SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Editor’s Note: An earlier version of this column mentioned taxable income instead of gross sales. This has been corrected.

I heard that you could deduct expenses from your gross sales. Does that mean it’s possible to pay no tax if you have plenty of expenses?

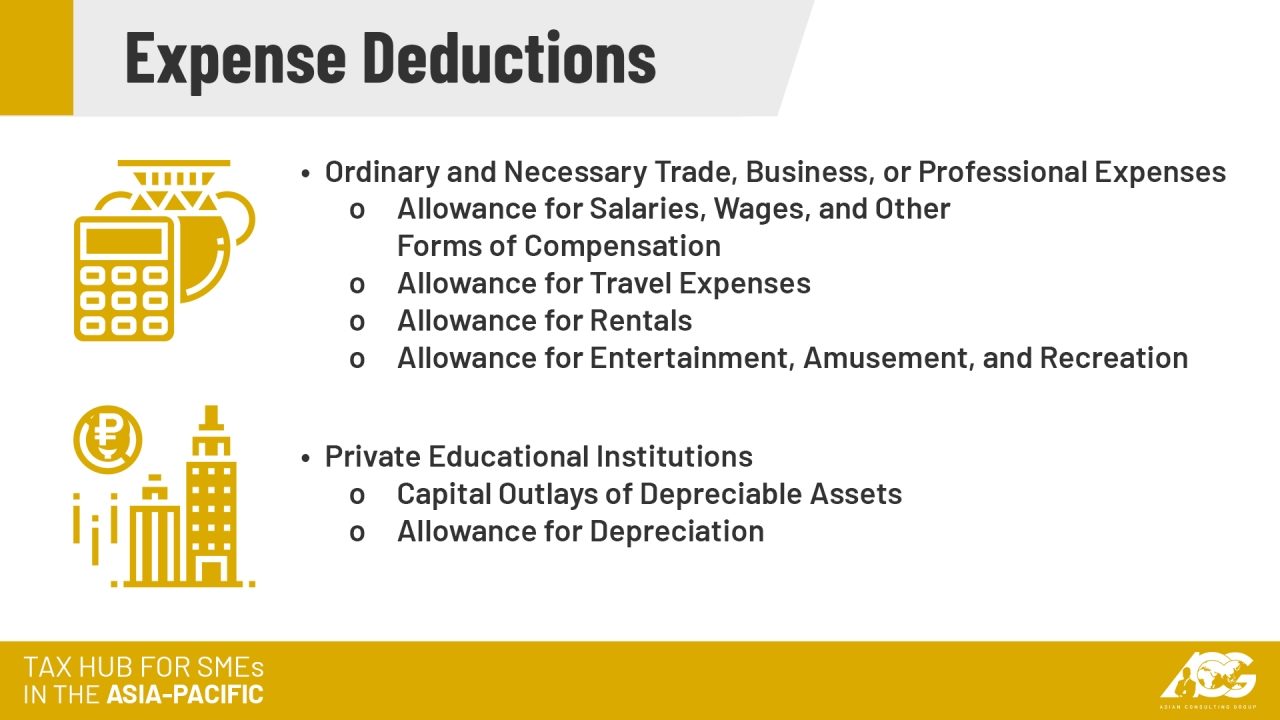

If you have enough expenses, then yes. However, keep in mind that not all expenses are deductible. First, the expense has to be directly related to the conduct of business. It also has to be incurred within the taxable year. Deductible expenses include reasonable allowances for salaries, travel expenses, rentals, and entertainment.

Compensation income earners will not be able to apply for deductible expenses. Private educational institutions can also deduct certain expenses, such as expenditures considered as capital outlays of depreciable assets and allowances for depreciation.

How do I deduct expenses from my gross sales? Do I need to bring additional documents?

You only need to indicate the expenses in your tax return. However, an important part of claiming expenses is substantiating your claims. No deduction can be claimed if the taxpayer cannot prove it through official receipts or other adequate records.

The exact amount of the expense has to be indicated in the records. Its direct relation to the conduct of trade or business has to be clear as well.

Note that a common cause for incurring violations during the Bureau of Internal Revenue (BIR) audit is the overstatement of expenses and deductions.

By claiming deductions they cannot prove, taxpayers are subjected to deficiency taxes along with surcharge, interest, and compromise penalties. Worse, it may even be the grounds for Oplan Kandado or the BIR’s Run After Tax Evaders program.

Knowing the risks and how to avoid them in the future is a crucial part of handling taxes. To check your vulnerabilities, you can schedule a free consultation with us here.

For more questions about taxes, you can reach us at consult@acg.ph or at (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.