SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Do all VAT-registered businesses need to issue receipts? What about those food stalls that do not issue receipts?

Yes. In fact, under Section 237 of the Tax Code, all businesses need to issue receipts or invoices for all transactions amounting to P100 or more. This means that small businesses are not necessarily non-compliant if they do not issue receipts since they only need to issue receipts past a certain amount.

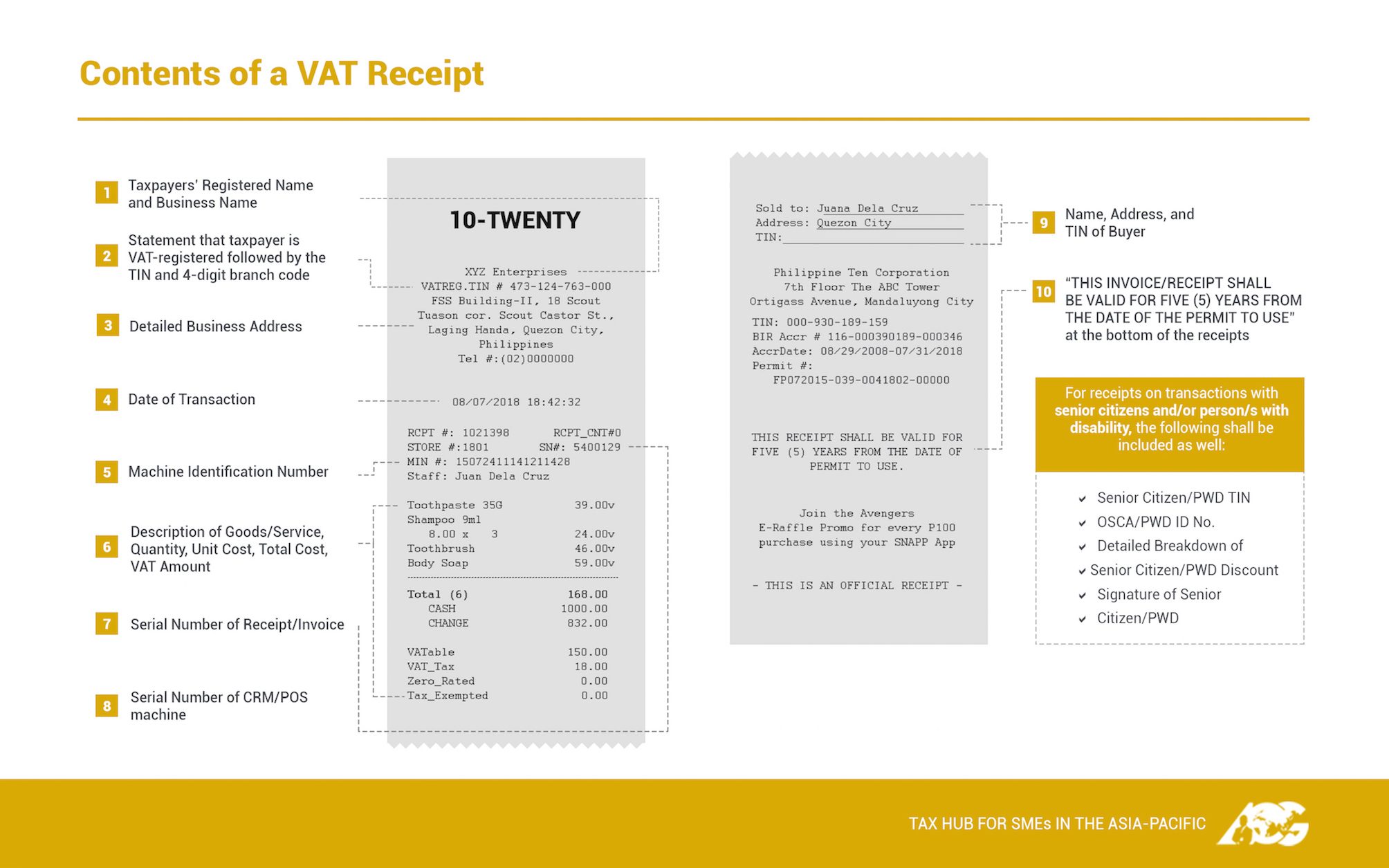

Note that VAT-registered taxpayers would need to issue a different kind of receipt from a VAT-exempt taxpayer. The VAT-registered taxpayer needs to provide additional information in receipts, as provided by Revenue Regulations No. 16-2018.

I am the owner of a small restaurant, and I want to educate myself on the violations related to receipts. Aside from the failure to issue receipts, are there any other violations I need to look out for?

