SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

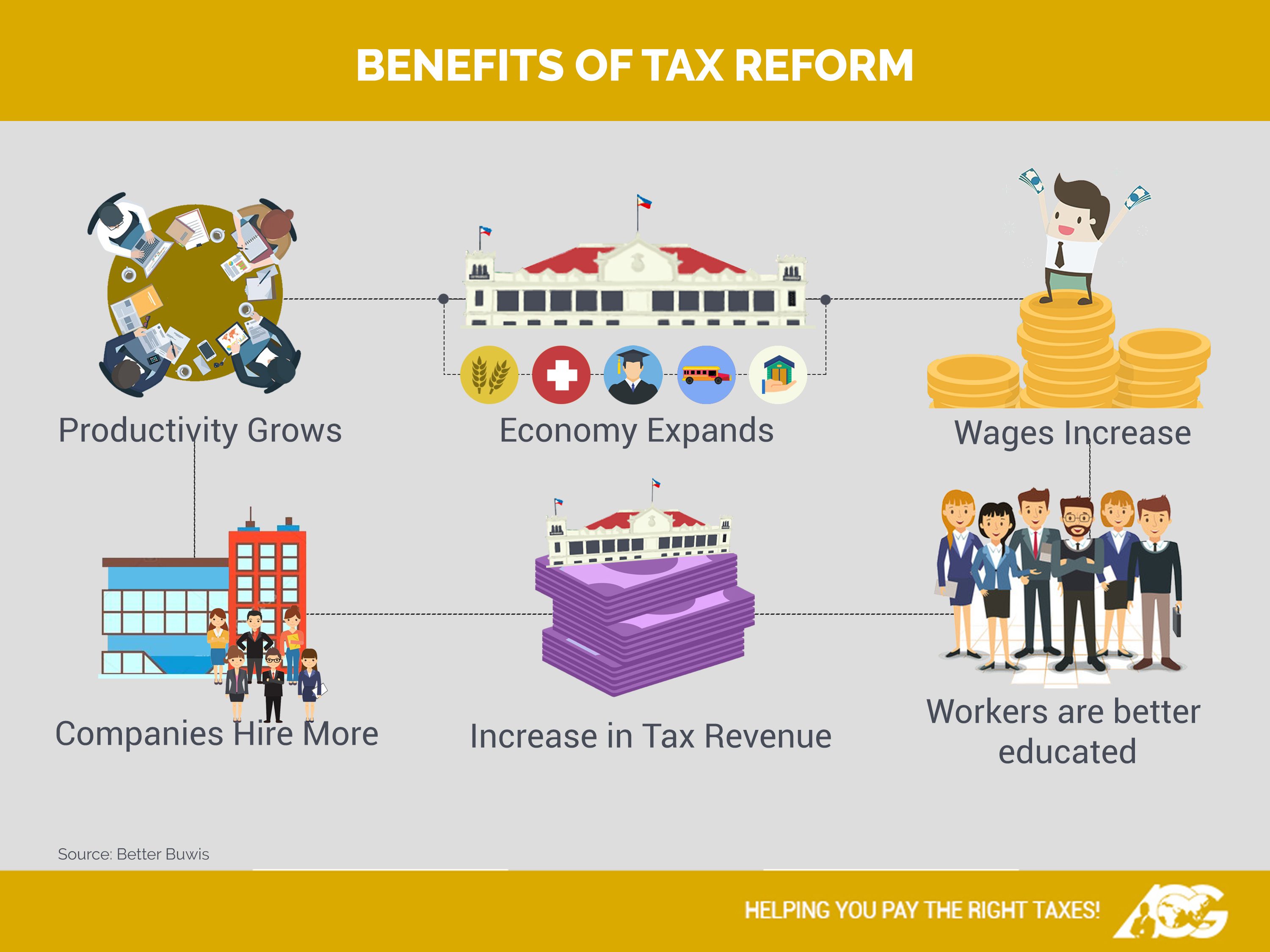

1. What are the benefits of tax reform? Where will the government use the additional revenues to be collected under the Tax Reform for Acceleration and Inclusion (TRAIN) law?

As reiterated by the Department of Finance (DOF), TRAIN is the first step to once and for all correct our unfair, complex, and inefficient tax system. After 20 years, we are finally adjusting and updating the personal income tax rates which burdened mostly our ordinary employees earning above minimum wage up to P500,000 in annual gross salary and were being taxed up to 32% under the old tax system.

