SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

We’ve already filed all our returns and remitted all our taxes due for 2018. Are there any other documents we need to submit annually to the BIR?

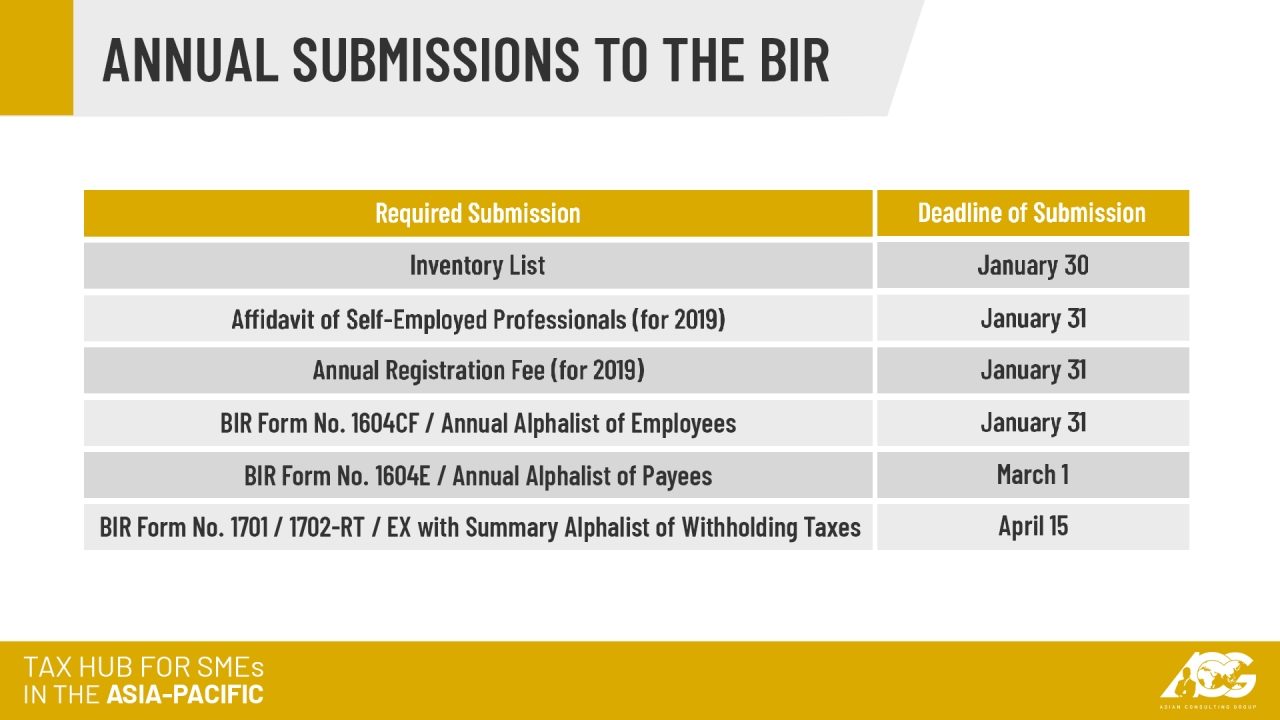

Yes. First, you have to submit an Inventory List of finished goods, work in progress, raw materials, supplies, and stock-in trade. The Inventory List is due every January 30.

Furthermore, the self-employed and professionals (SEPs) will need to submit an Affidavit of Self-Employed Professionals for 2019. Those with employees will also have to submit the Annual Alphalist of Employees along with BIR Form No. 1604CF.

Other documentary submissions such as the Annual Alphalist of Payees and the Summary Alphalist of Withholding Taxes, while not due in January, still cover the previous year.

I started my small business last year and I learned that I need to renew my business permit annually. Do I have to do the same with the BIR?

Yes. With the BIR, you need to pay your Annual Registration Fee in the amount of P500. As the name implies, you will have to pay this amount every year. The Annual Registration Fee is due on January 31 and failure to pay this amount will incur a compromise penalty of P1,000. This already triples the amount you need to pay.

To pay for your Annual Registration Fee, you need to use BIR Form No. 0605. The Alphanumeric Tax Code you need to use will be “MC 180” and the Tax Type will be “RF.” From there, simply indicate the amount required (P500) and then pay the registration fee at an Authorized Agent Bank.

Keeping track of these deadlines can sometimes be impossible, especially for startups. Running a business requires constant compliance such as, in the case of the BIR, returns, remittances, and other documents as may be needed. By learning about taxes, you can avoid violations and penalties.

The Asian Consulting Group offers guidance to taxpayers as part of our advocacy as a social enterprise. For consultations, appointments, or queries, you can reach us here. You can also contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.