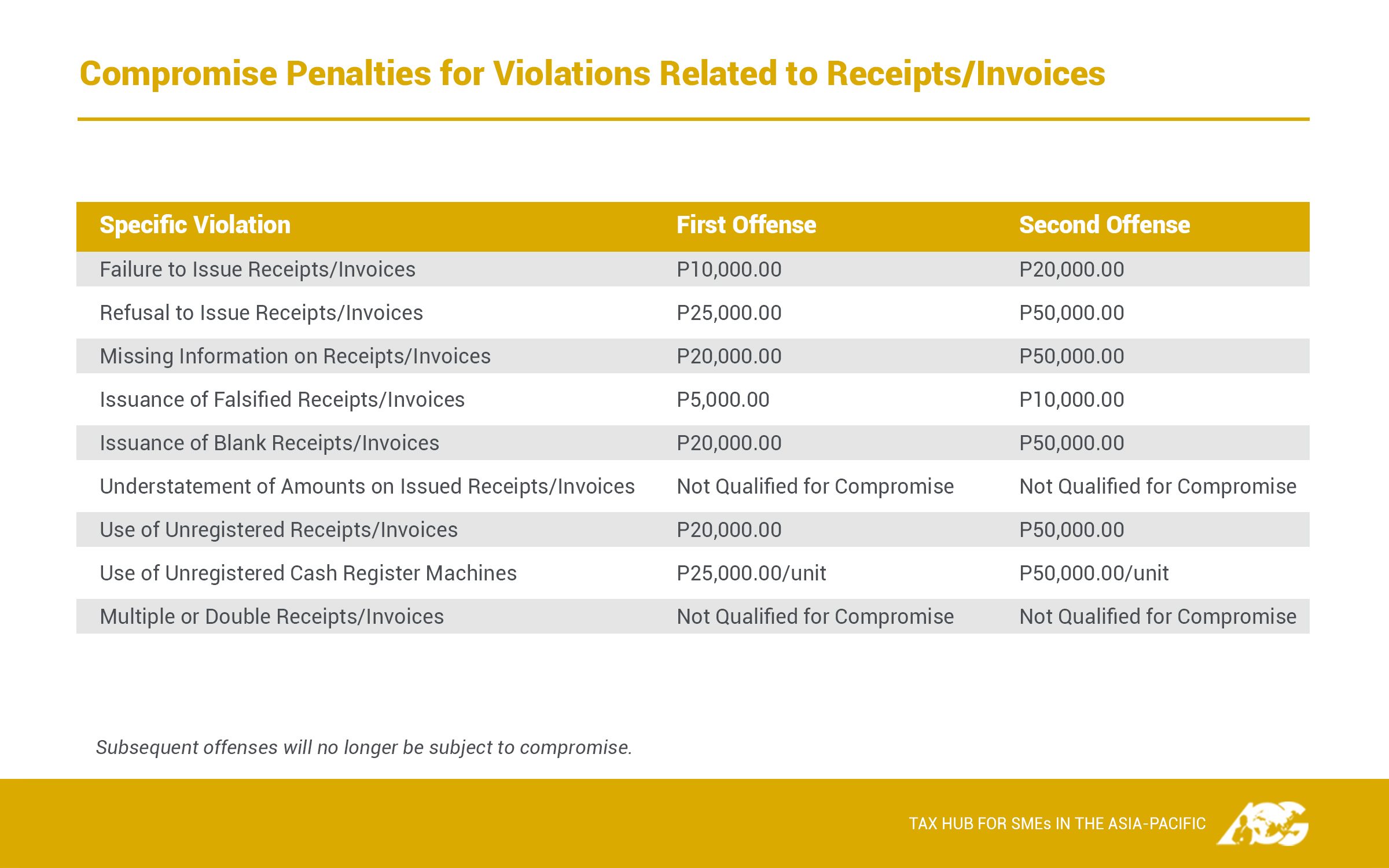

Yes. In fact, there have already been restaurants that were shut down under Oplan Kandado due to various violations related to receipts or invoices. Revenue Memorandum Order No. 7-2015 prescribes the compromise penalties and the violations associated with them. Those violations include refusal to issue receipts, understatement of amounts on issued receipts, and issuance of blank receipts, among others.

The Bureau of Internal Revenue (BIR) has several ways of dealing with taxpayers who do not issue receipts or invoices, such as through its milder Tax Compliance Verification Drive (TCVD) or its more thorough sibling, the dreaded BIR audit.

To avoid unnecessary expenses brought by insufficient preparation, taxpayers and business owners need to engage in tax planning that will ensure full compliance with BIR regulations. To learn more how to be free from both worries about the BIR and the burdens of taxes, business owners may engage in an Executive Tax Briefing. Contact us at consult@acg.ph or 6227720.

If you want to know more about tax compliance, visit our Facebook page, The Philippine Tax Whiz, and leave us your questions. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.