SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

As a self-employed individual, I want to file my annual income tax return (ITR) earlier than the deadline. Which form will I use? If I remember right, under the Tax Reform for Acceleration and Inclusion (TRAIN) law, the ITRs should be simpler and shorter.

You’re right, ITRs should be shorter. Under Sections 13 and 15 of the TRAIN law, individual and corporate ITRs should both be no longer than 4 pages.

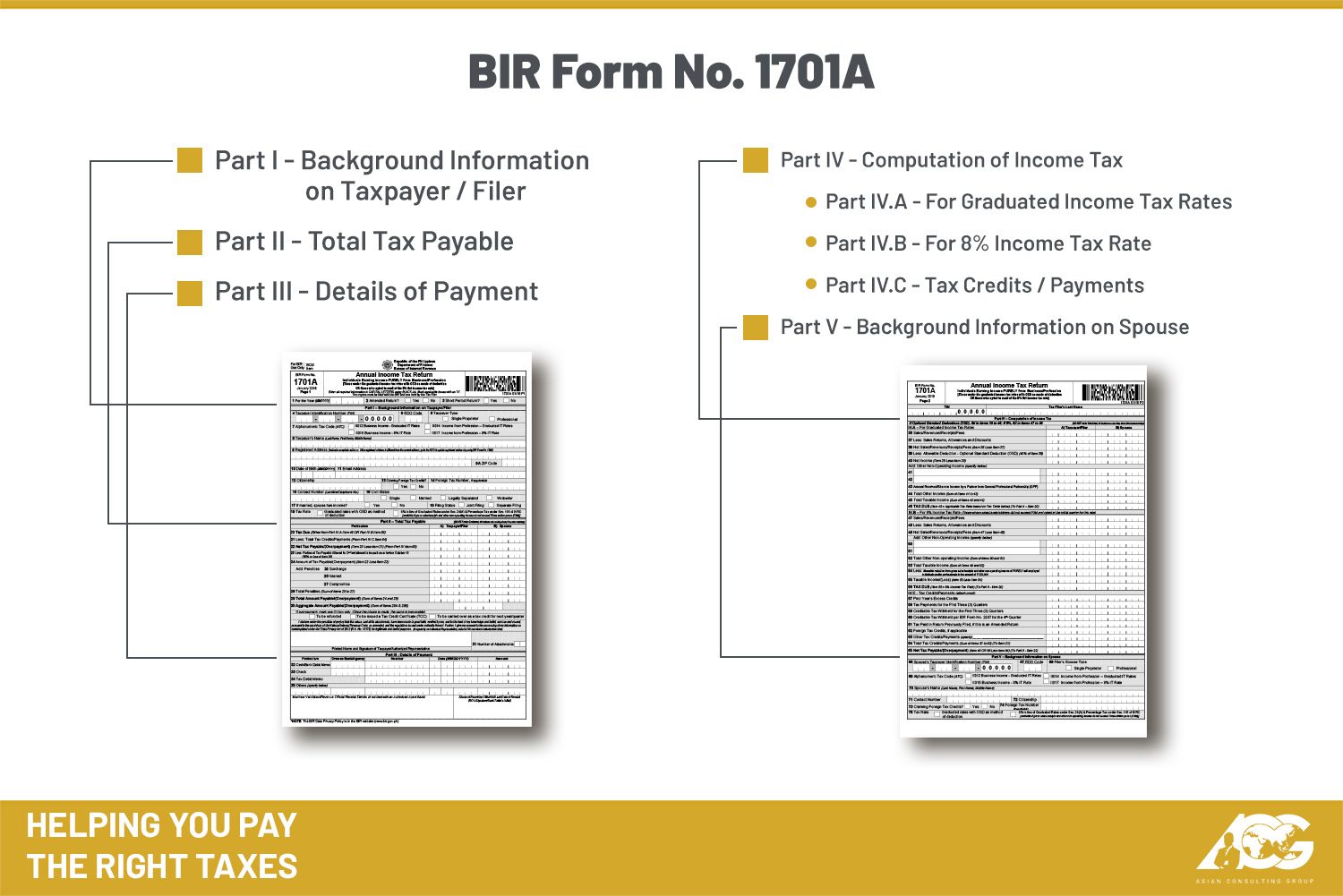

Recently, the Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular (RMC) No. 17-2019. The RMC circularizes the availability of the new BIR Form No. 1701A for ITR filing. This return will be used by individuals earning purely from their business or profession.

The new BIR form only has two pages and there are significantly fewer sections to fill out.

For manual filers, they can simply download the form from the BIR website. For eBIRForms users, the new form is already available in the Offline eBIRForms Package v7.3. However, the form is not yet available via eFPS and users are urged to use the eBIRForms as a work-around.

I was not aware of the work-around for filing the annual ITR as an eFPS user, and I already filed and paid using the old form. Do I still have to file another tax return using the new form? Will I have to pay the tax again?

According to RMC 17-2019, eFPS users who already filed their annual ITRs using the old BIR form are still required to file through the work-around of using eBIRForms. They only need to file the new form as an amended ITR.

There is an item in the ITR that allows you to input the tax paid in your previously filed returns. Assuming the computation is correct and you paid your taxes due, you won’t need to pay more taxes. But if the computation results in tax payables, you are required to pay the tax due either through manual payment (via authorized agent banks or the revenue collection officer), or through online payment (via GCash, Landbank Link.BizPortal, or DBP Tax Online).

Tax compliance can be confusing and moving forward blindly is a one-way ticket to violations and penalties. The TaxWhizPH mobile app simplifies and automates tax compliance for a seamless process. The app covers all types of taxpayers, including those availing of the 8% income tax rate. To subscribe for free, you can go to app.acg.ph. For more questions, you can contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.