But as I have said in my previous interviews, it’s not all gains, as there are sacrifices we all have to make since the government needs to raise additional revenues to fund massive infrastructure projects and to improve public services. (READ: EXPLAINER: How the tax reform law affects Filipino consumers)

Not more than 70% is earmarked for infrastructure projects such as, but not limited to, the Build, Build, Build program.

Not more than 30% will be used to fund social mitigating measures like the additional P200 unconditional cash transfer for the poorest 10 million households, and other social welfare benefits and programs.

2. Are we not supposed to improve first the tax administration before imposing new taxes? Were there administrative reforms included under the TRAIN law?

Under the leadership of Bureau of Internal Revenue (BIR) Commissioner Caesar “Billy” Dulay, several administrative reforms have been implemented – from the continuous streamlining of processes and documentary requirements for registration, to the processing of tax clearance, and review of all pending audit cases which is perceived to be a source of corruption.

In fact, in partnership with the Center for Strategic Reforms of the Philippines (CSR Philippines), the BIR has launched the Seal of Honesty (SOH) Certification Program, and has released the Tax Guide for Small Businesses to promote tax education and reform, thus upholding integrity and honesty in paying taxes. Visit www.sealofhonesty.ph for more information.

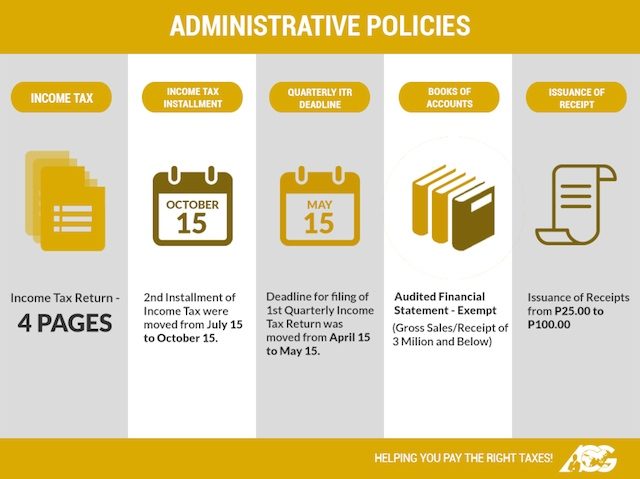

Under the TRAIN law, there are administrative reforms included which will simplify compliance for taxpayers:

-

From a 12-page income tax return (ITR), it has been reduced to only 4 pages.

-

The deadline for the filing of 1st quarter ITRs was moved from April 15 to May 15 effective 2018. However, deadline for filing Annual Income Tax Return shall still be on or before April 15.

-

The second installment of annual income tax was moved from July 15 to October 15.

-

Taxpayers with gross annual sales/receipts amounting to P3 million and below are exempt from having their books of accounts (and financial statements) audited by independent Certified Public Accountants.

-

Use of relevant and appropriate set of bookkeeping records duly authorized by the Secretary of Finance, and issuance of receipts at the point of sale valued at P100 or more.

