SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

What are mixed income earners? How do you compute their tax due?

Mixed income earners are those who derive income from business or practice of profession and compensation income. An example is an employee who also works part-time as a freelance photographer.

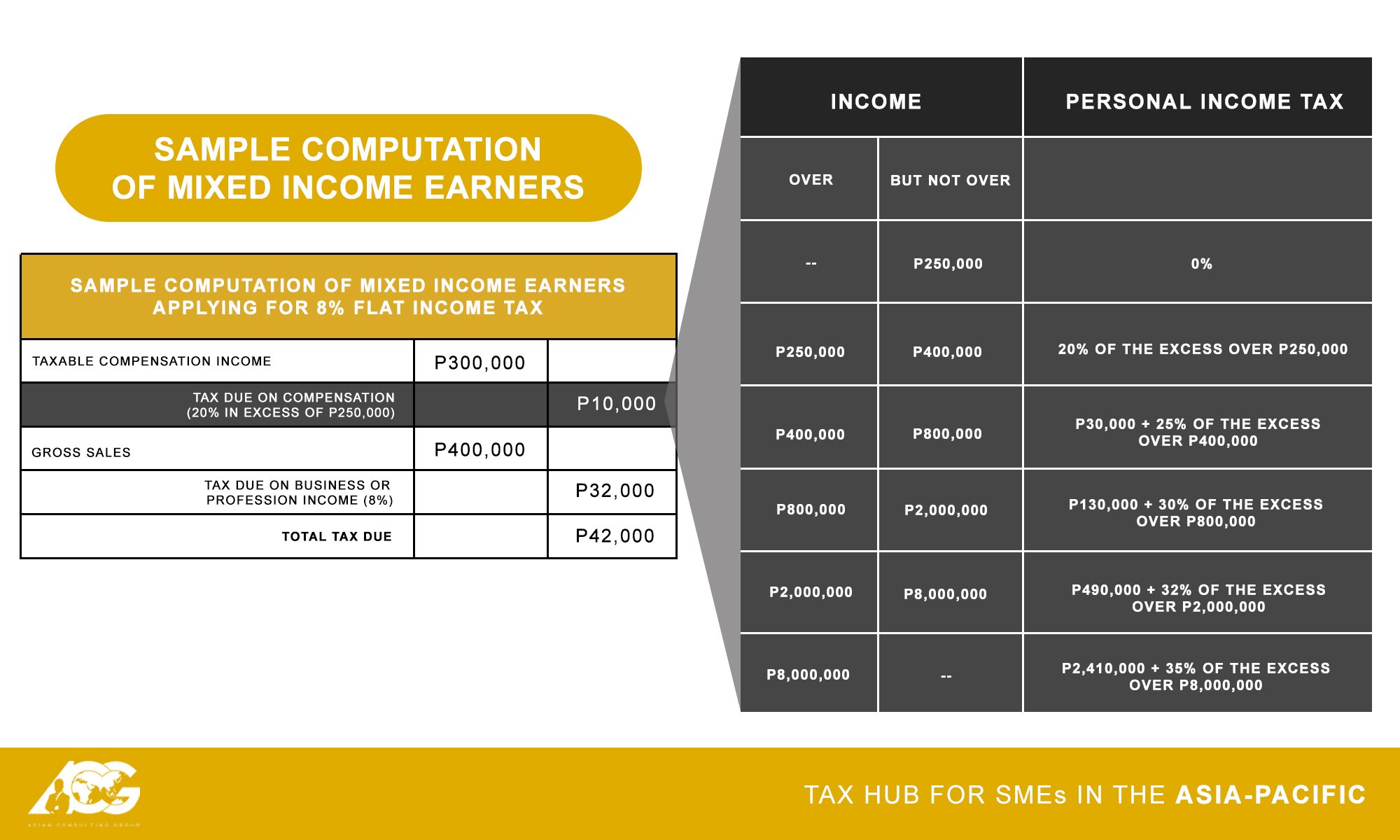

In computing the tax due, there are two options available to mixed income earners – graduated income tax rates or the 8% flat income tax rate.

If the taxpayer uses graduated income tax rates, then he or she simply has to combine his or her income and run it through the graduated income tax table.

If, on the other hand, the taxpayer applies for the flat rate, then he or she will have to compute the tax due separately since the 8% will only apply to income from business or practice of profession.

Note that the P250,000 is only deducted once. For the self-employed and professionals, the 8% flat income tax rate would only apply to gross sales or receipts in excess of P250,000.

For mixed income earners, the P250,000 is already taken into account when calculating the tax due on compensation, so there’s no longer P250,000 deducted from the business or profession income.

If I am employed (not as a freelancer) by two employers, do I count as a mixed income earner? Will I have to file my own tax return?

No, you are not a mixed income earner. Even if you have two employers, you still do not have income from business or practice of profession. Your income still comes from compensation.

But having two employers means you will have to file your own tax returns.

Normally, employees only need BIR Form No. 2316 and can use that as their income tax return. However, certain employees such as those who have two employers – whether consecutively within the same year or concurrently – have to file BIR Form No. 1700 on or before April 15.

There are different ways of mixing up your sources of income, and it doesn’t necessarily have to follow the Tax Code’s definitions. You could have two employers, be a freelancer and a business owner, or be an investor and an employee. The options are up to you and if you want something to help you decide, the Asian Consulting Group’s latest publication Iwas Buwis-it: What to Do When Tax Attacks has a chapter exactly for that. The book also covers a variety of topics, including a basic overview of taxes, careers, employment, business, and more.

For more questions, you can contact us at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.