SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Two of the listed firms that have opted not to meet the Philippine Stock Exchange’s (PSE) minimum requirement of 10% public ownership were officially delisted on Friday, December 21.

First Metro Investment Corp. (FMIC), the investment banking unit of tycoon George Ty, and Metro Pacific Tollways Corp. (MPTC), the tollway unit of businessman Manuel V. Pangilinan, got the PSE’s nod on December 12 to voluntarily delist their shares.

In October, the two firms separately disclosed that they would delist as the yearend deadline loomed.

Aside from FMIC, the Ty-led listed firms include FMIC’s parent, Metropolitan Bank and Trust Co., and GT Capital Holdings.

On the other hand, the listed firms under Pangilinan include MPTC’s parent, infrastructure conglomerate Metro Pacific Investments Corp., as well as Philippine Long Distance Telephone Co., Manila Electric Co., and Philex Mining Corp.

Starting January 1, 2013, the trading of firms that fall short of the public float rule will be suspended. If they remain non-compliant after 6 months, they will be automatically delisted.

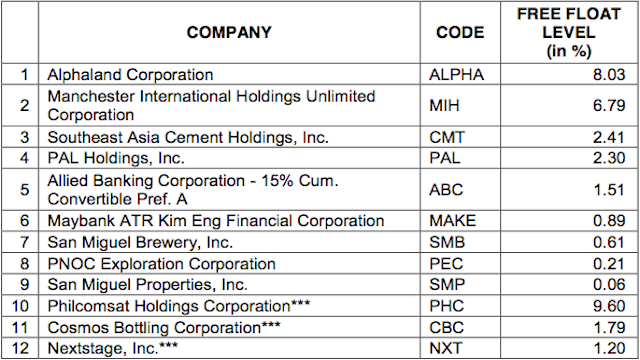

As of December 21, the following firms have yet to comply with the rule:

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.