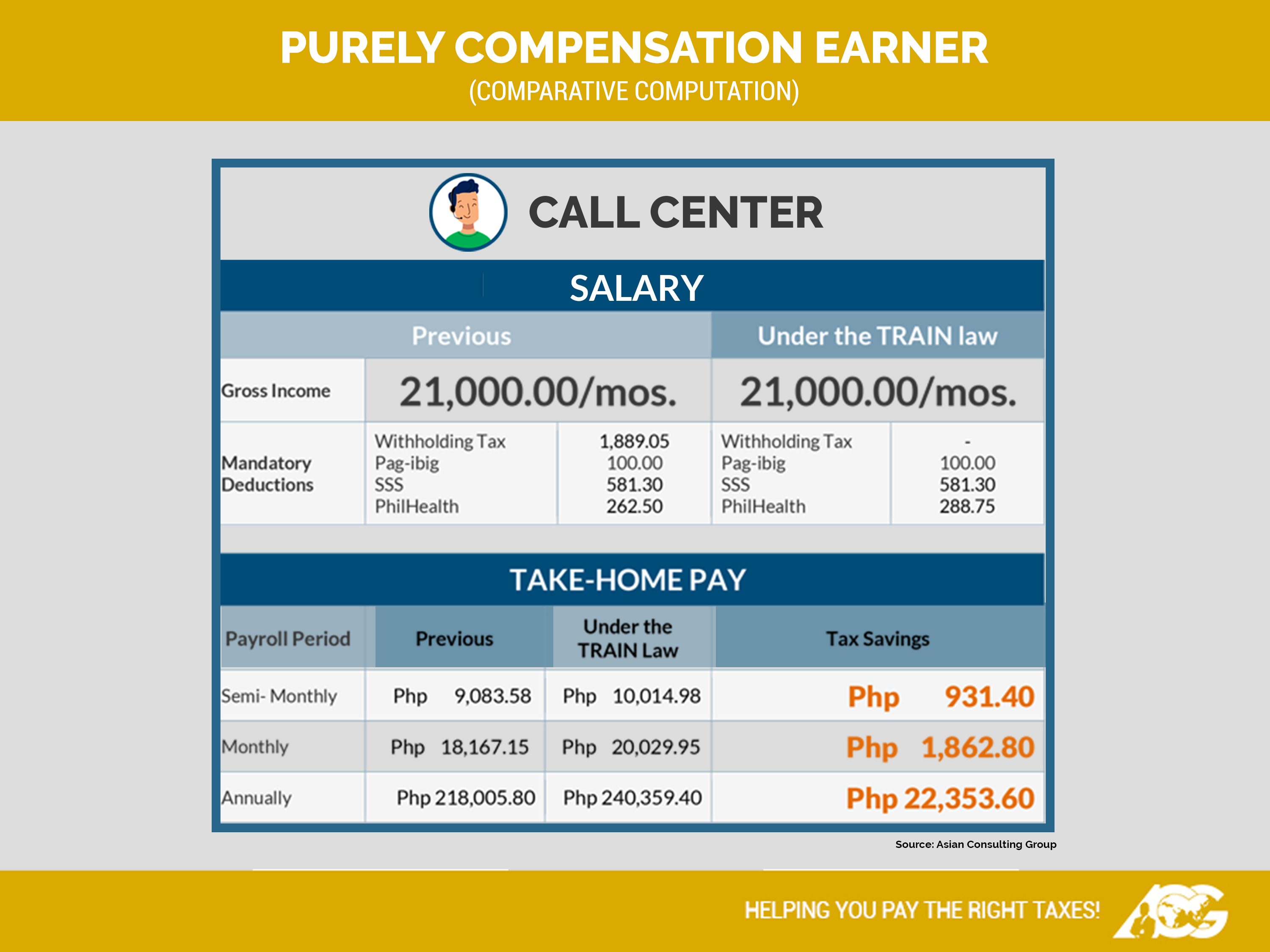

3. For an ordinary employee like me (a call center agent) earning a monthly salary of P21,000, what benefits can I expect from the TRAIN law? When would it be effective?

The key component of the TRAIN law is the lowering of personal income tax and exempting the first P250,000 income of all individuals or a P20,833.33 monthly salary.

Here’s the computation of your higher take-home pay under the TRAIN law:

This is effective January 1, 2018 which means all employees must receive higher take-home pay starting this month.

