SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

What is a compromise settlement? Is that the same as a compromise penalty?

No, it’s not the same as a compromise penalty, which is only an amount you pay for various tax violations.

If you’ve been audited by the Bureau of Internal Revenue (BIR) and was assessed a tax liability you cannot afford to pay, you can request a compromise settlement. What abatement, a technical term for compromise settlement, essentially means is a request to pay a lower amount than the assessed amount.

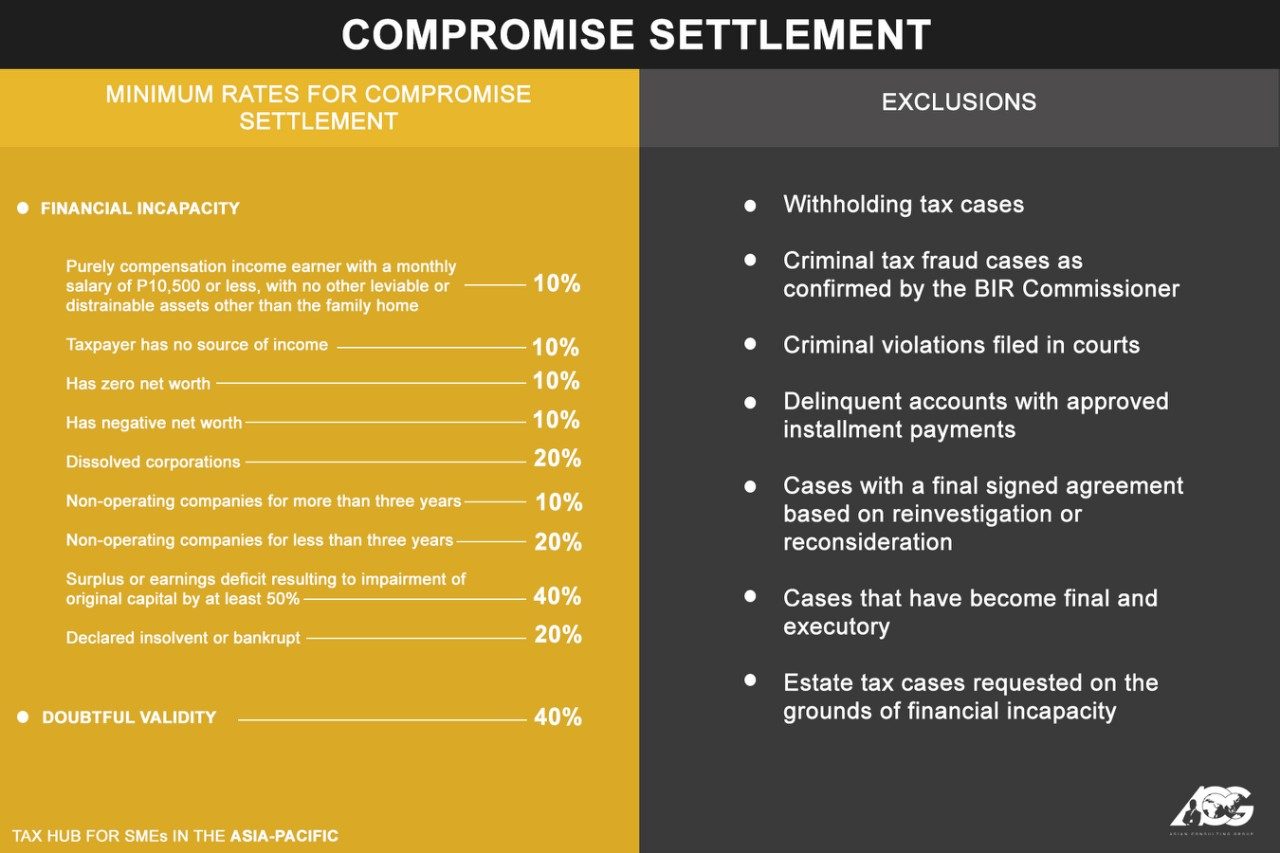

Only two types of cases can be resolved by a compromise settlement: doubtful validity of assessment and financial incapacity.

The compromise settlement does not mean taxpayers can get away scot-free. They still have to pay a minimum amount depending on the nature of the case. For cases of financial incapacity, the minimum amount could go as low as 10% of the basic tax assessed or up to 40%.

For cases of doubtful validity, it cannot get lower than 40% of the basic tax assessed. Taxpayers can still request a lower amount, though they must explain why they should be allowed to do so, and this must be approved by the National Evaluation Board (NEB).

Does that mean taxpayers can get away without fully paying their penalties? Is this legal?

Yes. Compromise settlements are listed in the Taxpayers’ Bill of Rights and implemented by Revenue Regulations No. 30-2002. For the compromise settlement to be granted, a majority of the members of the NEB must approve the request.

Rather than getting into a drawn-out legal battle in cases of doubtful validity or collecting nothing in cases of financial incapacity, the compromise settlement allows the government to collect at least some of the taxes due.

Besides, more serious violations are not allowed to be compromised. Among these exceptions are criminal violations, criminal tax fraud, withholding tax cases, and more.

It is important for taxpayers to understand their rights. A compromise settlement is neither the only way to settle dues nor is it the only way the BIR can collect taxes from delinquent taxpayers.

If you want to know more about the BIR audit, the Asian Consulting Group’s latest publication, Iwas Buwis-it: What To Do When Tax Attacks, gives its readers an overview of steps to take.

For more information, contact ACG at consult@acg.ph or (02) 622-7720. – Rappler.com

Mon Abrea, popularly known as the Philippine Tax Whiz, is one of the 2017 Outstanding Persons of the World, a Move Awards 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), an Asia CEO Young Leader of the Year, and founding president of the Asian Consulting Group (ACG) as well as the Center for Strategic Reforms of the Philippines (CSR Philippines). Assisting him in his column is JM Miñano, communications associate of ACG. He graduated with a bachelor’s degree in Communication Arts from the University of the Philippines Los Baños.

For inquiries, you may email consult@acg.ph or visit www.acg.ph for tax-related concerns.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.