SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Which form should I use if I’m self-employed, availing of itemized deductions under the graduated rates? Is it BIR Form No. 1701 or 1701A?

You will have to use BIR Form No. 1701. Since you’re availing of itemized deductions, it doesn’t matter if your income is purely business/profession or mixed.

The only ones who should use BIR Form No. 1701A are individuals earning purely from business/profession and availing of either the 8% income tax rate or the Optional Standard Deductions under Graduated Rates.

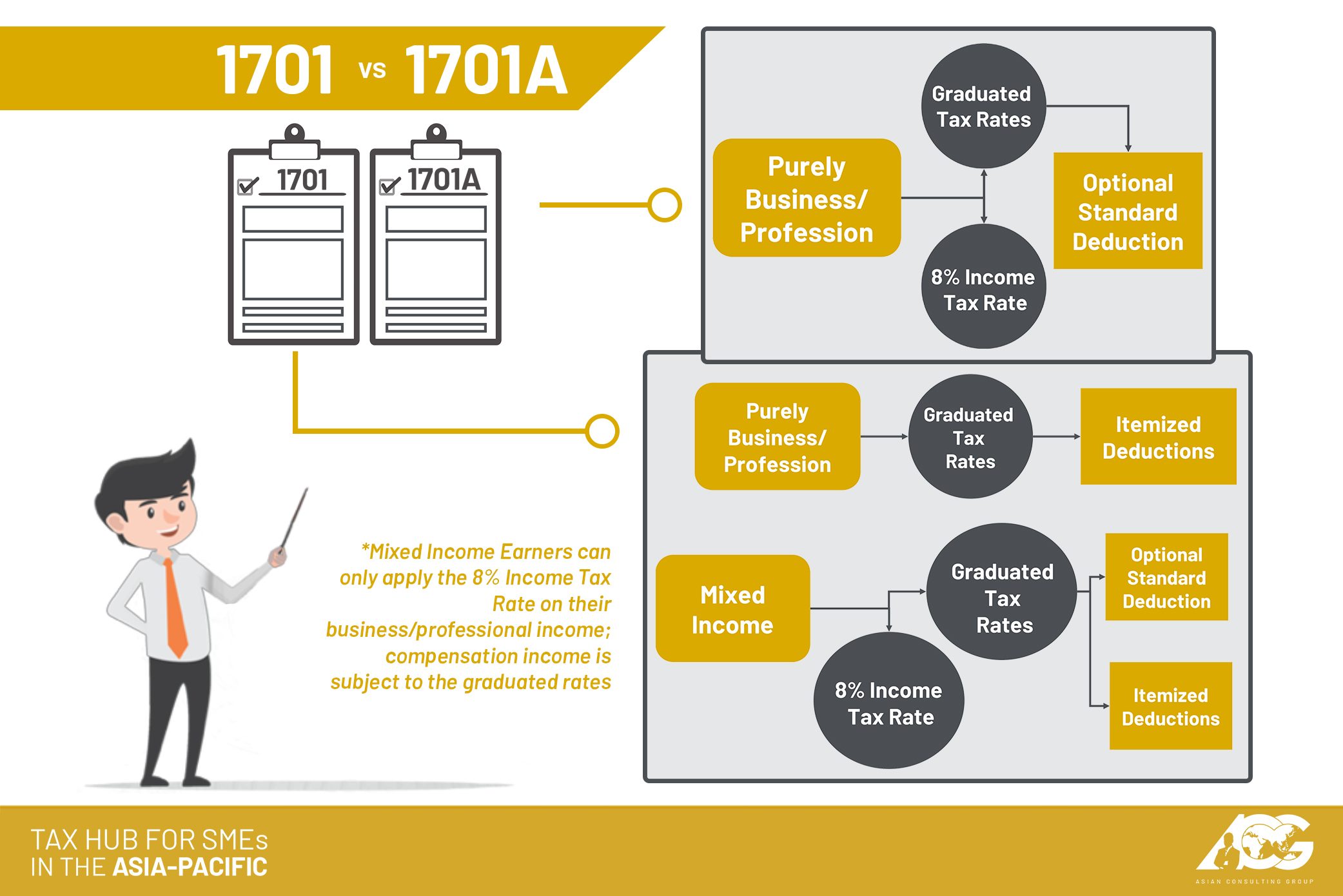

It might be a bit confusing, so those who are self-employed and professionals can use the image below for easier reference:

For estates and trusts, they should also use BIR Form No. 1701.

When is the deadline for filing my annual income tax return (ITR)? And how do I file the new BIR Form No. 1701? Can I do it online?

The deadline for filing your ITR is on April 15. It does not mean you should wait for the deadline and rush it on the last day. It is better to handle your tax compliance early so that you’ll have plenty of time in case you made mistakes such as using the wrong form or miscalculating tax dues.

To file the new BIR Form No. 1701, you have to go to the BIR. According to Revenue Memorandum Circular No. 37-2019, the new form is not yet available via eBIRForms or eFPS.

However, payment can be done online via GCash Mobile Payment, Landbank’s Linkbiz Portal, or DBP Tax Online.

Annual income tax is one of the most important types of taxes throughout the year. It does not matter if you filed your quarterly returns responsibly. Failing to file your annual ITR means the BIR can still charge you for penalties.

The Center for Strategic Reforms of the Philippines recently launched the #April15Challenge to promote information about ITR filing. Join by sharing the video on the CSR Philippines Facebook page, with your answer as the caption, and use the hashtag #April15Challenge.

For more tax-related inquiries, you can contact us at (02) 622-7720 or consult@acg.ph. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.