SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Plenty of provisions in the Tax Code have been changed due to the ongoing tax reform process. Will all these changes need new forms?

Most, but not all. For instance, changes in value-added tax, while extensive, are not reflected in the current Bureau of Internal Revenue (BIR) forms. But in cases where rates have been amended, such as for final withholding taxes or when deadlines have been moved, new forms will be needed.

There are also cases where new forms are created to reflect the availability of the new 8% income tax option. The imposition of new taxes, such as on sweetened beverages and cosmetic procedures, will of course need new forms.

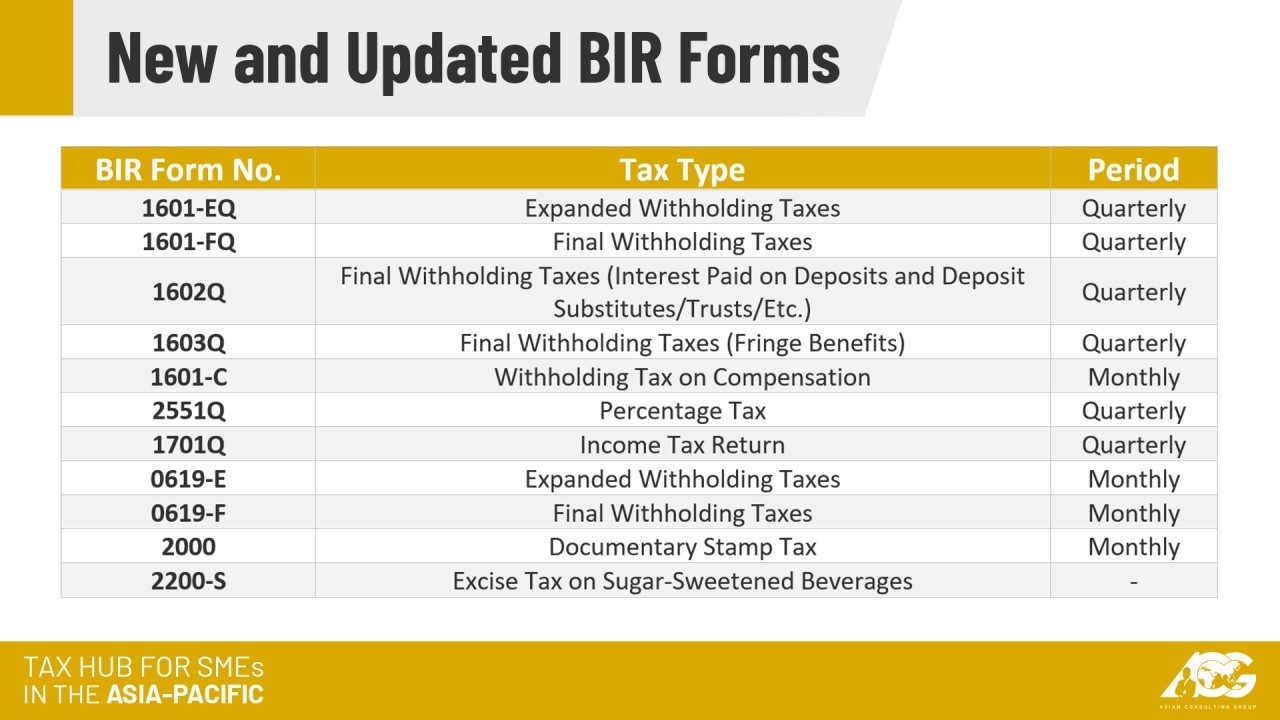

To date, there have only been 11 BIR forms that needed to be updated due to the Tax Reform for Acceleration and Inclusion (TRAIN) law.

Other forms were also discontinued due to the changes. For example, BIR Form No. 1601E was used to remit expanded withholding tax monthly. Under the TRAIN law, this was replaced by 0619-E for the remittances in the first and second months of the quarter, and 1601-EQ for the third.

Due to the removal of personal and additional exemptions, the need for BIR Form No. 2305 (Certificate of Update of Exemption and of Employer’s and Employee’s Information) has been taken out as well.

Those forms seem few compared to the changes implemented under the TRAIN law. Should I expect other types of taxes to get new forms?

Yes. The changes to estate tax, donor’s tax, and stock transfer tax are significant, yet they still do not have new forms. The newly-imposed excise tax on invasive cosmetic procedures is still subject to transitory provisions. According to a BIR advisory, it needs to be paid using BIR Form No. 0605 until BIR Form No. 2200-C is released.

Another notable provision is that of the annual income tax return (ITR). The TRAIN law contains a provision shortening the ITR to no more than 4 pages. The current BIR Form No. 1701, however, remains lengthy.

These new forms serve not only to reflect the new rates and deadlines, but also to make tax filing and payment simpler. Accidentally using old forms may not necessarily lead to penalties, but it will certainly cause unwarranted difficulty.

Regularly checking the BIR website for updates should prevent issues. Alternatively, taxpayers can also attend tax seminars for comprehensive updates on relevant matters.

For more questions and other tax-related concerns, you can reach us here. You can also contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.