SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Now that 2019 is here, do you have pointers for us before we start planning for the year ahead? Is there anything else we need to take care of in our 2018 finances?

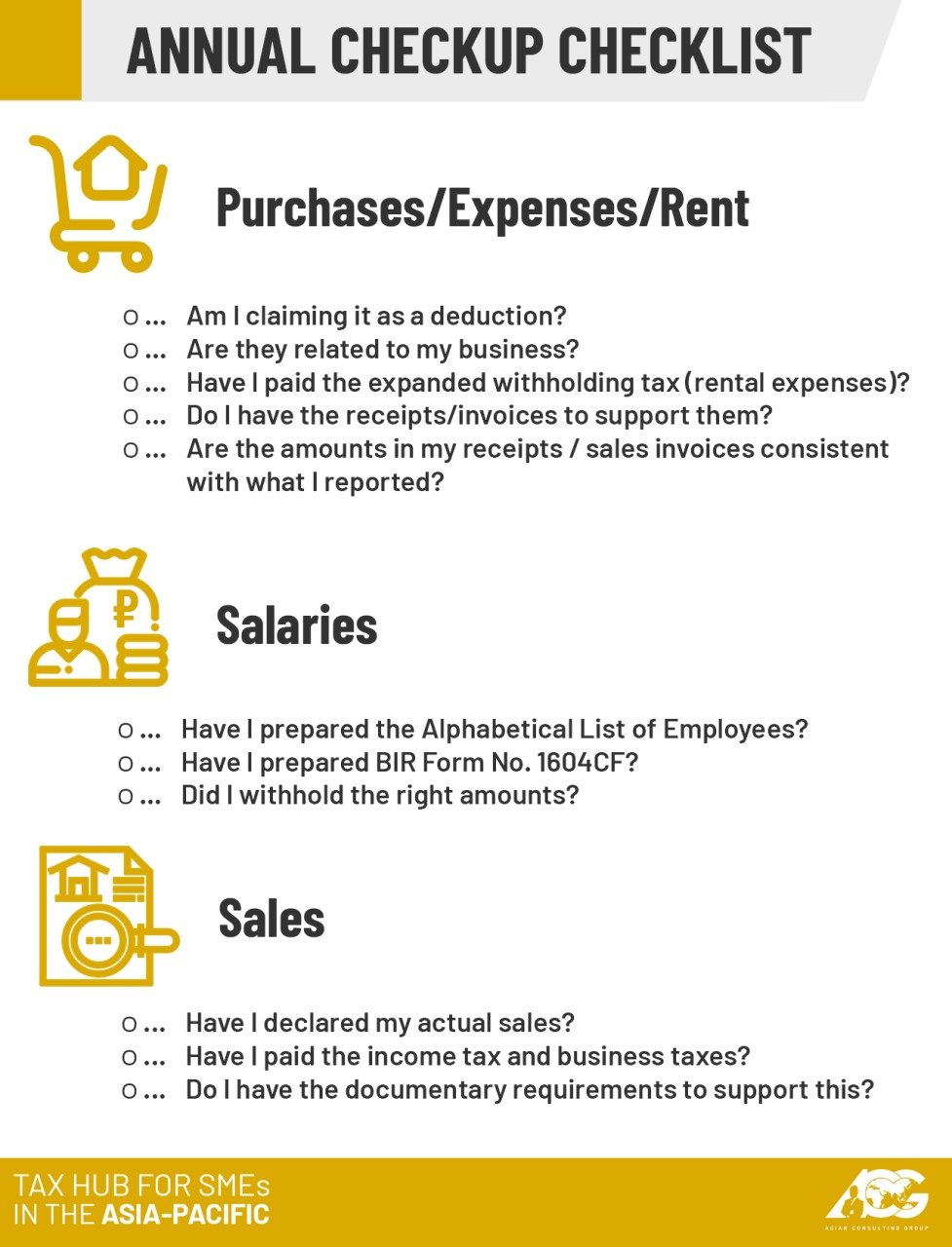

Before leaving 2018 behind, you need to make sure your taxes are in order. You need to reconcile your records (books of accounts) with supporting documents (receipts and/or sales invoices). Then, you need to ensure that these are consistent with what you reported to the Bureau of Internal Revenue (BIR).

Among the things you need to check are your rents, salaries, sales, purchases, and professional fees.

Conducting an annual checkup is not a requirement, but it could help you address discrepancies immediately. These inconsistencies could trigger a BIR audit and cause unnecessary stress and, potentially, expensive penalties.

I’m a VAT-registered taxpayer who bought supplies from someone who did not issue me a sales invoice. Can I still claim the expense as input VAT to reduce my taxes due?

If you can reach your supplier and get the sales invoice, then you should. Otherwise, you shouldn’t. Claims for input VAT are required to be supported by receipts, sales invoices, or other such documents.

Yes, you will end up paying more tax than if you claimed it as a deduction, but you will end up saving more from penalties. In cases like this, it would be better to err on the side of caution.

The same goes for all other transactions.

Failure to support your reported sales and expenses will cause deficiencies. These penalties could end up costing you twice the amount than if you had simply complied.

Of course, failed compliance is not necessarily intentional. Learning more about taxes should help in avoiding these situations. This can easily be done by attending tax seminars or more tailored exclusive tax coaching sessions and executive tax briefings.

For more inquiries, you can reach us here. You can also contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.