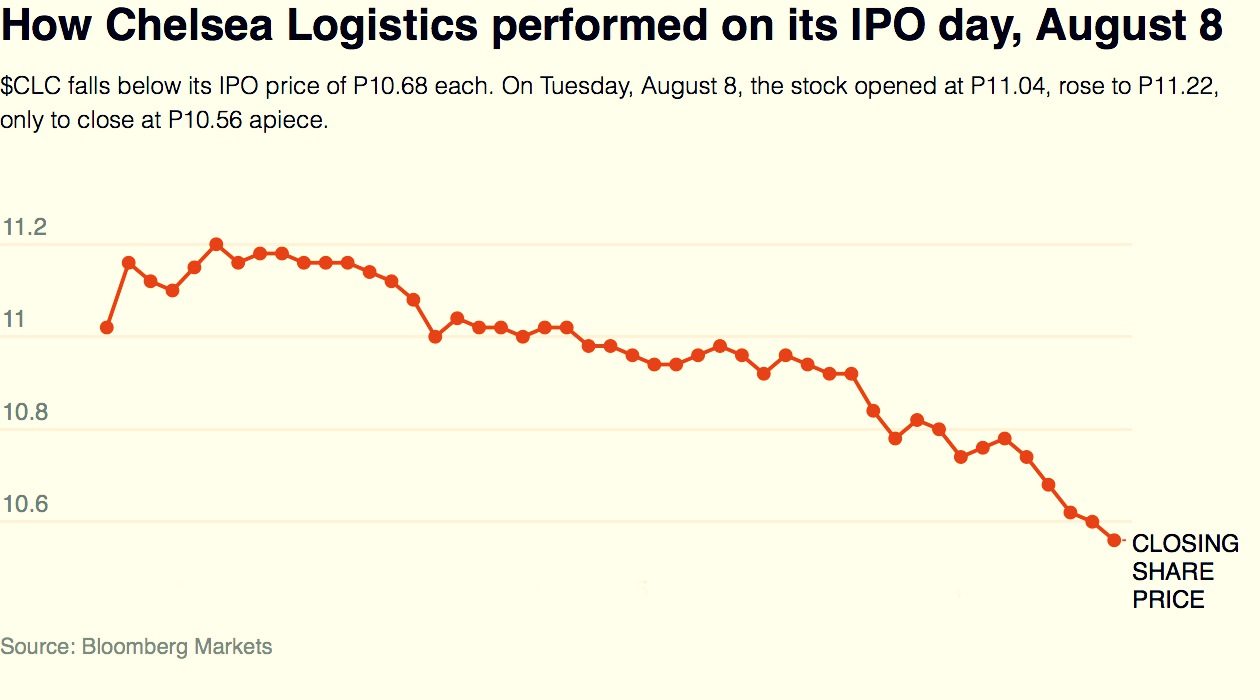

On Tuesday, the stock fell below its initial public offering (IPO) price of P10.68 each. It opened at P11.04, rose to P11.22, only to close lower than its IPO price, at P10.56 each.

This came against a backdrop of mostly sluggish trading on the Philippine Stock Exchange (PSE). Most stock indices ended lower on Tuesday.

“Chelsea Logistics’ maiden voyage was met with many headwinds. Even though it closed below its IPO price, the stock gained on average above the P10.68 set earlier. Perhaps some of this was also because of the index falling on a weak note,” Marita Limlingan, president of Regina Capital Development Corporation, told Rappler.

Davao-based Chelsea Logistics priced its IPO of about 546.59 million shares at P10.68 each. That was below the maximum offering price of P14.63 per share that the company listed when it filed plans to go public in April.

For the first day, Limlingan said Chelsea Logistics traded with a volume weighted average price of P10.96 with 136 million shares. “[This] means most sellers still – on average – made a profit from the listing,” she said. (READ: PSE approves Dennis Uy’s Chelsea Logistics IPO)

“It’s just a disappointment for today for those who expected to do a trade on the opening. It opened well and then it took a profit taking,” said Harry Liu, president of Summit Securities Incorporated.

Of the IPO proceeds, Chelsea Logistics earmarked about P1.78 billion for fleet expansion, including the purchase of a medium-range tanker that can carry 45 million to 55 million liters of bunker fuel across international waters.

The company also plans to set aside P245 million for the acquisition and upgrade of ports, port facilities, containers, machineries, as well as equipment to support its core business.

Meanwhile, about P3.20 billion was earmarked for the purchase of other shipping and logistics companies to expand its market reach.

“Right now, the market share of Chelsea group, including the 2GO stake, is 32%. We are always opportunistic and entrepreneurial on how we do things. We expect to close at least one [deal] this year,” Chelsea Logistics chairman Dennis Uy said in a media briefing.

The remaining P275 million from the IPO funds will be used for general corporate purposes, payment of drydocking expenses, and other working capital requirements, Uy said.

Port development opportunities

Chelsea Logistics aims to become the leading mover of vital goods, cargo, and passengers in the Philippines, and eventually a regional player by expanding organically and creating synergies with 2GO Group Incorporated and affiliates within the Udenna Group.

Udenna, the holding firm of Uy, started its shipping business in 2006 through Chelsea Shipping to support the operations of Phoenix Petroleum Philippines Incorporated, Uy’s first firm to be listed on the local bourse.

The business has since grown into the country’s largest shipping group. It has the largest tanker fleet in terms of capacity with a total gross registered tonnage of 39,271.64.

Uy told reporters that Chelsea Logistics is also eyeing opportunities in port development across the country.

“We will look if there is an opportunity to expand into ports since we are a major user,” he said.

Uy added that Chelsea will look into the Davao Sasa Modernization project of the government, too.

In March, Chelsea Logistics bought a 28.15% indirect economic interest in 2GO Group and subsequently took over its management. SM Investments Corporation completed its purchase of a 34.5% stake in 2GO’s parent firm, Negros Navigation, later that month.

Uy said Chelsea intends to increase its stake in 2GO to about 32% to 39.85%.

BDO Capital & Investment Corporation served as issue manager, lead underwriter, and sole bookrunner of Chelsea’s IPO.

Chelsea Logistics began trading on the PSE under the “CLC” ticker symbol. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.