SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Is there a way to be certain if a specific medicine is exempt from value-added tax (VAT)? What are the penalties for failing to exempt these medicines from VAT?

The Food and Drug Administration recently released the List of VAT-exempt Diabetes, High Cholesterol, and Hypertension Drugs on its website. The Bureau of Internal Revenue has also included this list under Revenue Memorandum Circular No. 4-2019.

Furthermore, according to Revenue Regulations No. 25-2018, the sale of drugs not included in that list will still be subject to VAT. The word “VAT-exempt” must be prominently indicated in the invoice issued for sale of the foregoing drugs or medicines.

Violators will be imposed a fine of not more than P1,000 and will face imprisonment of not more than 6 months.

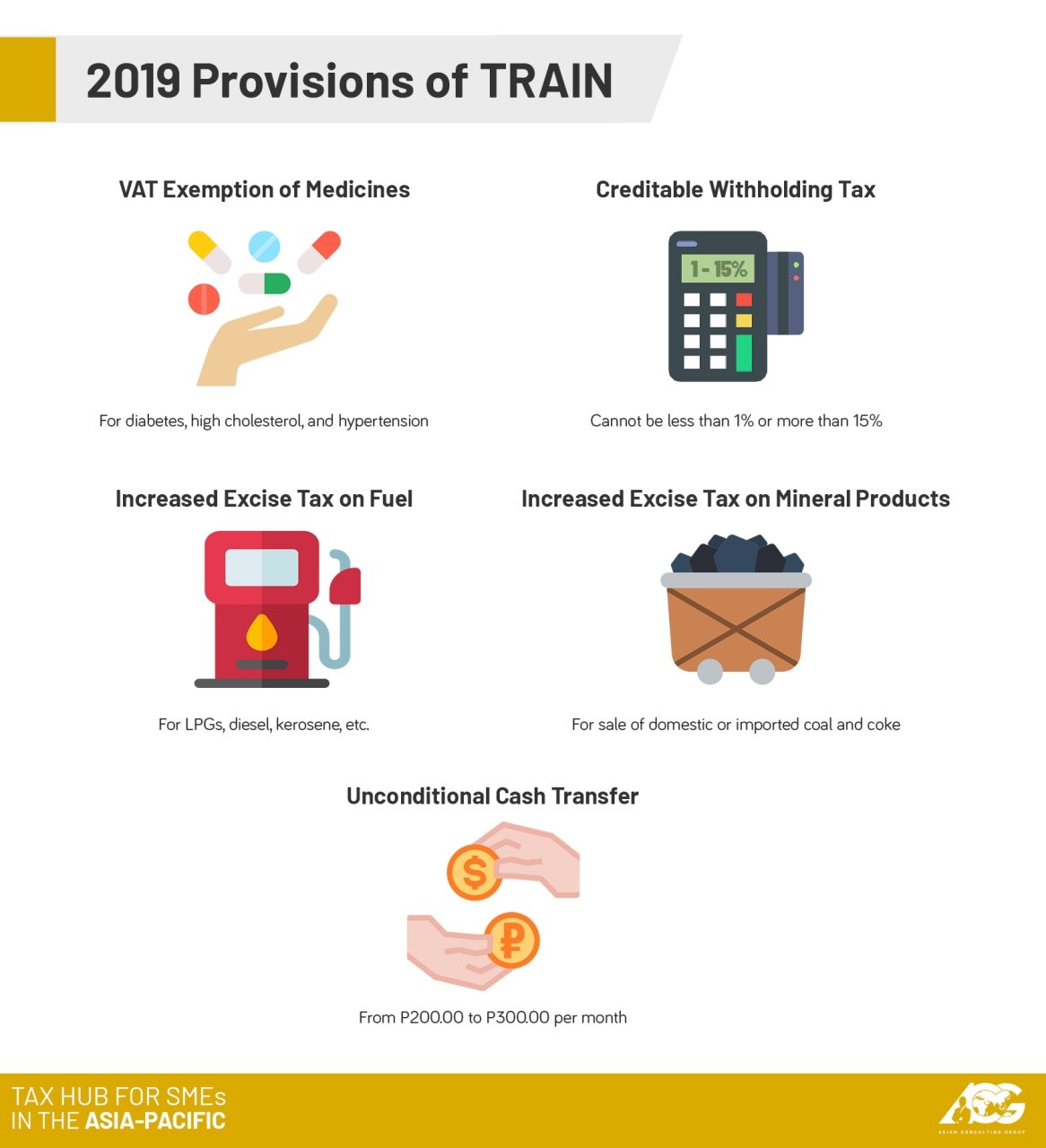

The Tax Reform for Acceleration and Inclusion (TRAIN) law is now on its second year. Are there any other provisions that will only take effect starting this year?

Aside from the VAT exemption of medicines for diabetes, high cholesterol, and hypertension, the second tranches of the excise tax on fuel and certain mineral products will be taking effect.

The excise tax on fuel increased by at least P1 for certain fuel products and as much as P2 for others. For mineral products, the excise tax on imported or domestic coal and coke increased by P50 per metric ton.

As of 2019, the creditable withholding tax (expanded) cannot be more than 15%, whereas it could previously be assigned a tax of up to 32%.

Moreover, another beneficial aspect of TRAIN will also be taking effect – the increase in the amount of the unconditional cash transfers (UCTs). Under the TRAIN law, on its second year, the amount of the UCTs shall be increased from P200 to P300 per month.

As the TRAIN law contains wide-ranging changes, keeping an eye on recent regulations could present opportunities to take advantage of and also pitfalls to avoid. Attending seminars, tax coaching sessions, or even just setting an appointment for consultation could easily provide you with the necessary information to do so.

For more inquiries, you can reach us here. You may also contact us at consult@acg.ph or at (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.