SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Edgar “Injap” Sia II, last year’s big gainer on the Forbes Asia list of the Philippines’ wealthiest, dropped out of the ranks of Filipino dollar billionaires this year.

The Mang Inasal and DoubleDragon founder fell from 17th place in 2016 to 21st place in 2017, the latest Forbes Asia list of 50 richest Filipinos showed.

The drop in ranking came as Sia’s estimated net worth of $820 million as of August 23, 2017 is down 32% from his estimated fortune of $1.2 billion this time last year.

Meanwhile, the exclusive club of Filipinos who are billionaires in dollar terms has swelled from a record 14 last March to 18 in August.

Based on Forbes’ estimates, the new members of the club are Jaime Zobel de Ayala of Ayala Corporation (5th richest), Lucio and Susan Co of Puregold Price Club (11th), Inigo and Mercedes Zobel also of Ayala Corporation (13th), Mercedes Gotianun of Filinvest (15th), and Dean Lao of D&L Industries (18th).

Stock setback

It’s a reversal of fortune for the 41-year-old Sia, who grew his net worth by 200% to $1.2 billion last year on the back of his upstart real estate firm DoubleDragon Properties Corporation, which went public in 2014.

DoubleDragon, known primarily for its CityMalls brand of community malls, is a joint venture with Jollibee founder Tony Tan Caktiong. Sia owns 37% of the firm through investment vehicle Injap Investments Incorporated.

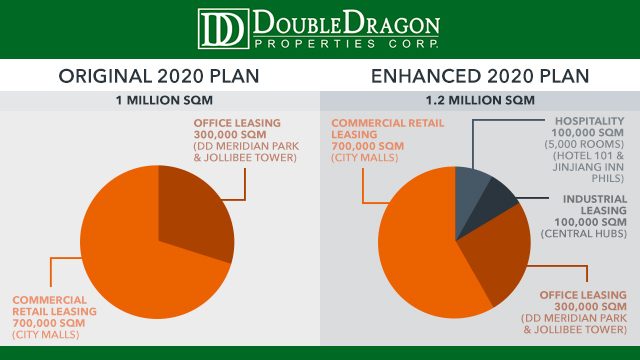

Beyond CityMalls, DoubleDragon is also behind the hotel brands Hotel 101 and Jinjiang Inn, as well as the Meridian business complex in the Mall of Asia area.

Originally listed on the Philippine Stock Exchange’s Small and Medium Enterprises Board, DoubleDragon’s popularity soared with investors and it was transferred to the main board in July 2016.

Forbes noted in August 2016 that “DoubleDragon’s 350% [stock] run-up is attributed to strong rental revenues and growth of its CityMalls brand.”

By the same token, it’s the retreat of DoubleDragon stock this year that is largely responsible for the drop in Sia’s net worth.

Since August 2016, DoubleDragon’s stock price has gone from a high of P60.80 to a low of P36.00. It closed at P44.15 at the end of trading on Thursday, August 24.

The firm has become a victim of its own popularity as expectations in early- to mid-2016 raised the stock price so high that it precipitated a selloff and eventually settled down at a price in the mid-P40s.

Rising Dragon?

While the fall from the ranks of dollar billionaires may sting, it is worth noting that Forbes estimated Sia’s net worth to be at $350 million in 2015, prior to skyrocketing to $1.2 billion in 2016.

What’s more, DoubleDragon’s recent performance has been consistent, more than doubling its net income in 2016 to P1.47 billion as recurring revenue almost tripled.

In the 1st half of 2017, DoubleDragon’s net income grew to P324.7 million from P131.5 million in the same period last year. It also recently announced plans to build the largest hotel in Davao City.

The firm also plans to sell over P7 billion worth of shares in a follow-up to its 2014 initial offering, and has set an even more ambitious net income target by 2020 in a bid to become a blue-chip stock.

Should the new offering turn out to be as popular as the initial one, it wouldn’t be surprising to see Sia once again rising in next year’s Forbes list. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.