SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

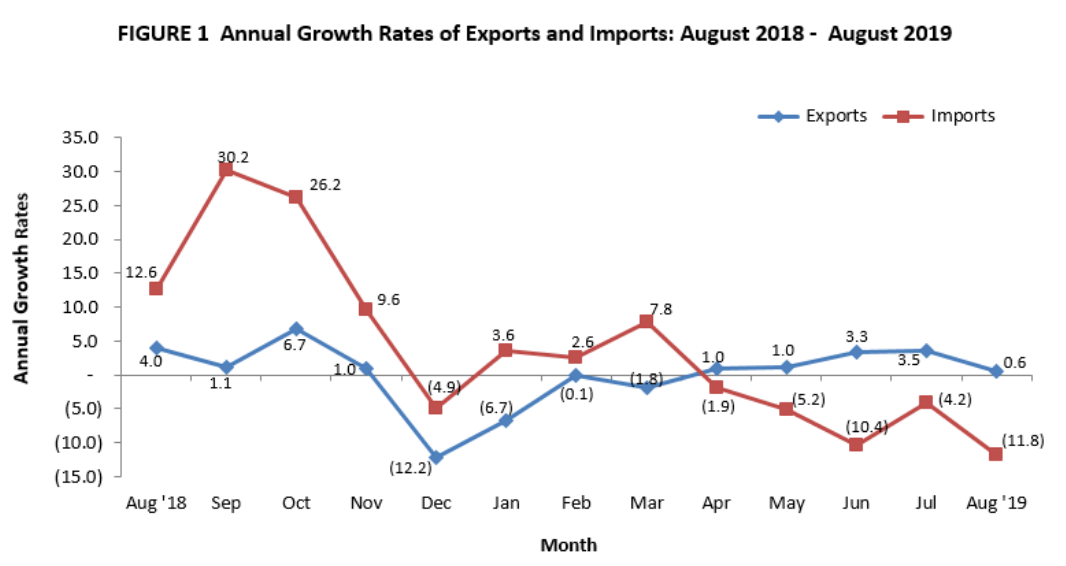

MANILA, Philippines – The country’s total trade declined by 7% in August 2019 to $14.9 billion, as both exports and imports fell during the period, the Philippine Statistics Authority said on Thursday, October 10.

Trade exports registered a slower 0.6% growth, supported by modest performance of agro-based products, forest, and electronic products.

The electronics subsector grew 6.6% despite the United States-China trade war affecting markets.

By major trading partners, exports to the US comprised the highest value of $992.72 billion or a share of 15.9% to the total exports in August 2019.

Other major export trading partners were China ($944.23 million), Hong Kong ($938.26 million), Japan ($870.03 million), and Singapore ($353.53 million).

Meanwhile, imports contracted by 11.8%, as raw materials, intermediate goods, and capital goods posted declines.

China was the Philippines’ biggest supplier of imported goods with a 23.1% share to total imports amounting to $2 billion.

Other major import trading partners were Japan ($800.32 million), the US ($609.13 million), Indonesia ($598.95 million), and South Korea ($586.30 million).

The country’s trade gap hit -$2.41 billion, narrower than the market consensus of -$3.6 billion. This is lower by 33.1% from the $3.6-billion deficit in August 2018.

ING Bank Manila senior economist Nicholas Mapa said the sustained import compression “signals continued weakness in overall growth momentum for the Philippines.”

The country’s gross domestic product (GDP) is still below the government’s revised target band of 6% to 7%.

GDP for the 2nd quarter of 2019 hit a disappointing 5.5%, missing the consensus of 6% due to the budget impasse which dragged on until April.

“With the import numbers indicating a sustained pullback in investment machinery, Philippine [3rd quarter] growth numbers might exhibit further weakness in capital formation,” Mapa said.

He added that the subpar growth for the 3rd quarter may convince the Bangko Sentral ng Pilipinas to act on interest rates. ING sees further rate cuts as early as the 1st quarter of 2020.

“[I]mport compression coupled with surprise export growth is in line with our forecast of only mild peso depreciation by year-end, to settle at P52.89,” Mapa said.

Socioeconomic Planning Secretary Ernesto Pernia urged the government to redouble efforts to support export products.

“We must continue to initiate programs that provide comprehensive packages of support for products with comparative advantages, including related industries, to facilitate expansion in the international market,” he said.

Pernia also said pushing for reforms like amendments to the Foreign Investments Act, Public Service Act, and Retail Trade Liberalization Act would make the Philippines more competitive and encourage foreign investors to do business in the country.

“As subdued investments in emerging markets, coupled with the persisting trade tensions, continue to hamper global expansion, implementation of timely reforms will vastly improve the country’s resilience to external shocks,” the Philippines’ top economist said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.