SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I saw my business as one of the top withholding agents listed by the Bureau of Internal Revenue (BIR). What does it mean to qualify for that list?

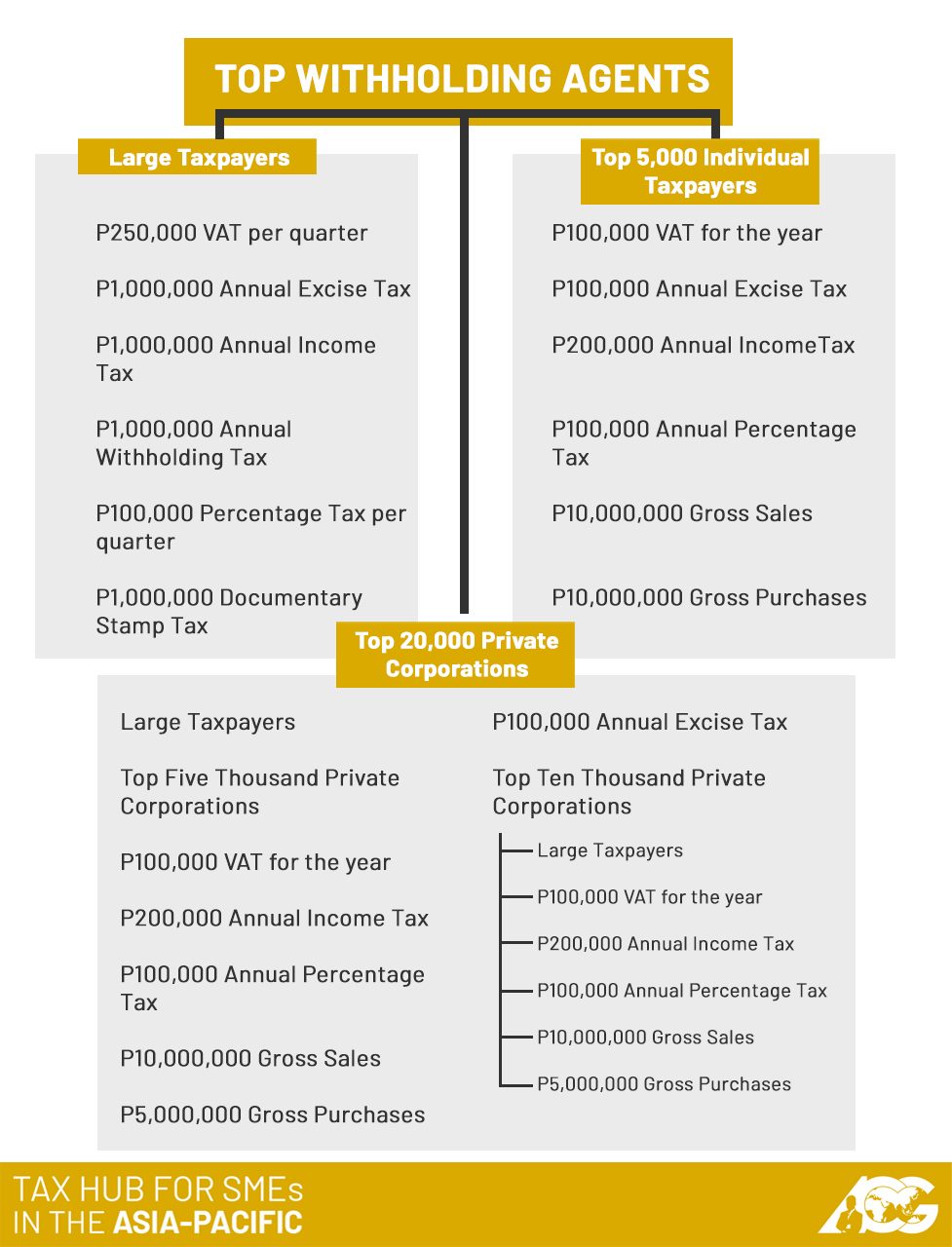

Top withholding agents are defined as large taxpayers, the top 20,000 private corporations, and the top 5,000 individual taxpayers.

Taxpayers classified as medium taxpayers and those under the Taxpayer Account Management Program are also considered top withholding agents.

So if you see the name of your business in the list, that means you fit into any of the above descriptions.

Already, the BIR has released two lists of top withholding agents – the first one in October 2018 and another, more recent one in March 2019.

As a top withholding agent, does this mean I’ll have to pay more taxes? Which purchases are we required to withhold taxes on?

No, you will not have to pay more taxes. You just have more responsibility. As a top withholding agent, you have to withhold either 1% (for goods) or 2% (for services) from your purchases. You then have to remit these withheld taxes to the BIR.

The purchases covered are those made from your regular suppliers. According to Revenue Regulations No. 11-2018, “regular suppliers” are defined as those that you bought from at least 6 times, regardless of amount. For single purchases of P10,000 or more, top withholding agents are already required to withhold the 1% or 2%, regardless of whether the purchases are made from “regular suppliers” or not.

If you fail to remit these taxes, the liability is on you and, therefore, the penalty as well. Avoid penalties by regularly reading up on BIR issuances or attending seminars such as the Tax Hub Talks series of the Asian Consulting Group (ACG).

ACG will also be launching the Tax Hub Talks series in its soon-to-open satellite offices in Vigan (June 14-15), Palawan (June 21-23), Laguna (July 9), Albay (July 10-11), and Bacolod (July 19-20).

For more questions, contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.