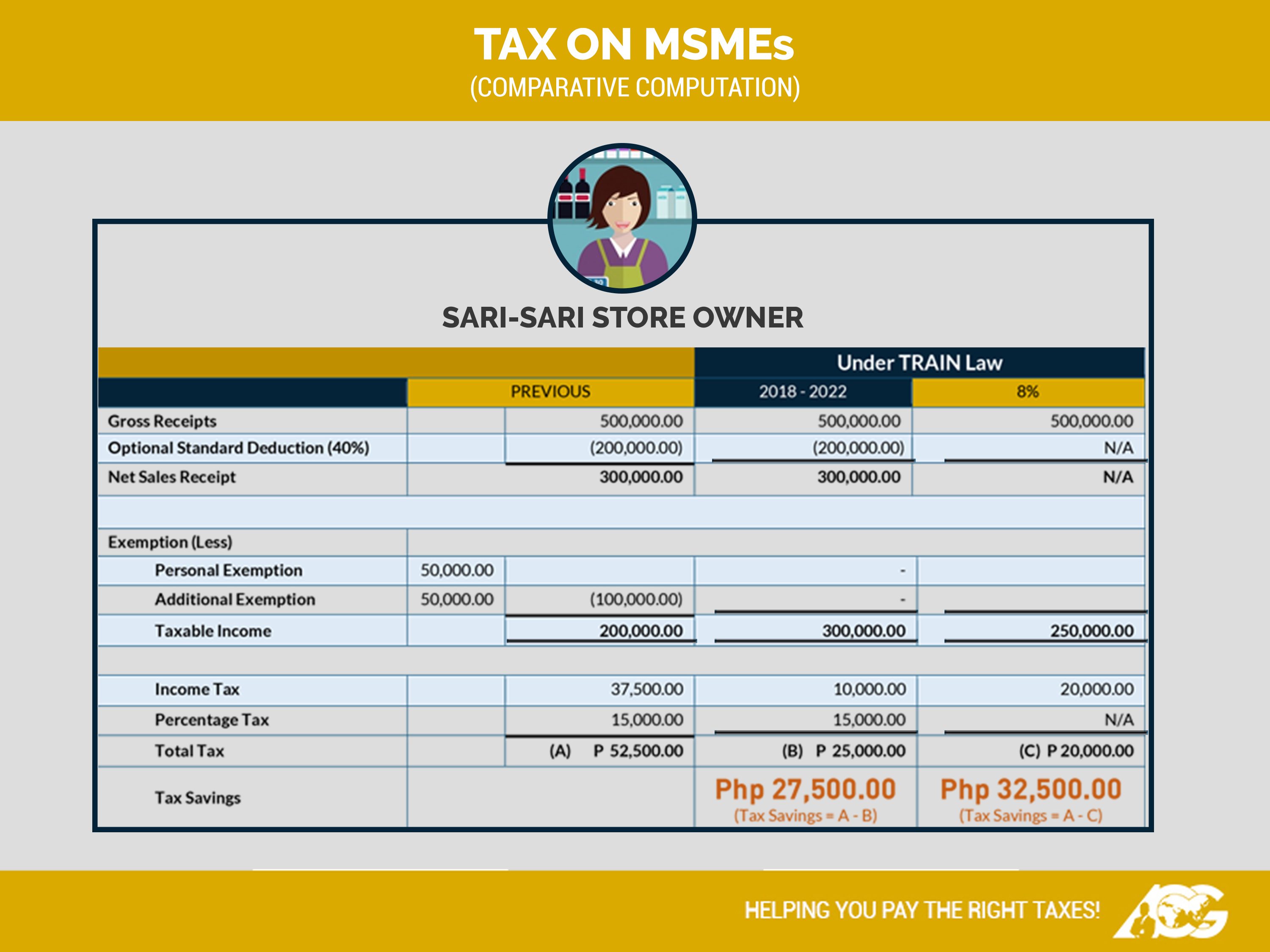

4. For microentrepreneurs like me (a sari-sari store owner) earning annual gross sales of P500,000, how much tax will I pay? Will there be any tax savings or benefit from the TRAIN law?

Aside from ordinary employees, micro and small businesses will also benefit from the TRAIN law. Other than the lower personal income tax, there is an optional 8% flat rate in lieu of income and percentage tax for those with gross sales/receipts amounting to P3 million and below.

Here’s the computation of your tax savings under the TRAIN law:

