SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

How is the tax amnesty on delinquencies different from the general tax amnesty? Which cases are covered by the tax amnesty on delinquencies?

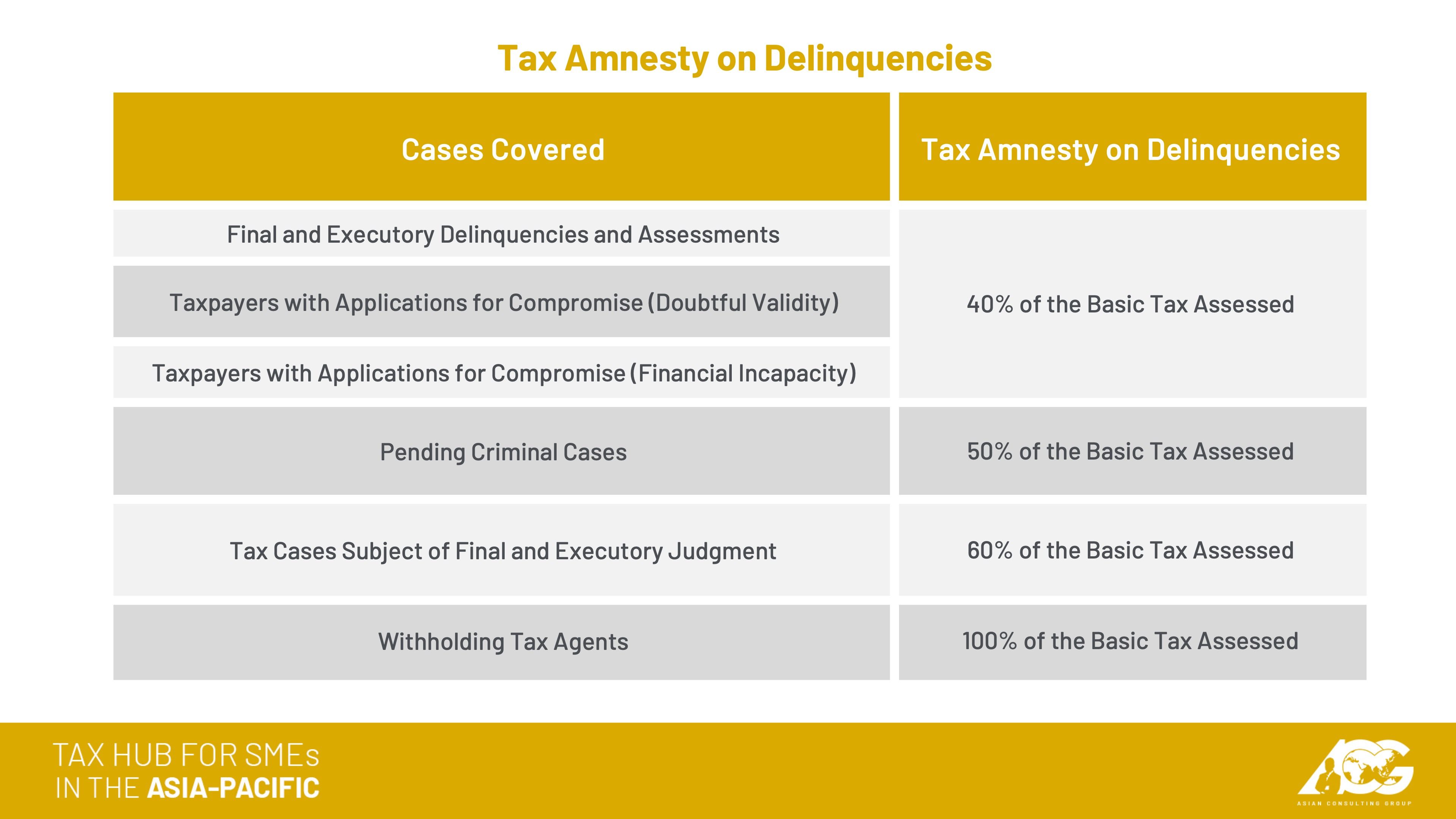

The keyword here is “delinquencies” since not all tax deficiencies are delinquencies. Already, the law provides which cases are covered by the amnesty. These are:

-

delinquencies and assessments which have become final and executory

-

pending criminal cases

-

tax cases subject of final and executory judgment

-

withholding tax agents who failed to remit withheld taxes

It will also cover those applying for compromise under the basis of doubtful validity of assessment and financial incapacity of the taxpayer.

How much will I have to pay for the amnesty? Until when can I avail of it?

According to the Tax Amnesty Act, different cases will be subject to different rates – ranging from 40% to 100%. The amnesty rate will be based on the basic tax assessed which, according to the law, refers to the latest assessment of the Bureau of Internal Revenue (BIR) without the interest, penalties, and surcharge.

An example of such an assessment would be final assessments during a BIR audit – or even disputed assessments.

Note that this is based on the assessment and not the total amount of your deficiencies. As such, the basic tax assessed might not exactly reflect how much you actually failed to pay (as might be the case in disputed assessments).

Taxpayers can avail of the amnesty within one year from the effectivity of the implementing rules and regulations.

Once the amnesty has been availed, taxpayers would need to ensure proper tax compliance in the future. The TaxWhizPH mobile app automates tax compliance to aid in avoiding penalties. As part of an advocacy to promote the ease of paying taxes, subscription to the app is free. Those interested can simply download it via the Play Store for Android users or App Store for iOS users.

For more questions and inquiries, you can reach us at consult@acg.ph or via (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.