SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Social media went abuzz when hugely popular Filipino company Jollibee announced it is buying United States-based brewer The Coffee Bean and Tea Leaf for a whopping $350 million.

Investors, however, seemed to have gotten the jitters because of the deal and heavily sold off their stocks for two straight days.

For this week’s Stocks to Watch, we zoom in on Jollibee’s financial statement and check out how it has grown throughout the years.

Stocks

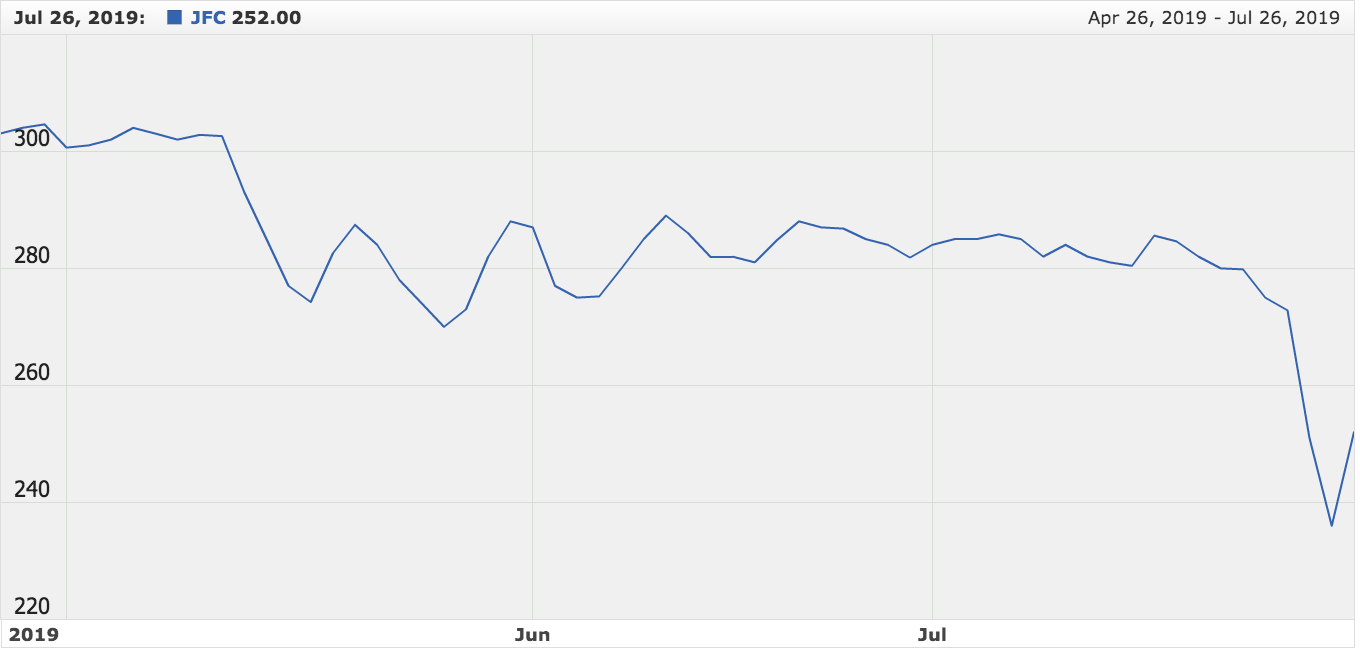

Jollibee lost more than 13% over two days when it announced the acquisition. From P272.80 on Tuesday, July 23, it plunged all the way to P236 on Thursday, July 25.

The stock then recovered on Friday, July 26, as bargain hunters scrambled to get one of the most expensive blue chips in the Philippine Stock Exchange.

From Jollibee’s 3-month chart, it can be seen that the company lost a quarter of its value in that period – some P40.7 billion worth of market capitalization – because of the news.

As of last Friday, Jollibee’s one-year return is at a disappointing -4.4%, while its price-to-earnings ratio stood at 34.00.

Earnings

Jollibee is bracing for a challenging 2019, as its new businesses chew off its earnings.

In the 1st quarter of 2019, Jollibee reported a net income of P1.5 billion, 14.7% lower than the reported P1.8 billion in the same period in 2018. This is due to the lackluster performance of American food chain Smashburger, which Jollibee fully acquired in 2018.

“Our sales and profit performance in the 1st and 2nd quarters will not be as strong as in previous years. Our profit is also being affected by the performance of Smashburger in the United States,” said Ysmael Baysa, the company’s chief financial officer.

Smashburger dragged down Jollibee’s earnings by P380 million – and Coffee Bean is expected to perform similarly.

Some analysts even described Coffee Bean as a distressed asset with due loans and not enough cash. It incurred $25.5-million and $21.4-million losses in 2017 and 2018, respectively.

Jollibee said Coffee Bean will add $313 million or 10% of its revenues. However, Coffee Bean’s loss of $21 million in 2018 is equivalent to 12% of Jollibee’s earnings.

Jollibee’s financial statement also shows that the company is shelling out more for investments than what it is earning. In 2018, it used some P13.9 billion for investing activities, while its net income for the year stood at P7.77 billion.

Meanwhile, its sales continued to grow to P153.07 billion in 2018.

Other businesses

It’s not just chicken – Jollibee is also selling cakes, coffee, pho, and burgers. As of 2018, the Jollibee group operates almost 4,300 stores locally and abroad.

At this point, non-Jollibee stores already outnumber the number of Jollibee stores at 2,883.

Its total number of stores abroad is at 1,402, which means that one-third of its stores are not in the Philippines. (IN PHOTOS: Why people braved long lines for Jollibee’s first UK store)

With this composition, it seems that investors need to look at the company with a more global lens. Can Jollibee stand the heat of the international arena?

“Most are in a ‘wait and see’ attitude at this point,” an analyst said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.