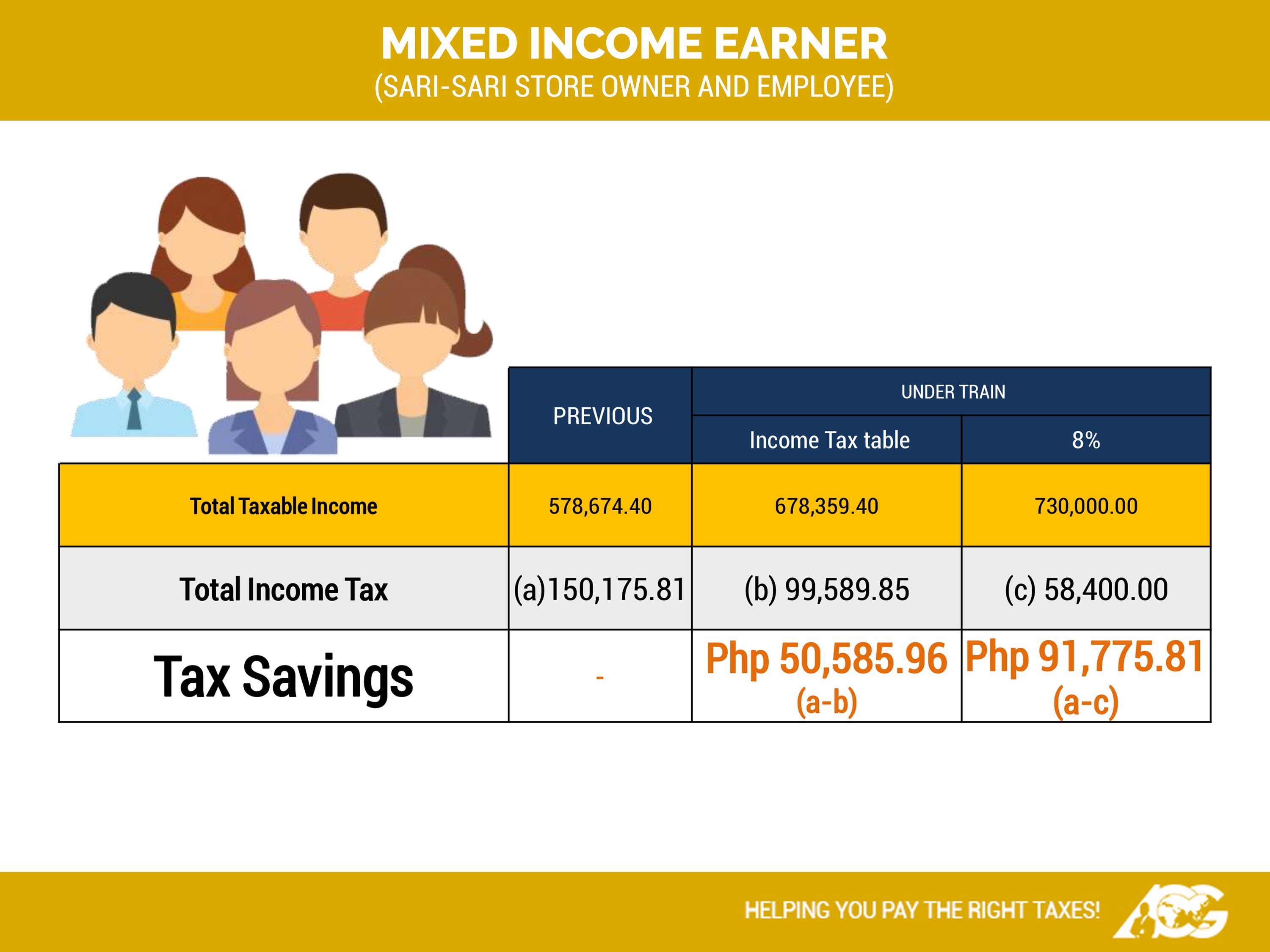

5. For mixed income earners such as a call center agent with a sari-sari store (refer to above information on item nos. 3 & 4), how much will they pay considering they have both compensation and business income?

For mixed income earners, you have an option to consolidate your compensation and business income subject to the revised personal income tax table, or use the optional 8% flat rate if your gross sales/receipts do not exceed the P3-million value-added tax (VAT) threshold.

Here’s the computation of your tax savings under the TRAIN law (using compensation income in no. 3 and business income in no. 4):

