SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I am the owner of a food manufacturing facility and we’re currently thinking of importing raw materials instead of sourcing them locally. Do I need to apply as an importer with the Bureau of Internal Revenue (BIR)? What are the taxes that I will have to pay?

To become an importer, taxpayers need to have an Importer’s Clearance Certificate. However, this application no longer needs to pass through the BIR. Previously, the application was a two-part process – first with the BIR, then with the Bureau of Customs (BOC).

Under the Department of Finance’s Department Order No. 11-2018, the BOC will have the sole authority to accredit customs brokers and importers.

Imported goods are subject to tariffs, but this amount will differ based on the source of the imported goods. For revenue taxes, imported goods are subjected to an additional 12% value-added tax (VAT). The VAT will be based on the total value to be determined by the BOC.

Am I liable to pay the VAT on imported goods even if I am earning below the threshold? What are the other VAT exemptions?

The VAT threshold of P3 million only exempts the sale or lease of goods or the performance of services. In other words, even if the taxpayer has annual gross sales of below P3 million, they are still liable to pay the 12% VAT on imported goods.

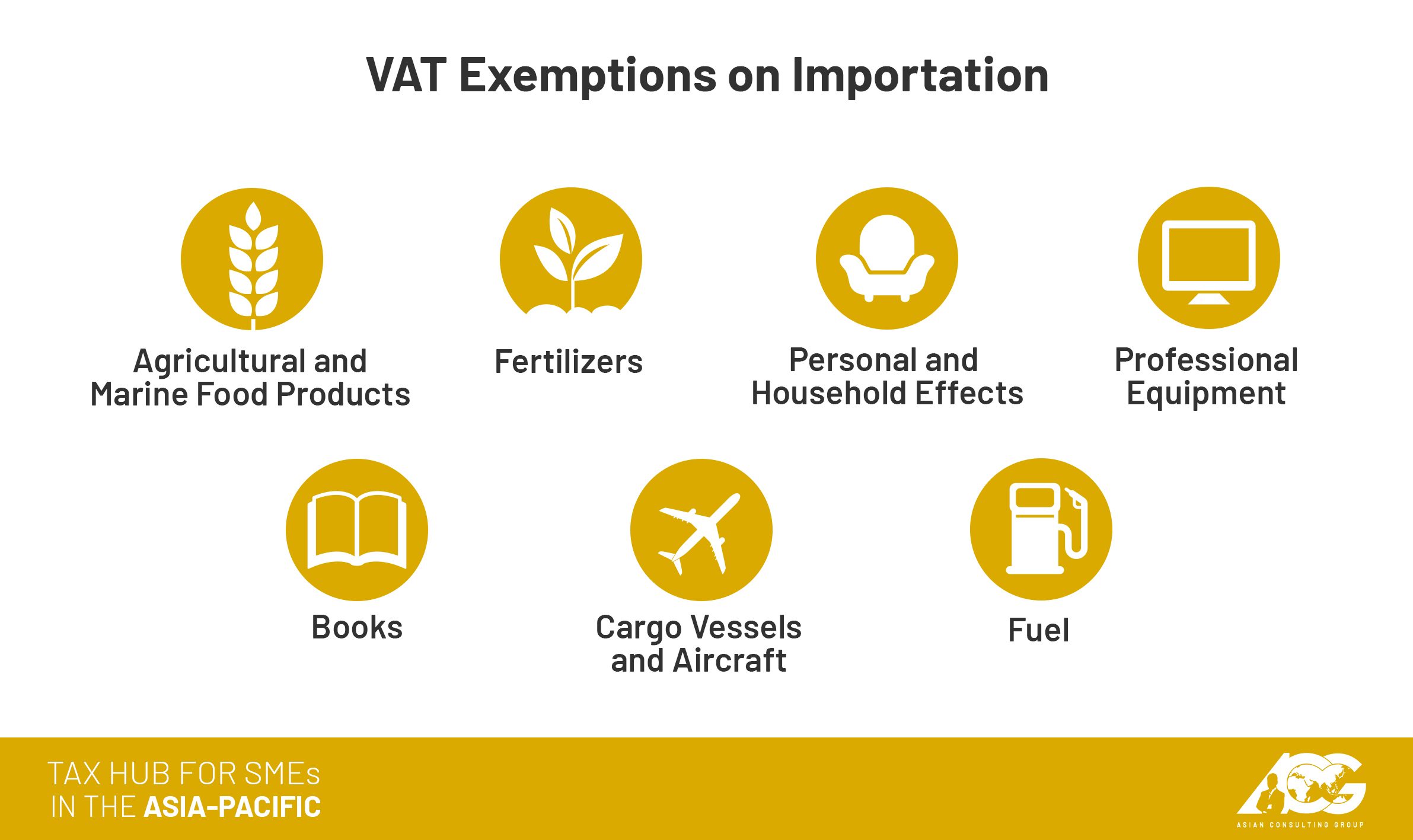

But there are still exemptions from the VAT on imported goods.

However, it should be noted that importers are required to use the BIR’s Electronic Filing and Payment System (eFPS) under Revenue Regulation No. 10-2014. Failure to use the eFPS platform will render the importer a priority target for BIR audits, as stated by Revenue Memorandum Order No. 19-2015.

Being audited by the BIR can be costly and stressful. The BIR has openly admitted to the House committee on ways and means that it issues very high assessments simply to meet its deadlines. For regular taxpayers, these large assessments can cause unnecessary expenses.

Taxpayers currently dealing with BIR audits, or those who wish to learn how to properly prepare for them, can engage in Citizen Tax Planning (CTP). Avoiding fines and penalties is easy with just a strategic tax plan.

To learn more about CTP, you may contact us at consult@acg.ph or call us via (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). You may email him at consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.