SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I have recently been reading articles about violations of restaurants in terms of taxes. What exactly are their most common violations?

Under the Run After Tax Evaders (RATE) program of the Bureau of Internal Revenue (BIR), the most common violations of businesses in the food service industry, such as restaurants, cafés, and food outlets, are willful failure to pay taxes and unlawful pursuit of business. Meanwhile, under the BIR’s Oplan Kandado, the most common reasons are failure to issue receipts and underdeclaration of taxes.

According to the Tax Code, these violations are subject to a 25% surcharge under Section 248. The taxpayer would also need to pay an interest penalty, which has been effectively lowered by the tax reform law from 20% to 12%. Note that failure to file and/or pay taxes is different from willful failure. The first two offenses can still be compromised, while the third offense onward constitutes willful failure to pay taxes and will not be subject to compromises.

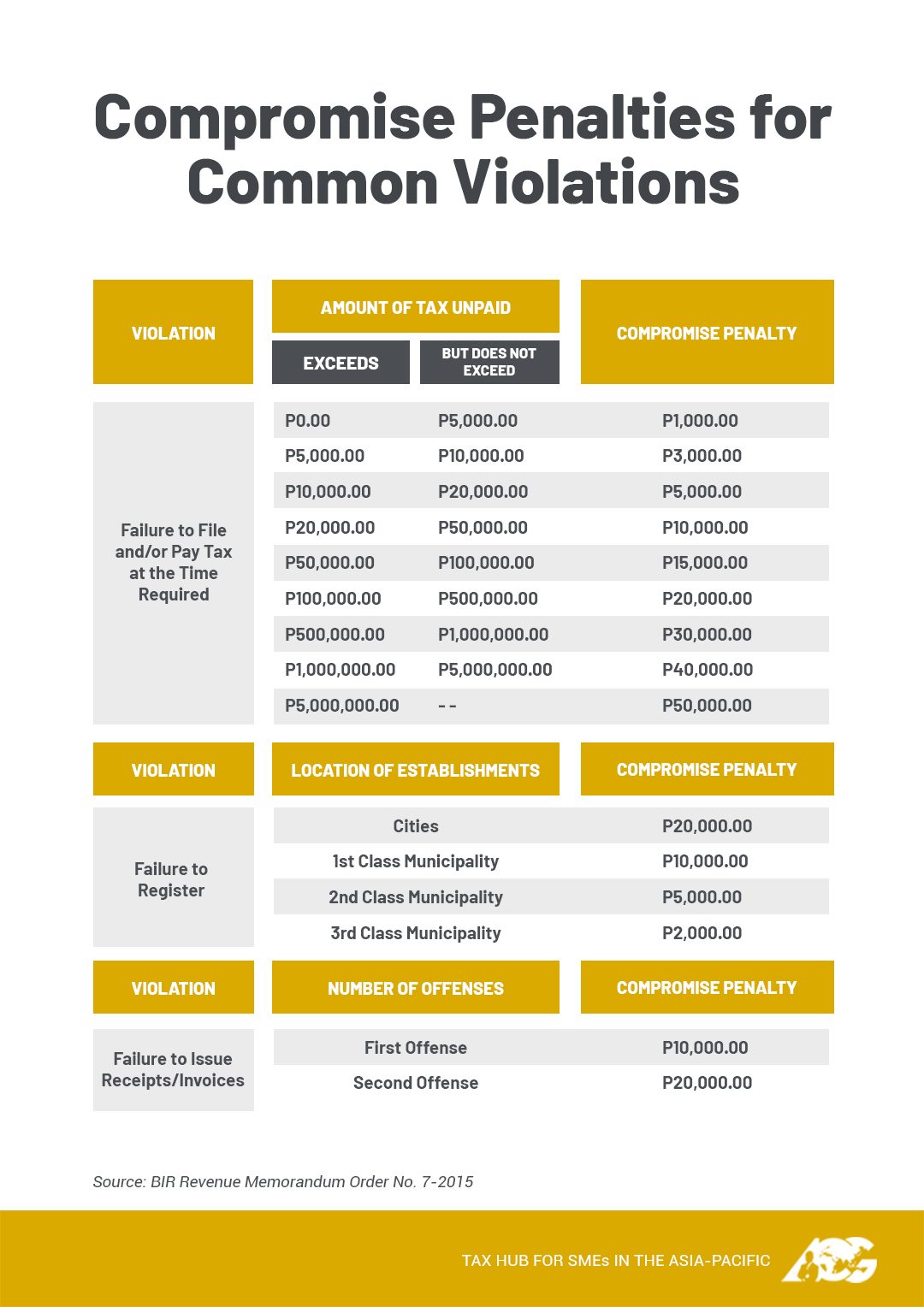

BIR Revenue Memorandum Order No. 7-2015 prescribes the following compromise penalties for the most common violations:

Can my business get shut down if I underdeclare my taxes? What if it’s just an honest mistake and amounts to very little?

Under Revenue Memorandum Order No. 3-2009, one of the factors for getting shut down by Oplan Kandado is if the underdeclaration of taxes amounts to 30% or more of the taxpayer’s gross sales. However, this does not mean that underdeclaration of income amounting to less than 30% is exempt from penalties. Such underdeclaration will be considered filing of a false return, which shall be imposed a penalty of 50% or half of the deficiency tax.

Whether the mistake is honest or not only affects the prescriptive period for an assessment. The taxpayer will still have to pay the penalties such as the 25% surcharge, 12% interest, and whatever compromise penalties will apply.

These unnecessary – and easily avoidable – fines cause more expenditures for businesses. Startups and small businesses are more vulnerable to these penalties due to lack of knowledge or professional guidance. To learn more about tax compliance, email us at consult@acg.ph or call us at 6227720 for Exclusive Tax Coaching.

If you want to know more about tax compliance, visit our Facebook page, The Philippine Tax Whiz, and ask us your questions! – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.