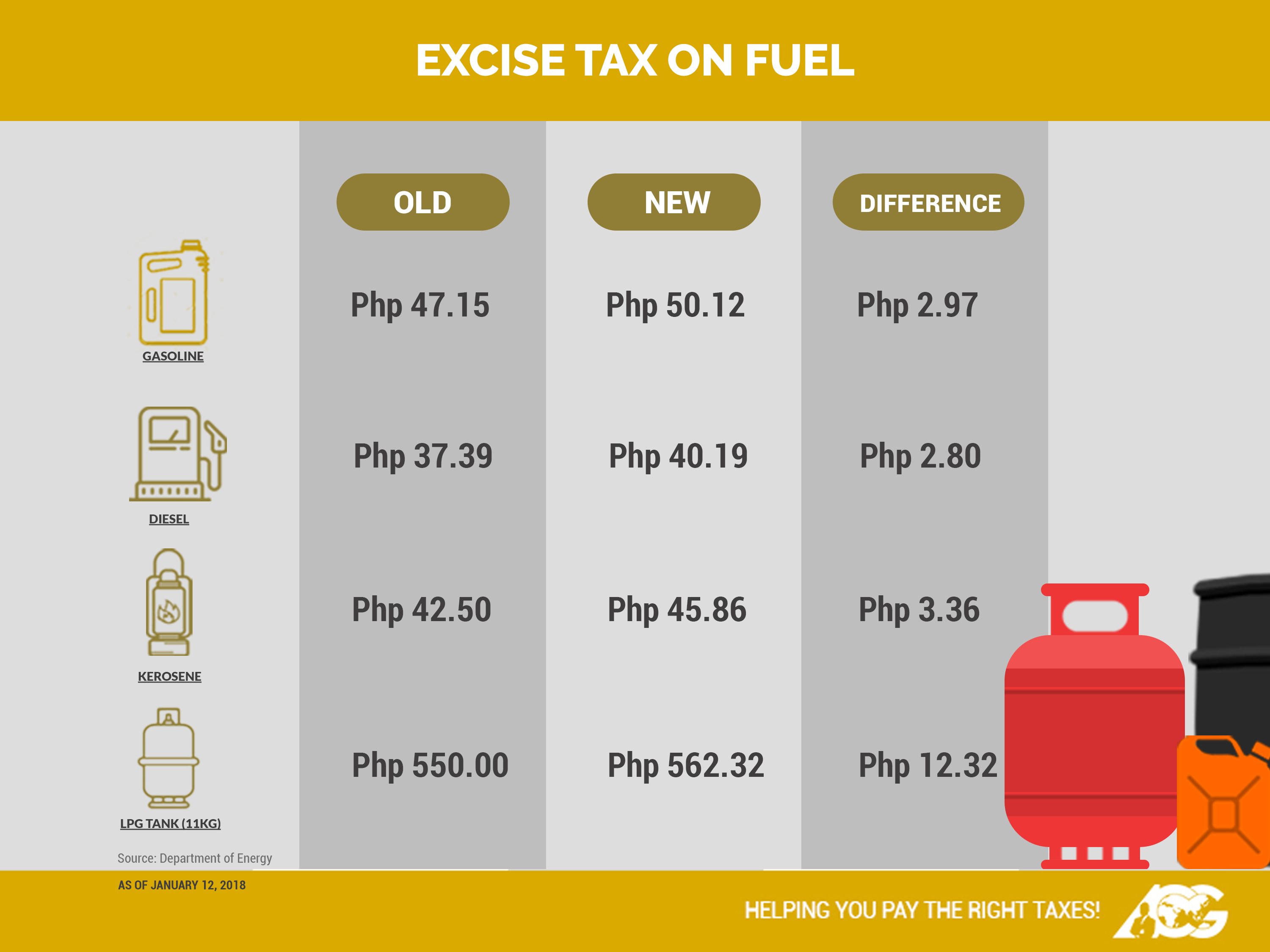

6. It’s all over the news that fuel prices have gone up due to excise tax. What are the new costs of fuel?

The Department of Trade and Industry (DTI) and Department of Energy (DOE) have been strictly monitoring the increase in prices to sanction retailers who may be profiteering or imposing an unnecessary markup on old stocks and other unaffected goods.

Here’s the list of prices as of January 12:

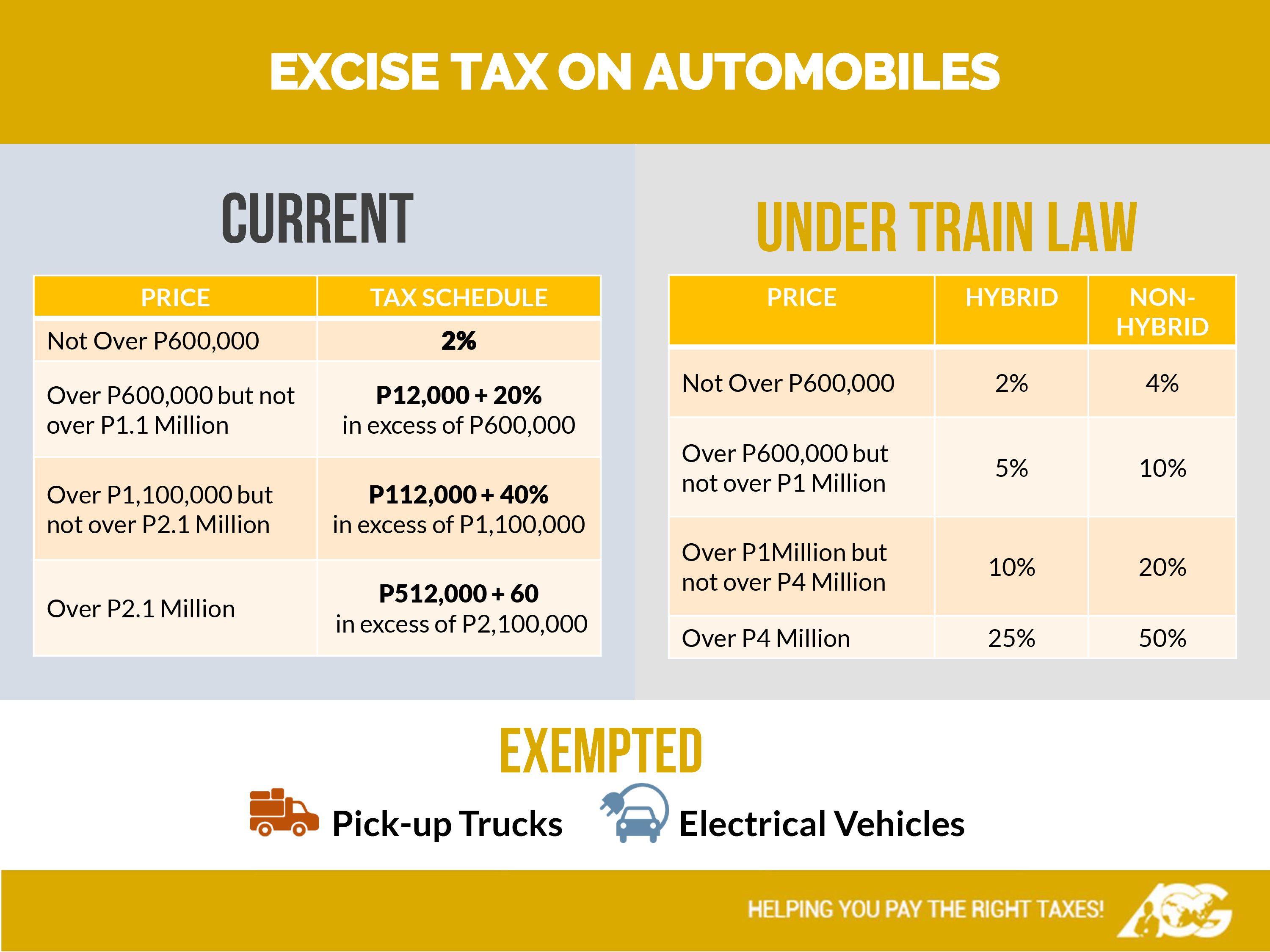

7. How about the excise tax on automobiles under the TRAIN law? What are the new rates?

Here’s the new excise tax on automobiles:

8. With the higher excise taxes on cigarettes and sugar-sweetened beverages, how much will those cost now?

An increase of P32.50 for the first 6 months of 2018 (January 1 to June 30) and P6 per liter for those with caloric and non-caloric sweeteners, and P12 per liter for those with high-fructose corn syrup like soda will be imposed under the TRAIN law.

Here are the new prices as of January 12:

