SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I paid for the professional services of an accountant and saw a line item that says “withholding tax of 15%” on one of the receipts issued to me which was dated 2017. Is this correct?

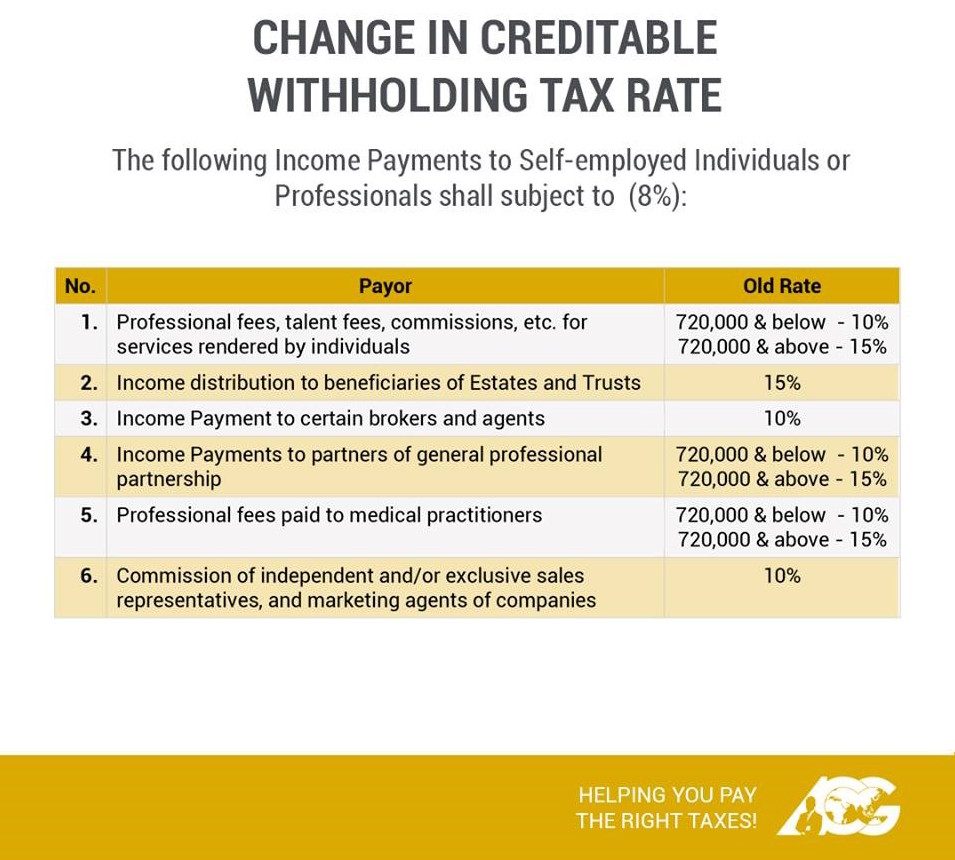

Yes. However, due to the passage of the Tax Reform for Acceleration and Inclusion (TRAIN) law, the Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular (RMC) No. 1-2018 which states that starting January 1, 2018, the creditable withholding tax rate on income payments to self-employed individuals or professionals shall be as follows:

What would happen if I did not subject my purchases and/or expenses to withholding tax or did not remit the withholding tax I withheld?

Non-withholding of expenses/purchases and non-remittance of withholding tax may lead to penalties such as:

- Surcharge of 25% or 50%, in case of fraud

- Interest penalty which was amended by Section 75 of TRAIN, at the rate of double the legal interest rate for loans or forbearance of any money in the absence of an express stipulation as set by the Bangko Sentral ng Pilipinas (previously 20%)

- Compromise penalty amounting to P1,000 to P50,000 depending on the unremitted tax, as per Annex A of Revenue Memorandum Order (RMO) No. 7-2015

In addition, expenses shall be allowed as a deduction only if it is shown that the tax required to be deducted and withheld therefrom has been paid to the BIR, based on Section 34 (K) of the National Internal Revenue Code (NIRC).

