SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

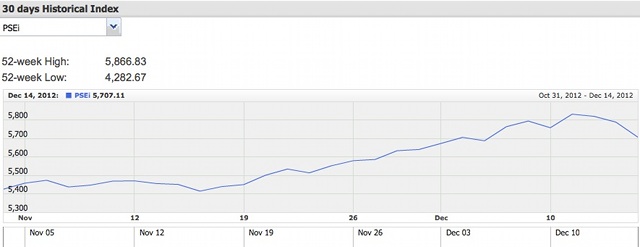

MANILA, Philippines – The Philippine Stock Exchange (PSE) main index, which has broken record highs 37 times this 2012, posted a 1.4% decline on Friday, December 14.

The PSEi closed 80.84 points lower at 5,707.11, reflecting the biggest one-day loss since July and the 3rd straight day it ended to close just above 5,700 level.

Analysts attributed this retreat from the previous 6,000-bound trajectory to investor concern over the US’ fiscal woes.

Metropolitan Bank and Trust lost 1.6% to end at P101.10, Ayala Land shed 3.1% to P25.05 and Alliance Global Group fell 2% to P16.36.

At the foreign exchange market, the peso ended barely changed, closing at 41.09 against the dollar.

Asian markets

Asian markets ended mixed, with strong Chinese manufacturing figures offset by concern about the US “fiscal cliff” and downbeat Japanese business confidence data.

Currency traders continued to sell the yen on the last working day before Japan holds a general election on Sunday that is expected to see the ruling party ousted.

Tokyo closed flat, dipping 5.17 points to 9,737.56, and Sydney was also virtually unmoved, edging up 0.3 points to 4,583.1. Seoul eased 0.39%, shedding 7.73 points to close at 1,995.04.

Hong Kong closed up 0.71%, or 160.40 points, at 22,605.98.

Shanghai surged 4.32%, or 89.15 points, to 2,150.63 after HSBC said China’s manufacturing activity hit a 14-month high this month, another sign the world’s number two economy is picking up steam.

The bank’s preliminary purchasing managers’ index (PMI) hit 50.9, up from a final 50.5 in November when the figure returned to growth after 12 consecutive months of contraction.

A reading above 50 indicates expansion while one below signals contraction.

The December reading is the highest since October last year.

Qu Hongbin, a Hong Kong-based economist with HSBC, said the new figure “confirmed that China’s ongoing growth recovery is gaining momentum, mainly driven by domestic demand conditions”.

He added that domestic demand was the main driver of the increase, but warned overseas headwinds remained a worry for the mainly export-dependant economy.

Chinese shares were also buoyed by expectations the country’s top leadership will hold a key annual meeting this weekend that will lay out major economic policies and goals for the next year.

However, markets are nervous that US lawmakers seem to be making slow progress on an agreement to avert the fiscal cliff — $600 billion in spending cuts and tax hikes slated to come into effect on January 1 which could send the economy into recession.

President Barack Obama and Republican House Speaker John Boehner held what were described as “frank” talks Thursday. But there was little sign they had found common ground on a more bearable plan to cut the country’s huge deficit.

Wall Street ended in the red with the Dow off 0.56%, the S&P 500 retreating 0.63% and the Nasdaq dropping 0.72%.

Adding to the sense of pessimism was the latest quarterly Tankan survey of manufacturers’ sentiment by the Bank of Japan, which showed a steep fall in confidence.

The index came in at minus 12, a big fall from the minus 3 seen in the 3rd quarter. Economists had expected a reading of minus 10.

The figures, which represent the percentage of firms saying business conditions are good minus those saying they are bad, are a key measure used by the BoJ in formulating monetary policy.

Japanese shares were given some support however, by the continuing weakness of the yen, which has tumbled since last month when the ruling Democratic Party of Japan announced a general election for December 16.

Prime Minister Yoshihiko Noda’s party is expected to be easily beaten by the Liberal Democratic Party headed by Shinzo Abe, a former premier who has promised to push for more aggressive monetary easing to jumpstart the economy.

In afternoon trade on Friday the dollar bought 83.67 yen compared with 83.64 yen in New York Thursday afternoon, while the euro bought 109.66 yen, from 109.38 yen and $1.3107 from $1.3073.

Oil prices were higher. New York’s main contract, light sweet crude for delivery in January, added 95 cents to $86.84 a barrel and Brent North Sea crude for January fell 58 cents to $107.33.

Gold was at $1,698.80 at 0700 GMT compared with $1,695.60 late Thursday. – Rappler.com and Agence France Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.