SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

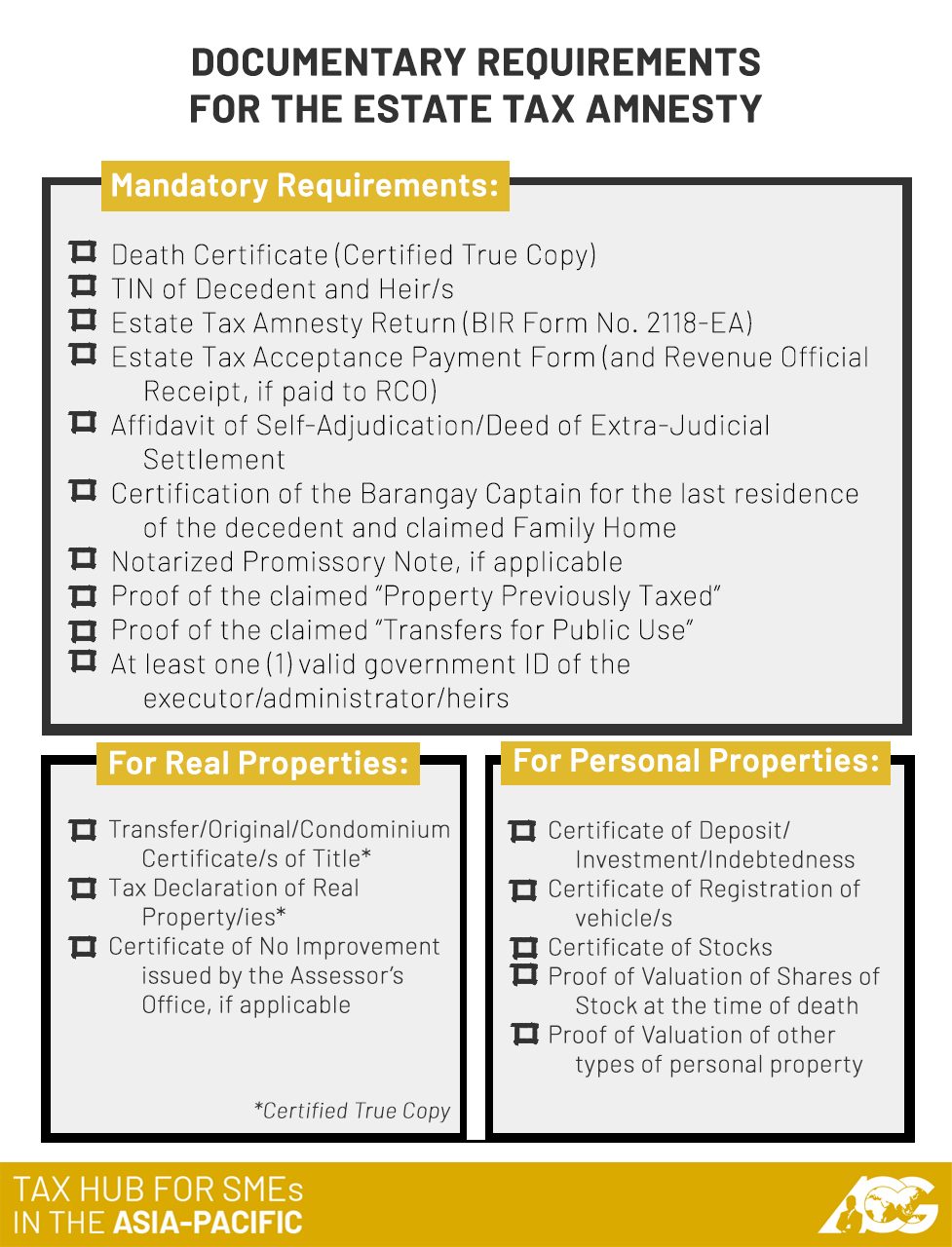

How do I avail of estate tax amnesty? What do I have to submit to the Bureau of Internal Revenue (BIR)?

To avail of estate tax amnesty, you will have to file all the documentary requirements in triplicate to the Revenue District Office with jurisdiction over the last residence of the decedent or the person who has died.

While there are documentary requirements that apply to all, there are also documents that only apply depending on the nature of the property to be inherited.

To summarize, here are the documentary requirements for the availment of estate tax amnesty:

Can I avail of deductions to lower the total net estate? If yes, should I use the latest laws on estate tax as basis for my deductions?

Yes, you can avail of deductions, but no, they shouldn’t be based on the latest laws. Instead, the allowable deductions are based on whichever law is applicable at the time of death.

To date, there have been 8 estate tax regimes which could apply when it comes to deductions.

These tax regimes are:

- Revised Administrative Code (1917-1936)

- Commonwealth Act No. 106 (1936-1939)

- Commonwealth Act No. 466 (1939-1950)

- Republic Act No. 579 (1950-1972)

- Presidential Decree No. 69 (1973-1985)

- Presidential Decree No. 1994 (1986-1992)

- Republic Act No. 7499 (1992-1997)

- Republic Act No. 8424 (1998-2017)

The exact differences between these laws are enumerated as an attachment to the rules and regulations of estate tax amnesty.

Availing of estate tax amnesty is a no-brainer if you have property that still hasn’t been transferred.

Unlike the tax amnesty on delinquencies where you can still protest the delinquency, you have no such alternative for estate taxes. (READ: #AskTheTaxWhiz: How do I avail of the tax amnesty on delinquencies?)

To learn more about tax amnesty, taxpayers can attend the Tax Amnesty Roadshow organized by the Center for Strategic Reforms of the Philippines in partnership with the BIR. The roadshow will feature the Asian Consulting Group’s Tax Hub Talks which aims to help taxpayers settle their tax liabilities without compromises.

The Tax Amnesty Roadshow will start in Vigan City (June 14-15), then in Bacolod City (June 18-19), Puerto Princesa City (June 21-23), Laguna (July 9), Albay (July 10-11), and Cebu (July 19-20).

For more information, you can reach us at consult@acg.ph or at (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.