SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

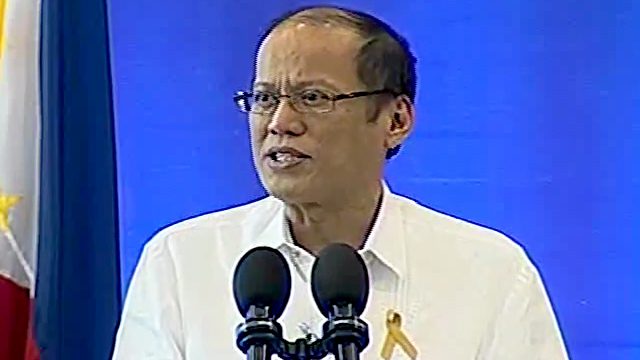

MANILA, Philippines (UPDATED) – President Benigno Aquino III is not yet convinced that lowering income tax rates will benefit the majority, stressing the government’s thrust of improving tax collection.

It was reported on September 3 that the Palace rejected a House bill that seeks to lower income tax rates in the country. The goverment is estimated to lose at least P30 billion ($641.49 million) during the first year of its implementation. (READ: Palace: No new or higher taxes, income tax cuts)

In an interview following the opening of the controversial Iloilo Convention Center on Monday, September 14, Aquino reminded the public that part of his 2010 presidential campaign was to ensure improved tax collection.

“At inabiso natin – pinangako natin, hindi tayo magtataas ng buwis. Unahin munang kolektahin ‘yung nasa batas na” (We promised that time that we won’t increase taxes, but instead, would collect taxes as already prescribed by law),” he said.

Marikina Representative and committee chairman Romero Federico “Miro” Quimbo earlier said the House bill on lowering income tax would have 4 brackets, which include:

- Workers earning less than P180,000 ($3,850.13) a year would be exempted from paying income taxes

- Workers earning P180,000 ($3,850.13) to P500,000 ($10,695.64) would pay a tax rate of 9%

- Those earning between P500,001 ($10,695.64) to P10 million ($213,901.29) a year would have a tax rate of 17%

- Those earning more than P10 million ($213,830.76) would pay a 30% income tax

Quimbo said corporate taxes would be reduced to 25%.

For progressive taxation

Aquino stressed that through prudent measures, the deficit has been managed, lowering it in proportion or as a ratio to the country’s gross domestic product.

For this, various credit rating agencies gave the country credit rating upgrades under his watch, Aquino said.

“Ang tanong, kapag binawasan natin ‘yung income tax, mababawasan ‘yung revenue, lalaki ‘yung deficit. Iyong paglaki ba ng deficit magiging negative factor kapag ni-rate sa atin o ni-rate tayo nitong mga credit ratings agencies?” he asked.

(The question is, if we lower the income tax rate, revenue would decrease and deficit would increase. If the deficit increases, would this be a negative factor once these credit rating agencies begin to rate us?)

He pointed out that when income taxes are lowered, the value-added tax (VAT) would increase.

The finance department submitted to Congress in August the government’s tax reform bill, which includes an all-in income tax exemption to all wage earners with an annual income of less than P1 million ($21,387.76).

Along with the proposal is increasing VAT from 12% to 14% and expanding the VAT base by removing all exemptions, except in agriculture, health, banks, education, as well as removing zero-rating, except direct exports.

“Kapag tinaasan natin ‘yung langis, o ‘yung taxes diyan, taasan lahat ng presyo dahil sa transportasyon, tataas ‘yung kuryente. So ang tanong, makabubuti ba ‘yung pagbababa ‘nung income tax level sa mga kababayan natin? At ako’y hindi kumbinsido sa ngayon,” he said.

(If we increase taxes in oil, prices in transportation, electricity would spike. So the question is, would it be beneficial if we lower the income tax level? I’m not convinced at the moment.)

Aquino said that what he thinks the Constitution asks is progressive taxation, or the tax rate increases as the taxable income increases, which puts a bigger tax burden on the rich over the poor.

“‘Yung mga tax tulad sa VAT, damay lahat anuman ang sitwasyon mo sa buhay, kung anuman ang level [mo sa] society. So parang ‘yung VAT at saka ‘yung sa oil, [tatamaan] lahat. Hindi yata ‘yan ang hinahabol ng Saligang Batas na dapat progressive taxation.”

(Taxes like VAT affects all, regardless of one’s status in society. So VAT or oil tax increases, [I don’t] think this is what the Constitution states as progressive taxation.)

Thus he reiterated his earlier promise that his administration will not increase taxes, with the exception of Sin Tax Law in 2012, which sought to channel more revenues to public health care.

Politically difficult

Malacañang’s view on tax reform, however, is not universally shared. An economist and former public official said the stand has more to do with politics than economics.

“Mr Aquino rejected the proposal because he is unwilling to push for the accompanying measures to lower income taxes, namely higher VAT rates and rationalization of fiscal incentives,” Benjamin Diokno, who served as buget chief during the Estrada administration, said in a text message to Rappler.

Both measures, he explained, are economically sound but hard to implement adding that “the personal income tax system and the corporate income tax system are both 19 years old.”

“No economist worth his soul would argue that the present income tax system is sound and fair,” Diokno said.

The rationalization of the fiscal incentives, he added, would also broaden the tax base.

As ASEAN integration looms at the end of year, the lack of tax reform would also leave the country “out of sync with the regional bloc,” Diokno said. – Rappler.com

US$1 = P46.77

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.