SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The year 2012 put the global spotlight on the Philippine aviation industry, largely due to the phenomenal performance of the low-cost carriers flying domestic and international routes.

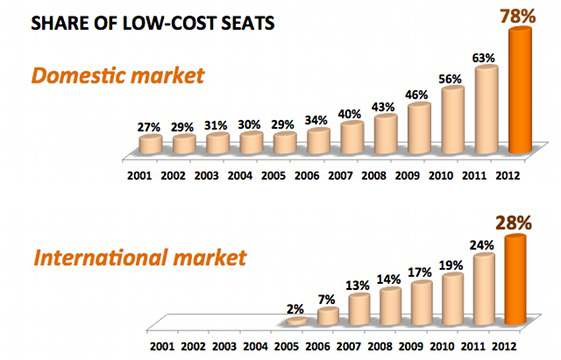

The share of budget carriers in the the Philippines in the first 9 months of 2012 has soared to an average of 60%, reflecting one of the highest in the world, according to business consultancy firm Innodata. Almost 80% of the domestic market’s 15.5 million passengers and about 30% of international’s 12.5 million flew budget airlines in January-to-September.

Since budget flights were introduced to Filipinos in 2005, the number of passengers hopping from one of the archipelago’s 7,100 islands to the next, or to Asian destinations less than 4 hours away, have been growing by leaps and bounds. The year 2012 saw the highest jumps.

The promise of low fares and new destinations were key reasons for this exponential growth. Budget carriers, in turn, battled it out in this increasingly competitive playing field by acquiring fuel-efficient aircraft and testing new markets. Some beefed up their war chest by getting new owners or partners with deeper pockets or wider reach.

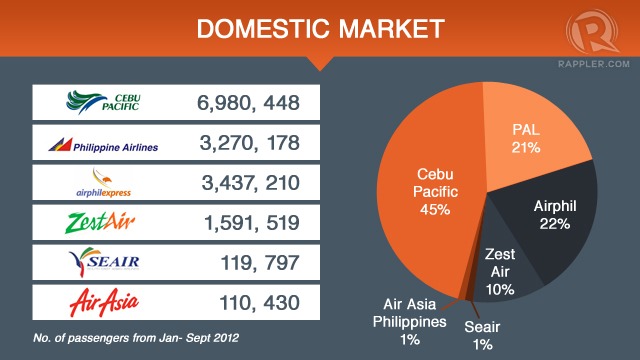

Of the 6 local commercial airlines, budget carrier Cebu Pacific Air continued to rule the domestic market that Philippine Airlines (PAL) dominated for decades. Under new management starting this 2012, full-service carrier PAL remained the leading local airline flying international skies.

On their heels are SEAir, which Singapore’s Tiger Airways partly acquired in November 2010, following a model almost the same as AirAsia, the region’s giant, which set up AirAsia Philippines, a local player. Seair, the smallest player, announced it is looking for an investor, too. PAL’s budget arm, AirPhil Express, has been expanding its route network abroad.

Consolidation, expansion

While the airlines are taking advantage of the Philippine government’s goal to increase tourist arrivals to 10 million by 2016, a Singapore-based aviation analyst expects some consolidation in 2013 as well as expansion among the players.

“As LCCs (low-cost carriers) already control over 80% of the Philippine domestic market, I wouldn’t expect further increases in market penetration domestically. I think we are instead potentially in for a year in which we may see some consolidation in the Philippines domestic market,” said Brendan Sobie, chief analyst at Centre for Aviation (CAPA).

“As for the international market, there should be a further increase in the LCC penetration rate as several of the local LCCs continue to expand regionally in Asia, and as Cebu [Pacific], and possibly AirPhil, launch their new long-haul low-cost operations,” he added during an interview with Rappler.

South Korea is currently the Philippine’s largest market. However, local carriers believe the Chinese market could eventually overtake South Korea due to China’s size and number of airport connections. Those plans have to be put on hold until the geopolitical tension between the Philippine and Chinese governments over the disputed South China Sea (also called West Philippine Sea) is resolved.

