SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Filipinos now have another way to obtain small loans beyond traditional banks with the launch of a new digital micro-loans platform.

Southeast Asia focused digital consumer lender startup AsiaKredit announced the launch of its pera247 on November 1.

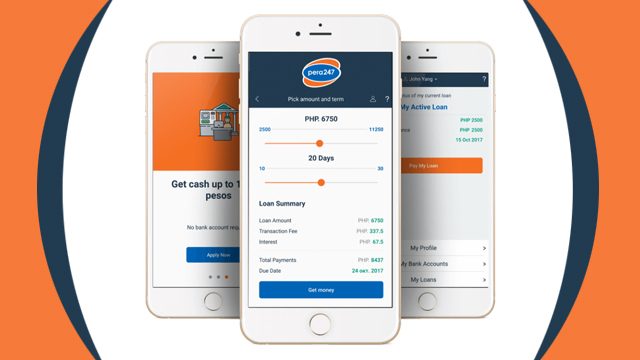

Pera247 is a mobile app-based lending platform which aims to provide unsecured small-ticket, short-term consumer loans for up to 90 days to the country’s underbanked population with no existing credit or collateral history.

The platform uses big data to optimize the credit assessment process to make credit decisions using alternative sources of data, such as behavioral mobile data from an applicant’s smartphone.

The pera247 app also acts as a mobile wallet for successful applicants, where funds will be disbursed to and linked to thousands of physical payment centers, within hours of the application, according to the firm.

“We are excited to take consumer lending fully digital in the Philippines as we see a dynamic shift in consumer digital behavior to access financial services through mobile and online channels,” said AsiaKredit founder and CEO Mike Singh in a statement announcing the launch.

“Through pera247, AsiaKredit has a huge opportunity to impact the lives of hundreds of millions unbanked clients in Southeast Asia, leveraging the high mobile penetration in the region to foster financial inclusion,” he added.

Founded this year, AsiaKredit has raised $675,000 to date from combined Pre-Series A and seed funding, part of which, the firm said, it will be used as funding for its customer loans.

After its initial launch, the firm said it plans to raise additional capital to expand its loan capital and operational balance sheets.

The firm is backed by Singapore-based investors FORUM as well as the Fintopia group. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.