SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I am a registered professional earning below P3 million (the value-added tax or VAT threshold), but I recently read that taxpayers may register as a VAT taxpayer even if the gross revenues fall below the VAT threshold. Is this correct? Any advantage of registering as a VAT taxpayer?

Yes. Regardless of gross revenues earned or projected, the self-employed or professionals may register as a VAT taxpayer. The advantage is that the VAT can be passed on to consumers, while percentage tax is assumed as part of gross sales to be remitted directly to the government. Also, VAT-registered individuals or corporations would normally prefer dealing with VAT-registered suppliers or professionals to claim input VAT.

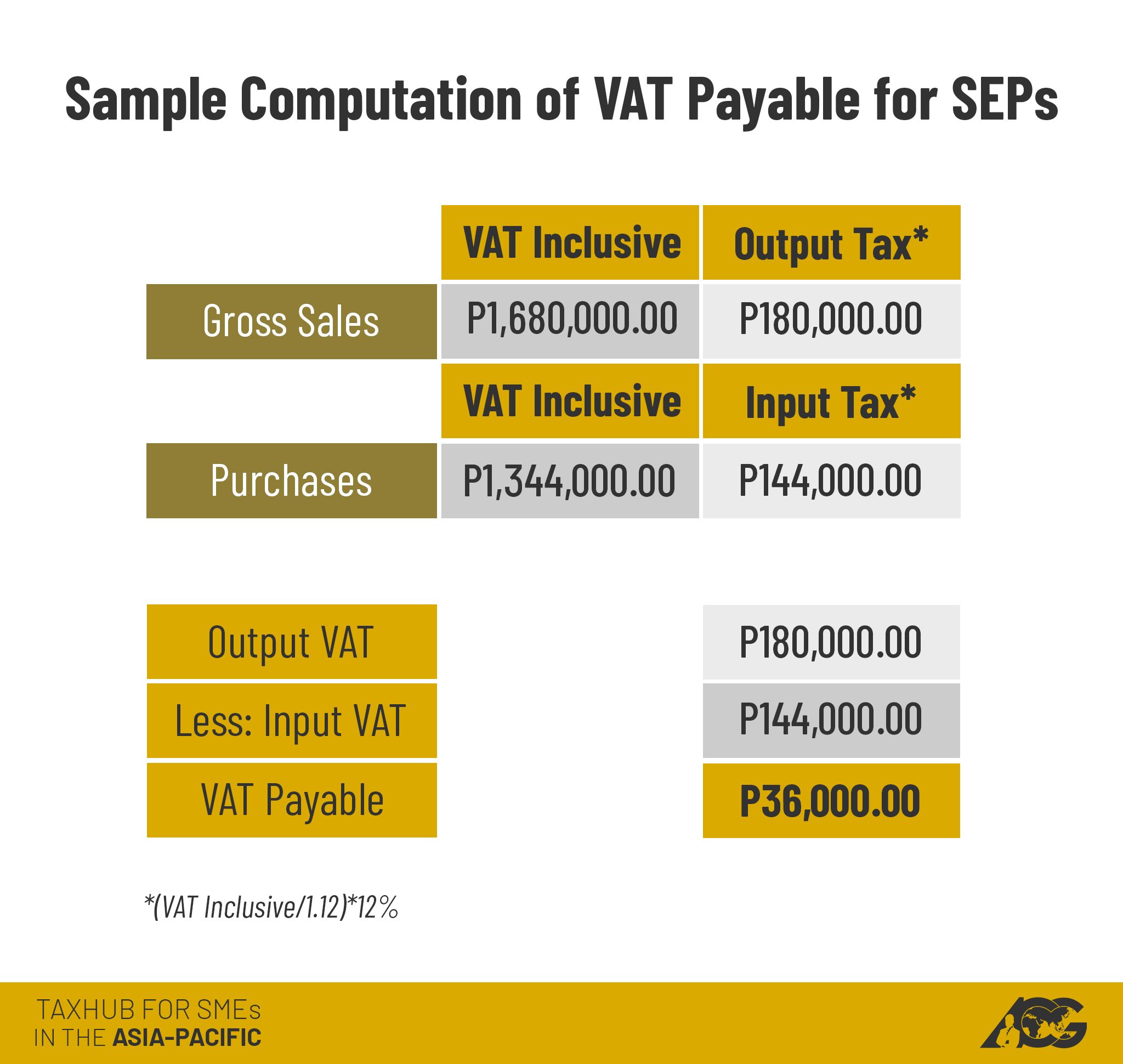

As shown above, the VAT payable is P36,000 only. But if the taxpayer is a non-VAT taxpayer, percentage tax due will be P50,400 (P1,680,000 x 3%).

What is the applicable withholding tax rates under the Tax Reform for Acceleration and Inclusion (TRAIN) law for professionals? Is it an additional tax or expense to be paid by professionals?