Many local airlines have also been eyeing the Middle East, which is a price-sensitive market as it primarily consists of migrant worker traffic. If the ongoing government-to-government negotiations on air rights would produce higher seat entitlements to lucrative markets like Saudi Arabia and United Arab Emirates, keen players with aircraft for long-haul flights, like Cebu Pacific and PAL, would likely benefit.

Other lucrative long-haul markets, like the United States and the Europe Union, remain closed to new or additional flights by Philippine carriers. Since 2008, the Civil Aviation Authority of the Philippines (CAAP), which regulates and oversees the airline industry, have failed to comply with minimum international aviation safety standards set by the International Civil Aviation Organization (ICAO).

Markets like South Korea, Japan, Canada, and others have followed suit and have also blocked any new Philippine carrier from entering its country until the CAAP passes ICAO safety audit.

Overburdened infrastructure

On top of the limits imposed by bilateral air rights and and regulation, another major challenge airlines have been facing in the Philippines are infrastructure constraints.

“[Infrastructure] is not up to the challenge of expanding, re-fleeting and unprecedented orders of aircraft [by local airlines],” Civil Aeronautics Board executive director Carmelo Arcilla told Rappler in an interview.

The World Economic Forum’s Travel and Tourism Competitiveness Index 2012 ranks the Philippines 112th among 139 countries for the quality of its air transport infrastructure. The only Asian countries to rank lower are Nepal, Bangladesh and Mongolia.

The Terminal 1 of the country’s main gateway — the Ninoy Aquino International Airport (NAIA) — has remained on top of the list of world’s worst due to the main foreign carrier’s host facility’s “collapsing ceilings, overcrowding, rampant bribery.”

There is little room for physical expansion of the airport located in the center of the capital city. The Transportation Department could only announce a slotting system to shift bulk of traffic to off-peak hours to avoid flight delays and terminal congestion.

The government has been mulling on making the airport in Clark, which is about 80 kilometers away from the capital, as the country’s new main gateway, but access has been an issue as the long-delayed Northrail project remained saddled by financial and legal issues between the government and the rail system’s Chinese contractor.

Meantime, opening up additional access points to the country via regional airports have been slow, largely due to the mandated auction process and changes in the plans for the airport projects’ financial design. Key airports, including Cebu, Puerto Princesa, Bohol, Cagayan de Oro, were meant to provide overseas Filipinos, tourists, businessmen direct and mostly no-frills trip to their destination.

The year that was

Below is a rundown of how 2012 was for each of the local airlines:

Philippines Airlines (PAL)

Philippines Airlines (PAL)

Destinations: 29 domestic, 31 international

Fleet : 40

Owners: Lucio Tan and San Miguel groups

San Miguel, the country’s biggest conglomerate, acquired a 49% stake in PAL’s parent companies in April and assumed control. The legacy carrier has since been aggressively pursuing lucrative long-haul routes but has been stumped by the Philippine regulatory body’s failure to meet safety oversight standards.

“San Miguel has said it aims to have PAL re-enter the European market and expand in North America. It is unlikely PAL will resume services to the Middle East as it is more logical to have its budget brand (AirPhil) operate these services,” said Brendan Sobie, Chief Analyst at CAPA.

For the US market, currently PAL’s cash cow, PAL has announced a workaround the US aviation ban: It has entered into arrangement with a Cayman-based airline that is not banned from mounting flights to the US.

“In the case of Europe, the airlines can actually work out an exemption. Unlike in the U.S., it’s the country (Philippines) that is banned, therefore, the airline is affected. We are an ISO (International Organization for Standardization) certified airline by IATA (International Air Transport Association), therefore we can use that to

leverage an airline exemption and we are working on that,” said PAL vice president for marketing support Felix Cruz.

In the domestic market, PAL has dropped several of its smaller secondary routes which are leisure-focused and have limited demand for premium or business passengers such as Puerto Princesa. As a result, PAL now accounts just 18% of total local capacity.

