SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – Filipino consumers felt the pinch at supermarkets, restaurants, and gasoline stations in September, as the country’s inflation rate accelerated to a 5-month high, data from the Philippine Statistics Authority (PSA) showed.

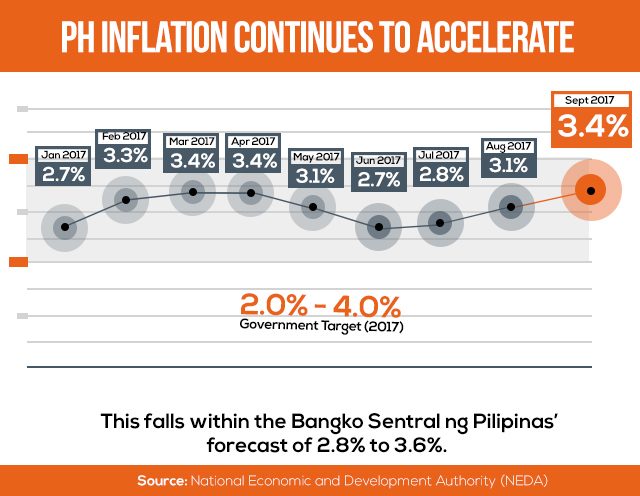

Inflation, the movement of prices of basic goods and services, accelerated to 3.4% in September, higher than 2.3% in the same month a year ago and 3.1% in August this year.

“This was primarily due to the 3.6% annual growth recorded in the heavily-weighted food and non-alcoholic beverages index,” the PSA said.

It was last March when inflation clocked in at 3.4% – the fastest in about 3 years since November 2014’s 3.7%.

The September 2017 inflation rate fell within the Bangko Sentral ng Pilipinas’ (BSP) forecast of 2.8% to 3.6% and is only slightly higher than median market expectations of 3.2%.

It also fell within the government’s inflation target of 2% to 4% for the entire 2017.

“We are still positive that inflation for full-year 2017 will settle within the government’s target of 2% to 4%,” Socioeconomic Planning Secretary Ernesto Pernia said in a statement on Thursday, October 5.

“However, we still face several risks to inflation such as higher domestic fuel prices, weaker peso, and minimum wage hike that will be effective today in the National Capital Region,” Pernia added.

Fast price increases

Food inflation increased slightly to 3.6%, from August’s 3.5%. Faster price increases were recorded for corn, fish, vegetables, cereals, flour, bread, pasta, as well as oils and fats.

“The accelerated adjustments in food, particularly corn, fish, and vegetables, can be partly traced to the lingering effects of [Tropical Storm] Jolina (Pakhar) and Tropical Depression Maring, which caused damage to agriculture and fisheries in the Calabarzon region, particularly Quezon province,” Pernia said.

The National Economic and Development Authority (NEDA) said total reported losses from Tropical Depression Maring were estimated to have reached P77 million.

Meanwhile, non-food inflation closed at 3.1% in September – its highest since February 2013.

NEDA attributed the acceleration to “faster year-on-year price adjustments in housing, water, electricity, gas and other fuels, transport, restaurants, and clothing and footwear.”

Higher annual increments were registered by alcoholic beverages and tobacco (6.4%); clothing and footwear (2%); housing, water, electricity, gas and other fuels (3.8%); transport (4.8%); as well as restaurant and miscellaneous goods and services (2.4%).

“The government needs to closely monitor movements in domestic fuel prices and utility rates. Faster inflation in these sectors will negatively impact the spending capacity of lower-income households for basic necessities like food, and important services such as health and education,” Pernia said.

BSP: It’s manageable

BSP Governor Nestor Espenilla Jr said his office sees no need to tweak interest rates, as the inflation rate in September still fell within their target.

“BSP remains of the view that the inflation environment will continue to be manageable over the policy horizon after taking into account the latest assessment of price levels in September,” Espenilla said.

The BSP’s Monetary Board said it expects headline inflation to average 3.2% between 2017 and 2019.

“However, BSP will continue to closely monitor emerging economic and financial developments to determine scope for further refinement of policy instruments,” Espenilla added.

For ING senior economist Joey Cuyegkeng, the Philippine central bank needs to be more cautious should inflation reports for October and November remain on an uptrend.

“We continue to expect that the BSP may need to implement a preemptive tightening at the December meeting to head off overheating in the economy,” he said.

“This would also address the need to possibly re-anchor inflation expectations while preserving interest rate differentials [in the wake of a likely Fed rate hike].” (READ: ADB retains PH growth outlook, sees no signs of economy overheating) – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.