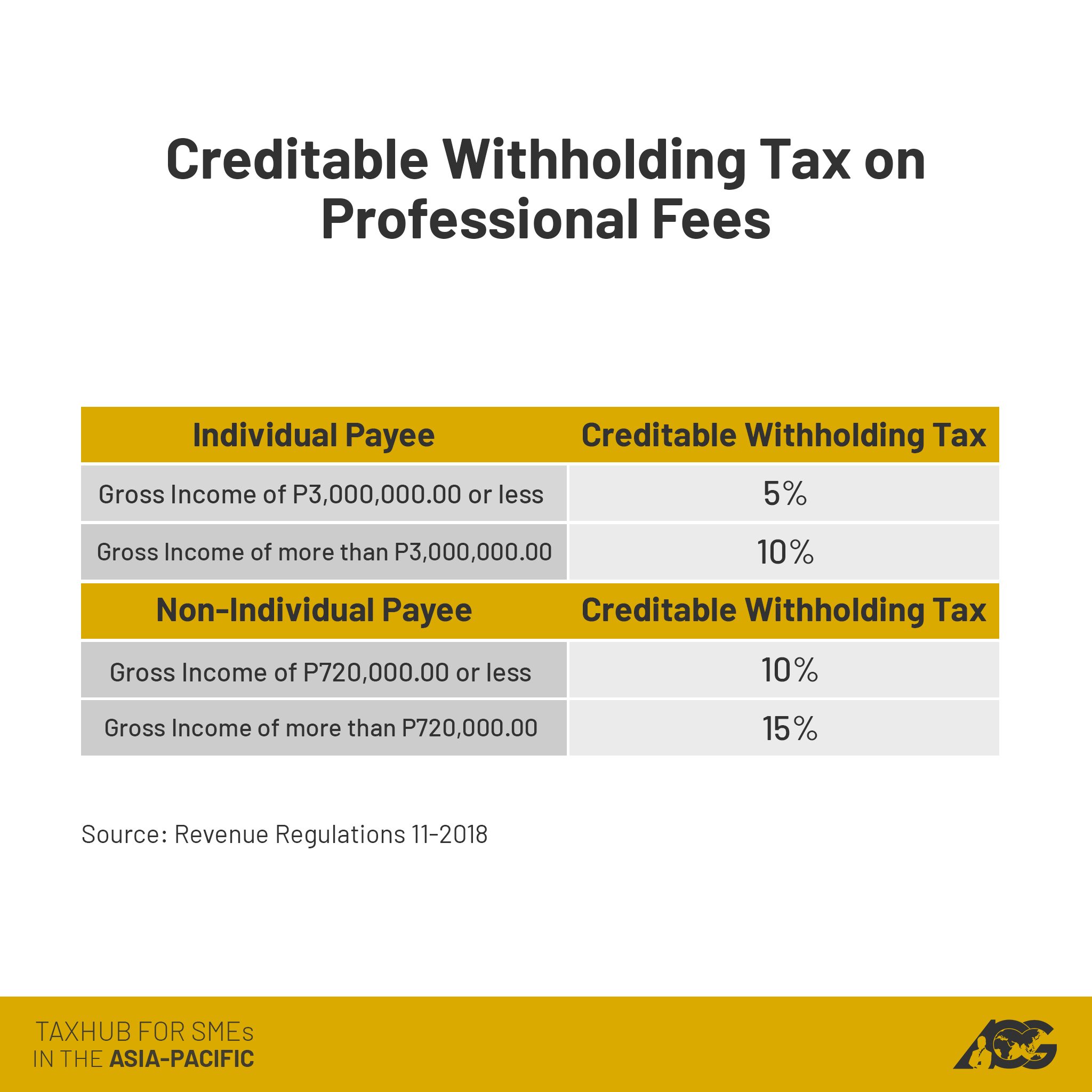

Per Revenue Regulation (RR) 11-2018, professional fees are subject to the following withholding tax rates:

Note, however, that withholding tax rates for non-individuals (or corporations) remain unchanged since the TRAIN law covers personal income tax only and its corresponding withholding tax rates.

Also, RR 14-2018 clarified that VAT-registered taxpayers, regardless of amount of gross income, are subject to the 10% creditable withholding tax.

Whether 5% or 10% withholding tax rate, the tax withheld is creditable as income tax payment. It is not an additional tax or expense since it can be used as tax credit to compute its income tax payable.

Knowing which taxes you have to pay is key to avoiding expensive fines and penalties. Due to hefty surcharges, interest, and compromise penalties, failure to pay the right taxes is more expensive than simply paying the right tax.

For ease of tax compliance, download the TaxWhizPH mobile app. Just take a photo of the receipts and the tax returns will be prepared automatically. Learn how you can file your tax returns whenever, wherever here. To subscribe for free, simply visit app.acg.ph.

For your tax questions, simply reach us via Twitter at @AskTheTaxWhiz or use the hashtag #AskTheTaxWhiz. You can also visit our Facebook page, The Philippine Tax Whiz. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.