PAL’s fleet modernization program has lifted the country’s imports portfolio in July, and has led the two global giant aircraft manufacturers — Airbus and Boeing — scrambling for PAL’s orders. In August, PAL placed a US$7 billion order, the biggest airline deal in Philippine aviation history.

Cebu Pacific

Cebu Pacific

Destinations : 32 domestic, 19 international

Fleet : 41

Owners: Gokongwei group

The year 2012 was marked with aggressive fleet expansion — mostly Airbus and ATR aircraft — as well as of local and regional routes.

It opened 10 new domestic routes in 2012 and expect to begin long-haul services (over 4 hour distance) in the 3rd quarter of 2013. It also expects the delivery of 20 more Airbus single-bodied aircraft in 2013, with most to be allocated for Middle East routes where 2.3 million Filipinos are working.

Poised to be a new entrant in the long-haul market, which PAL has dominated, Cebu Pacific has been pushing for seat entitlements from bilateral air negotiations. Cebu Pacific pioneered the low-cost model in Asia, but only started

implementing it in 2004.  AirPhil Express

AirPhil Express

Destinations: 30 domestic, 3 international

Fleet : 21

Owners: Lucio Tan and San Miguel groups

AirPhil is the budget brand of the PAL group. Its operator, Air Philippines Corp., was part of the deal when San Miguel acquired a stake in PAL in April.

San Miguel has rebranding plans for AirPhil. “It will be called PAL Express. There won’t be Airphil Express anymore,” said Ramon Ang, the president of PAL, the parent firm of Airphil Express and PAL Express, which is currently non-operating.

AirPhil has launched a new strategy to increase its domestic network taking over some of PAL’s domestic routes. AirPhil will also focus on new markets as it expands its international operation, which currently only consists of 5 scheduled routes. The international expansion is part of strategies to lower its cost base through higher utilisation of its Airbus A320 fleet.

SEAir

SEAir

Destinations: 10 domestic, 5 international

Fleet : 5

Owners: Tiger Airways, Filipino partners

The year 2012 was a landmark year for South East Asian Airlines Inc. (SEAir). Its former marketing partner, Singapore’s Tiger Airways, acquired a 40% stake for $7 million in August. New managers have since assumed control.

During the same year, the airline also embarked on its largest network expansion ever. It expanded its Airbus A320 family fleet from two to 5 aircraft in July.

It continued to adopt Tiger’s low cost business model, then created SEAir International, a full service airline that, starting on November 30, took on some of Seair’s routes. It is eyeing to increase its popular Batanes and Kalibo routes in 2013. Zest Airways

Zest Airways

Destinations: 14 domestic, 4 international

Fleet : 14

Owners: Alfred Yao group

Previously known as Asian Spirit, Zest Airways marked 2012 as a year when it announced it is eyeing to sell up to 40% of the airline to another investor. Its yearend deadline was not met, even after the group of juice magnate Alfred Yao said 3 foreign groups, including a Chinese carrier Hainan Airlines Company Limited, have expressed interest.

Zest is considered as one of the “most vulnerable” airlines in the low cost airline sector, mostly because it does

not have the finances or fleet size compared to its bigger competitors. Its most valuable assets are its slots in the congested Ninoy Aquino International Airport (NAIA), the country’s main gateway.

It adopted its low-cost model in 2008 and started to pursue a more aggressive expansion in 2010. It has been looking to launch international flights to Hong Kong, Bangkok and Singapore. AirAsia Philippines

AirAsia Philippines

Destinations: 3 domestic, 3 international

Fleet : 2

Owners: AirAsia Berhad and Filipino partners

AirAsia Philippines, which is part of the Asian network of the Malaysia-based budget carrier, AirAsia Berhad, is the newest player in the industry having only launched its local operations in March 2012.

It allows AirAsia — which has been operating low-cost regional flights in Clark in Pampanga since 2005 — to fly domestic routes and to mount flights from its hub in Clark to other international destinations, complementing the expanding Asian route network of the AirAsia family.

The Philippine unit has since then been working on expanding its regional operations while reducing its local flights. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.