SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Other than charging expensive fines and penalties, is there anything else the Bureau of Internal Revenue (BIR) can do to businesses they find non-compliant? For example, can the BIR close down a business?

Yes, the BIR can in fact close down businesses. Oplan Kandado gives the BIR the authority to suspend or close down a business, which can only be lifted once the taxpayer complies and pays the right taxes.

For 2018, the BIR is targeting at least one closure per semester for each Revenue District Office (RDO).

Of course, that is not to say the BIR can just do this on a whim to whoever it chooses.

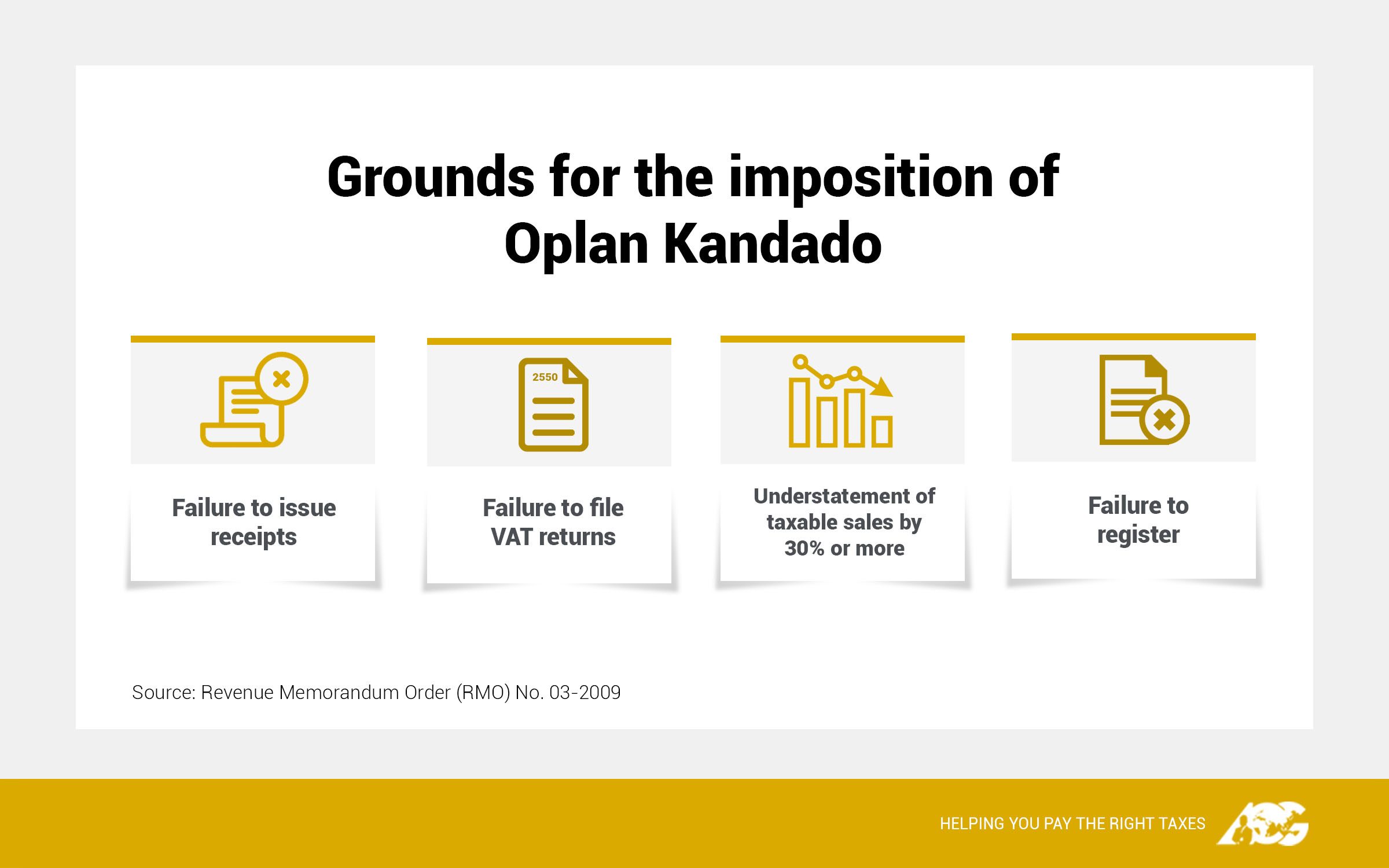

Revenue Memorandum Order (RMO) 03-2009 prescribes the policies, guidelines, and requirements for the imposition of Oplan Kandado on a non-compliant taxpayer.

In particular, the suspension or closure of a business first requires the surveillance of the business in question. Once the BIR analyzes the results of the surveillance, the non-compliant taxpayer can then be penalized.

Does the BIR issue standards for compliance? What is benchmarking, and is it the same as the Letter of Authority (LOA)?

One of the ways the BIR measures a taxpayer’s compliance is the Performance Benchmarking Method. The BIR gathers data and sets standards for compliance depending on the industry, based on pertinent information from tax returns and financial statements. Taxpayers are classified into high risk, middle risk, or low risk.

Benchmarking is not similar to LOA, but it may lead to the issuance of LOA. High-risk taxpayers become the priority for enforcement actions, which include the issuance of LOA, Oplan Kandado, and Inventory Stocktaking, among others.

Being locked down through Oplan Kandado is very detrimental to businesses. Not only are the operations stopped, but the reputation of the business could be damaged as well. There is no better solution against Oplan Kandado than simply being compliant with BIR rules and regulations. Formulating the right tax strategy could mean more savings and peace of mind.

The Asian Consulting Group’s Citizen Tax Planning (CTP) offers a game-changing tax strategy to address those issues. Through CTP, taxpayers can live a tax-free lifestyle – a lifestyle not free from taxes, but free from the burden of paying unnecessary penalties and compromises.

For more information, you can visit www.acg.ph or email consult@acg.ph.

If you have more questions about taxes, just tweet @askthetaxwhiz and use #AskTheTaxWhiz or visit our Facebook page, The Philippine Tax Whiz, and look for this poster:

– Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.