SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

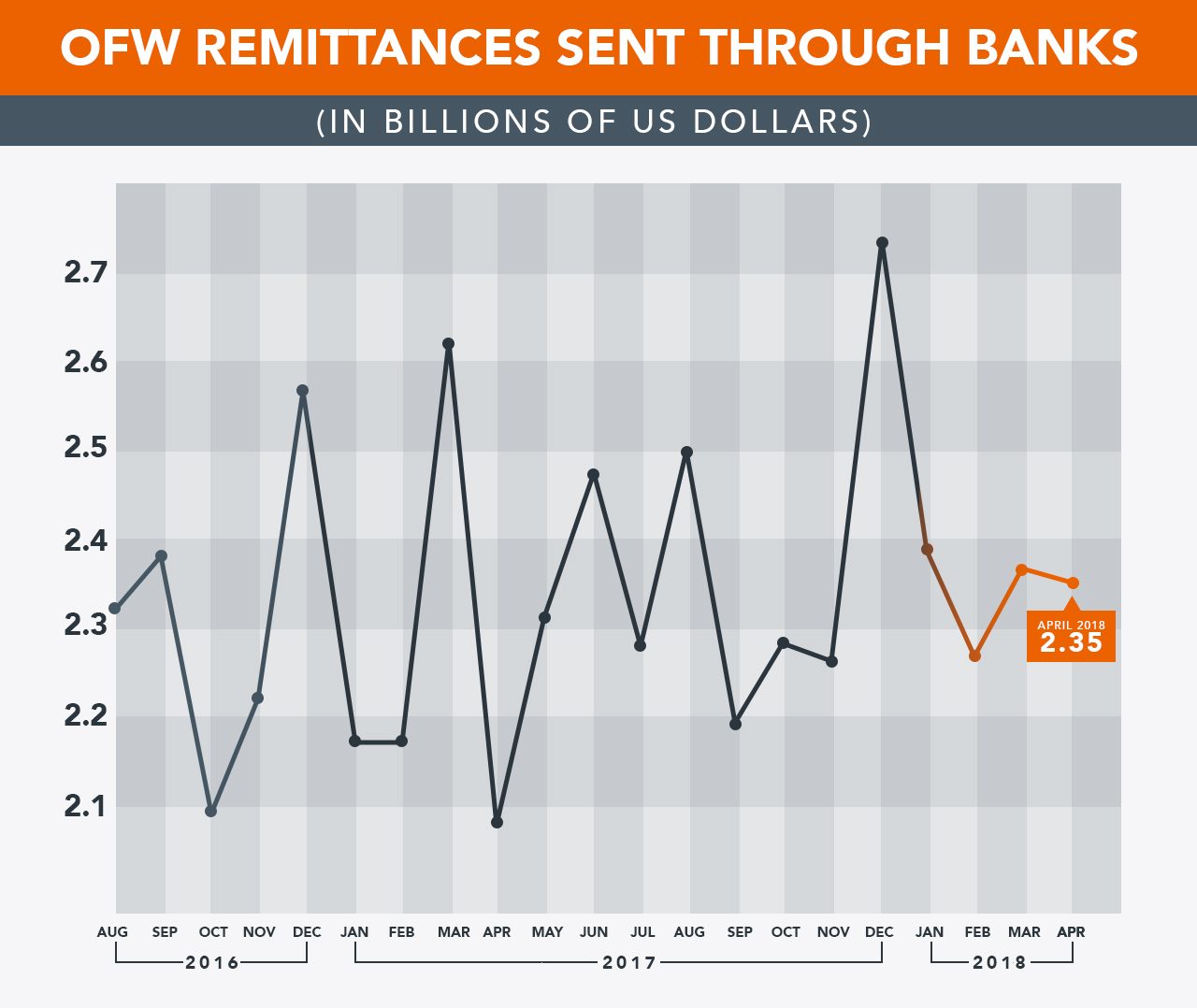

MANILA, Philippines – Cash of overseas Filipino workers (OFWs) sent through banks stood at $2.35 billion in April 2018, according to Bangko Sentral ng Pilipinas (BSP) data released on Monday, June 18.

The figure is 12.7% higher compared to the same month last year. However, it is 0.4% lower compared to March 2018.

Money sent by land-based workers stood at $1.8 billion, while sea-based workers sent $500 million.

Remittances last March had sharply declined year-on-year, due to the continued repatriation of Filipino workers from Middle East countries as well as fewer banking days. (READ: Philippines posts sharpest drop in remittances in 15 years)

Remittances in April came mostly from the United States, Canada, and Singapore.

Meanwhile, personal remittances totaled $2.6 billion in April 2018, or a 12.9% growth compared to the same month last year. These are cash and non-cash items that flow through both formal and informal channels, like money or goods carried across borders.

BSP Governor Nestor Espenilla Jr said the growth was driven by steady remittance inflows from land-based workers with work contracts of one year or more, which amounted to $8.1 billion. Compensation of sea- and land-based workers with short-term contracts reached $2.1 billion.

So far, OFWs have been able to send a total of $9.4 billion this year, 3.5% higher compared to the same period last year.

The bulk of cash remittances from January to April came mostly from the US, Saudi Arabia, United Arab Emirates, Japan, Singapore, United Kingdom, Canada, Germany, Qatar, and Kuwait. The combined remittances from these countries accounted for almost 80% of total cash remittances.

This year, the central bank is once again aiming for a 4% growth in personal and cash remittances.

The government was able to surpass that target last year. Remittances grew 4.3% in 2017, reaching $28.06 billion. (READ: PH remittances beat gov’t target, hit record in 2017)

From a yearly average of 7% to 8% in 2011 to 2015, the long-run growth of remittances in the past two years was down to 3% to 4%. The slowdown of remittances is due largely to global factors. (READ: [OPINION] Why is the Philippine peso the weakest in ASEAN?)

Money sent home by over 10 million overseas Filipinos is the 2nd largest source of foreign exchange for the Philippines, next to revenues from the business process outsourcing (BPO) industry.

Money sent home by OFWs account for around 10% of the country’s gross domestic product (GDP). It also gives the country buffers to survive external shocks.

Remittances help fund the widening current account deficit of the country as well. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.