SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

When will the proposed tax reform bill be passed? When will it be implemented? Given all the investigations and other hearings in the Senate, can they really pass the TRAIN bill?

The TRAIN (Tax Reform for Acceleration and Inclusion) bill has been certified as a priority bill of the Duterte administration. It is expected to be signed into law before the end of the year for implementation starting January 2018. This, however, will be a challenge for the Senate as they still have to pass the 2018 budget before they can deliberate on the tax reform bill.

Senate ways and means committee chairman Senator Sonny Angara expressed his concern that it will be difficult to pass TRAIN this year but they will still try. Otherwise, it will be passed in January 2018.

Will employees benefit from TRAIN? President Rodrigo Duterte promised to exempt all employees earning a monthly salary of P25,000 or less. Do you have any suggestion how to make sure that employees can be unburdened by our high income tax rates considering their low salaries?

The promise of the President to exempt ordinary employees earning a monthly salary of P25,000 and below is actually the heart and soul of the comprehensive tax reform bill. That is the reason why the Department of Finance (DOF) proposed to exempt the first P250,000 annual income (or P20,833.33 monthly salary) of all individuals as proposed in House Bill 5636 (contrary to Senate Bill 1592 lowering the tax-exempt income to P150,000 but still providing P25,000 additional exemption per qualified dependent, maximum of 4).

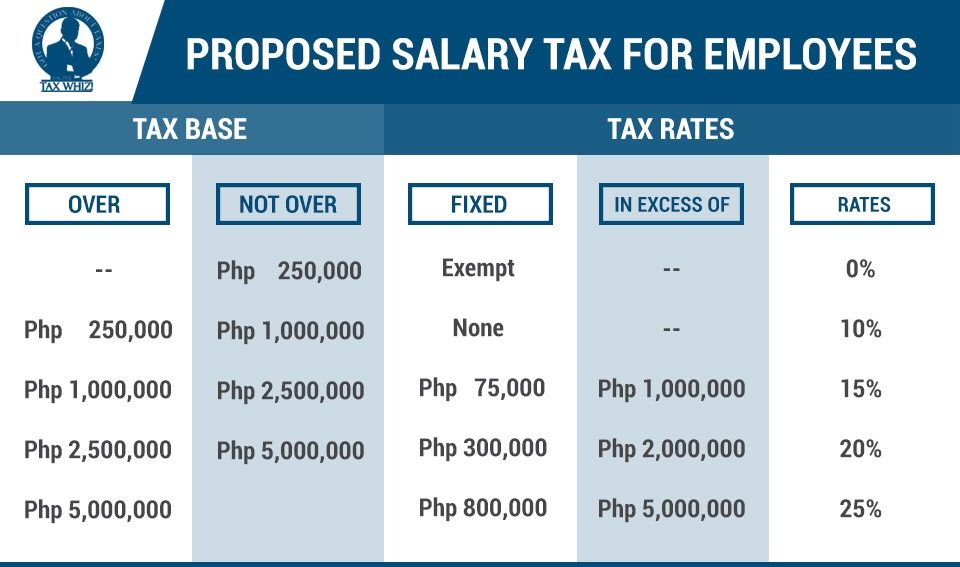

I actually suggested a salary tax exclusive to employees to make sure any reduction in tax rates will be enjoyed by the most compliant and honest taxpayers contributing 82% of our total income tax collections from individuals, per annual report of the Bureau of Internal Revenue (BIR) in 2015. (see table below)

This is similar to Hong Kong where they provide a separate income tax for employees called salary tax. The idea is encouraging more registered employees to declare above minimum wage while discouraging senior executives from availing of tax shields to lower their taxable income.

Based on the DOF presentation, there are only 0.1% of total registered individuals declaring above P5 million, while the BIR report shows less than 50% compliance from the self-employed and professionals against almost 99% compliance from employees.

Is it true that employees can expect a tax refund from the government? More or less, how much is the estimated refund? When can we expect it to be given?

Yes. The Supreme Court (SC) declared the pro-rated tax rate implemented by the BIR in 2008 as erroneous, ordering the agency to give a tax refund especially to minimum wage earners. The estimate is around P3,100.

The DOF said it will issue guidelines on how to process the refund before the end of this year.

It would mean a merrier Christmas for all employees if both the tax reform and tax refund will be approved before the end of the year. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2016 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founder of the Abrea Consulting Group and Center for Strategic Reforms of the Philippines (CSR Philippines). He currently serves as Adviser to the Commissioner of Internal Revenue of the Philippine government on tax administration reform in promoting inclusive growth. Follow Mon on Twitter (@askthetaxwhiz) or visit his Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.