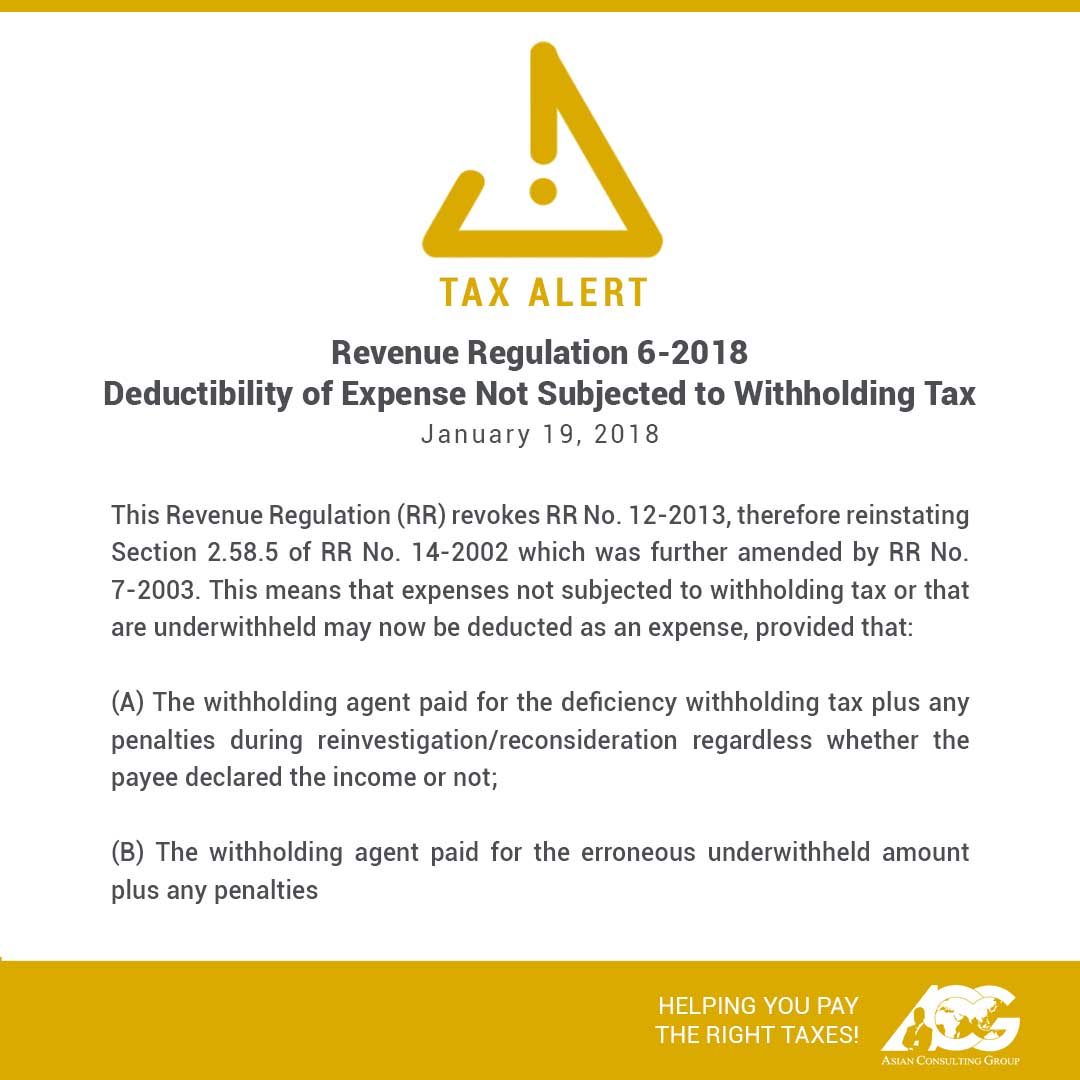

However, the BIR recently released Revenue Regulation (RR) No. 6-2018 which clarifies the treatment of expenses which were not subjected to withholding tax or were underwithheld:

How can a taxpayer avoid these mistakes which lead to higher tax liabilities plus penalties?

Taxpayers should ensure full compliance with all tax rules and regulations to avoid unnecessary penalties and compromises resulting from a BIR audit. In addition, we should do tax planning by projecting the estimated tax liabilities to be included in our business’ annual budget.

It should be noted that paying the right taxes is not necessarily paying more taxes.

In our social enterprise, we consider citizen tax planning as a game-changing strategy to help taxpayers pay the right taxes without the burden of unnecessary penalties and compromises. It’s an investment to help individuals and corporations save millions of pesos from unplanned tax compliance resulting in higher tax assessments with more than 200% in penalties, while helping in nation-building by paying the right taxes.

Moreover, we are developing a mobile application called the Tax Whiz App. Subscribe for free to enjoy the ease of complying with the new tax law. Register at www.app.acg.ph. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) and Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is Allen Gautier, director of the Tax Whiz Academy, a platform for learning and sharing of expertise to the taxpaying public through its strategic tax management programs, certification courses, publications, and seminars.

Follow Mon on Twitter or Facebook. You may also email him at taxacademy@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.