SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Now that the annual income tax return filing is done, the next ITR I need to file is the quarterly income tax return. Are there any important things to keep in mind?

For individuals, the deadline has already passed (1701Qs were due on May 15), but for corporations, the 1702Q will be due on May 30.

Aside from this deadline, you need to remember to use the new form. This has already been in circulation since 2018 (issued under Revenue Memorandum Circular No. 32-2018). On the filing and payment of taxes, there are no significant differences between 1701Q and 1702Q – you can do it either manually, through eBIRForms, or through eFPS.

What’s more, the 1st quarter ITR will also be the most important quarterly income tax return you will have to file.

In this return, you will need to make a choice that will affect you for the entire year: your tax schedule for the year. You will not be able to switch just because your current tax schedule is not suited to your finances for a certain quarter.

What are the different tax schedules I can choose from in my 1st quarter income tax returns? How important is this?

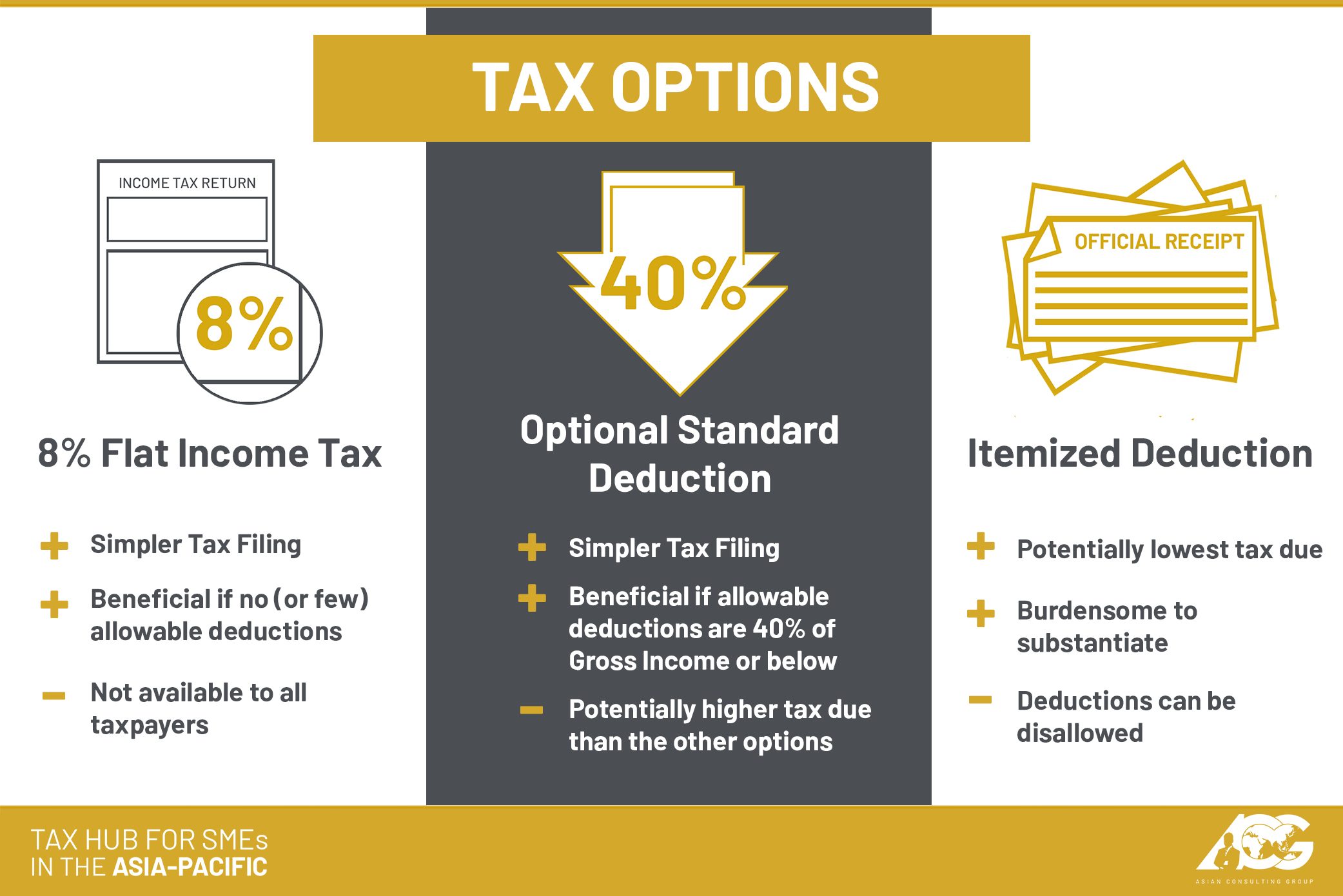

The tax schedules you can choose from are the graduated income tax rates and the 8% flat income tax. Further, under the graduated income tax rates, you will have a choice between the optional standard deduction and the itemized deductions.

It’s important to note that 8% flat income tax rate is only available to the self-employed and professionals, not to corporations.

Each will have its pros and cons. You will have to learn which one suits you best. For instance, if you have no deductions you can avail of (expenses, interest, etc), the 8% flat income tax might be suited to you. On the other hand, if you have plenty of deductions, you might want to avail of itemized deductions which could theoretically lower your tax due to zero.

Down the line, this choice will also affect how easy it would be for you to file your annual ITRs.

As earlier noted, you will not be able to switch your tax schedule on a whim. You will be stuck with what you choose so it is best to undergo tax planning to ensure that you have a long-term plan that would not come back to bite you in later quarters.

Learning about how each tax schedule affects you can be quite beneficial. You can learn by trying it out, or you can learn from others. Learning by yourself will have more impact, considering you will experience it firsthand. In contrast, learning from others could be less costly. Attending tax seminars, tax briefings, or even the Tax Whiz Academy’s Tax Hub Talks could help you decide.

For more questions, you can reach us at consult@acg.ph or (02) 622-7720. You may also visit our website at www.acg.ph. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

![[WATCH] Try This: Empanada Salteña from Argentina](https://www.rappler.com/tachyon/2023/04/try-this-empanada-saltena-argentina.jpg?resize=257%2C257&crop=765px%2C0px%2C1037px%2C1037px)

There are no comments yet. Add your comment to start the conversation.