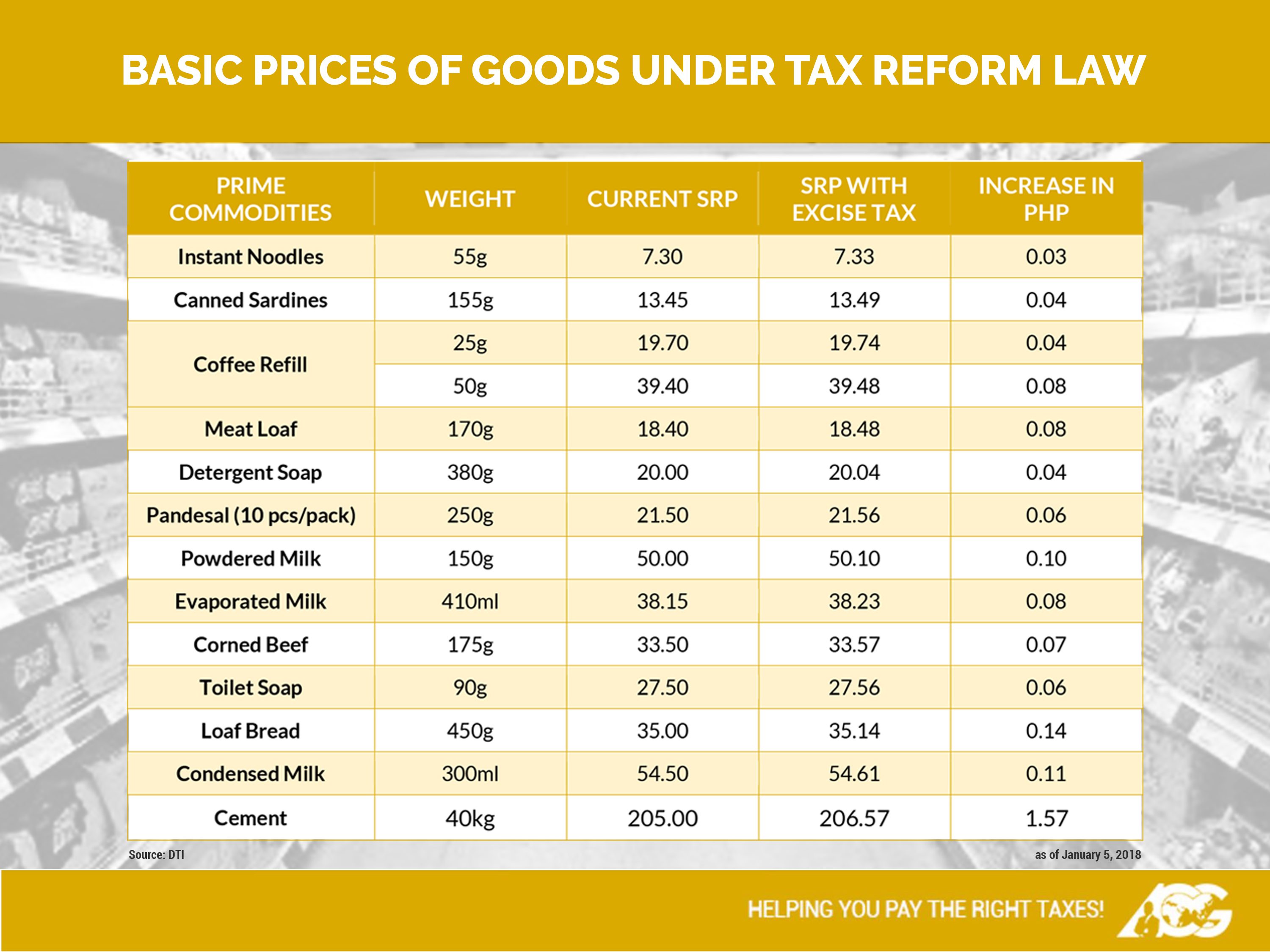

9. Is it true that due to higher excise taxes, all prices of basic commodities will be affected? Will this offset the increase in take-home pay? I hope you can explain this further as many stores and gasoline stations have drastically increased their prices. What can we do if there are those who are abusing or using the TRAIN law to make more profit?

The DTI has released a bulletin on suggested retail prices under the TRAIN law. See below:

10. As the most prominent tax advocate, how can you help us understand the TRAIN law? Where can we get more information? How can we comply properly given the new rules and regulations to be implemented by the BIR? Please help us as most of us are confused and afraid that we will face more penalties if we don’t get this right immediately.

Our social enterprise started the “Catching the TRAIN Seminar” every Friday of January 2018. This is a training seminar offered by the Tax Whiz Academy in partnership with CSR Philippines. Copies of the Free Tax Guide and Komiks are also given to all participants. For reservation, sign up through this link: http://bitly.com/TRAINSeminar.

We are also launching the TRAIN handbook this week. Just follow us on Facebook –www.facebook.com/consult.acg and www.facebook.com/AskTheTaxWhiz – for updates.

With red tape and high compliance cost still burdening our countrymen, it is time to find better solutions through developments in technology. In partnership with JuanTax, the Tax Whiz App is a game-changing platform that will serve as a 24/7 online helpdesk for taxpayers, specifically for those who are self-employed and professionals.

Sign up now for the Tax Whiz App and enjoy the ease of complying with the new tax law, rules, and regulations. Register here: http://app.acg.ph. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2016 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founder of the Abrea Consulting Group and Center for Strategic Reforms of the Philippines (CSR Philippines). He currently serves as Adviser to the Commissioner of Internal Revenue of the Philippine government on tax administration reform in promoting inclusive growth. Follow Mon on Twitter (@askthetaxwhiz) or visit his Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.